Monday—Friday, 6 AM to 3 PM PT

Easy Start onboarding program

Get ready for a successful tax season with Intuit ProConnect Tax.

Step 1 GETTING STARTED

Get set up with ProConnect

Get set up with ProConnect

Managing users and permissions

Learn how to set up preparer information, invite users, or manage them in ProConnect.

Provide your EFIN

To avoid e-file delays, register your e-File identification number (EFIN).

Secure your account

Safeguard your account and password with two-factor authentication.

Convert your data

Learn how to convert your tax returns from another software in ProConnect. To avoid duplicates, input the EIN/SSN of your current clients from QuickBook Online Accountants into ProConnect.

STEP 2 Personalize your software

Personalize your ProConnect software

Personalize your ProConnect software

Firm-level customizations

Spend less time sorting and printing documents, and more time focused on helping your clients.

Return statuses

Use default or create custom tax return status filters to implement returns statuses into your workflow. For example, you can create an “On extension” filter for post-season focus on clients with extensions.

Print setup function

Customize how you print your documents by setting up tax return and recipient type print settings.

Invoicing via Quickbooks

Create QuickBooks Online invoices from ProConnect with your tax client's billing details auto-populated, streamlining client invoicing, payment collection, and tracking accounts receivables.

Client-facing customizations

Delight your clients with a streamlined workflow that keeps things moving along.

Client letters

Create client letter templates with customized salutations and signatures in ProConnect.

eSignature powered by DocuSign

Request, send, and sign documents digitally anytime, anywhere. Plus, check the status of signature requests on a single dashboard. 5 eSignatures included for new customers.*

Link client portal

Request, send, and collect client data through a secure online portal, such as asking client questions and sending documents.

STEP 3 Start your first return

Quickly e-file your first return with efficient data import capabilities

Quickly e-file your first return with efficient data import capabilities

ProConnect offers you multiple ways to help you import data and minimize the amount of time spent on manual data entry

W2 and other financial forms

Easily add information to a client’s return by automatically importing forms, such as W-2, 1099 INT, DIV, 1098, and more.

How to import a W-2 in ProConnect >Input drawer

Review flagged items and import documents from Google Drive, Intuit Link, and more. Plus, view/edit the organizer, and track Intuit Link activity without ever leaving the tax return.

How to use input drawer to import data >Prep for taxes

Seamlessly move bookkeeping information from QuickBooks Accountant to ProConnect, or export the data.

How to use Prep for Taxes >K-1 import

Import Schedule K-1s from business returns you prepared in ProConnect.

How to import a K-1 >Import from a spreadsheet

Import Excel files (.xls or .xlsx) or comma-separated value files (.csv) in ProConnect.

How to import tax data from a spreadsheet >STEP 4 Enhance Your Experience

Enhance your ProConnect experience

Enhance your ProConnect experience

Time-saving tools

new

IRS transcript direct access

Access years of clients' IRS transcripts right from within ProConnect to complete tax returns faster and more accurately with less client back-and-forth.

How to retrieve IRS transcripts in ProConnect >Tax Planner (included at no cost)

Provide year-round tax planning support for your 1040 and Schedule C clients.

How to use Tax Planner >Intuit Tax Advisor (included with User Access)

Create custom tax plans in minutes and show clients valuable savings, all by using tax strategies automatically generated from your ProConnect returns.

How Intuit Tax Advisor works >Reporting

Download tax return data you e-filed to create robust client reports in ProConnect.

How to create and export reports >Tips and tricks

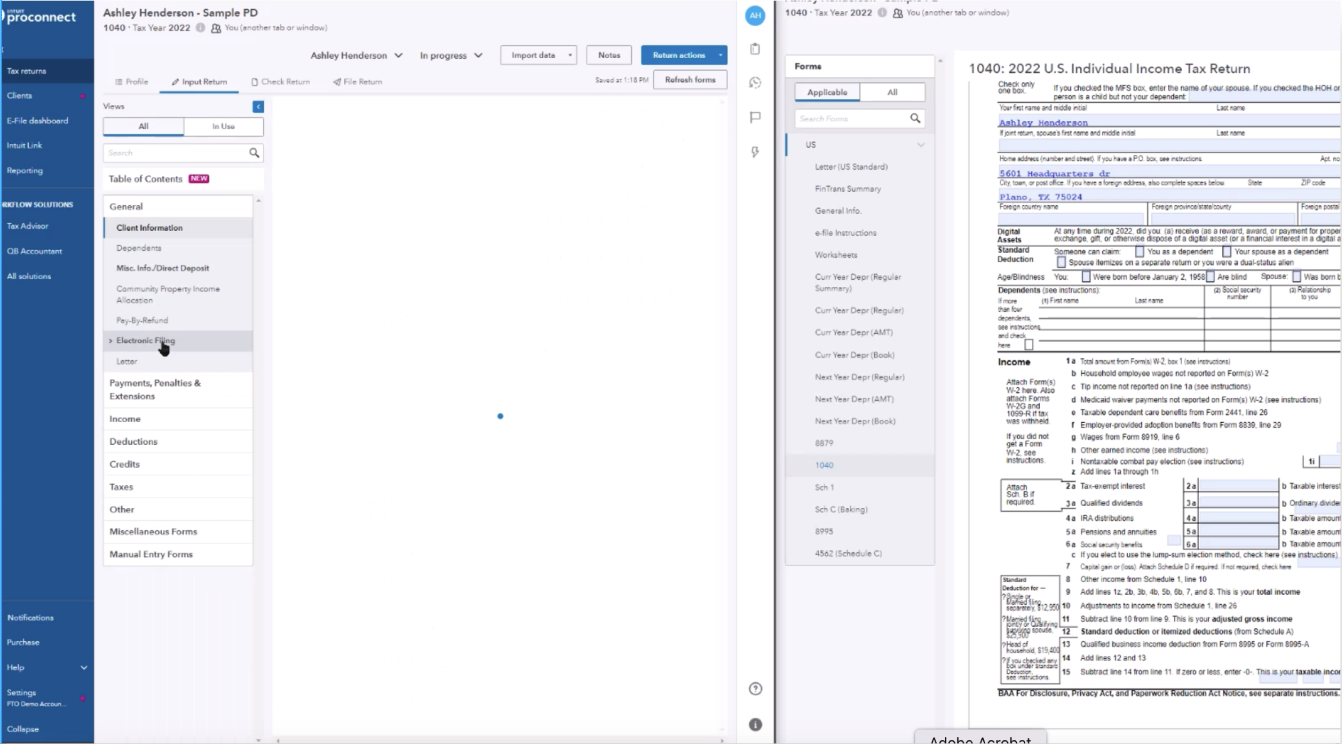

Multi-monitor display

Input and preview forms on separate displays to quickly view your changes.

- Select preview forms, and choose the form you want to view.

- See the form in full screen on your second display to start inputting data.

- On your first display, select refresh forms, and the form will automatically update with the new input.

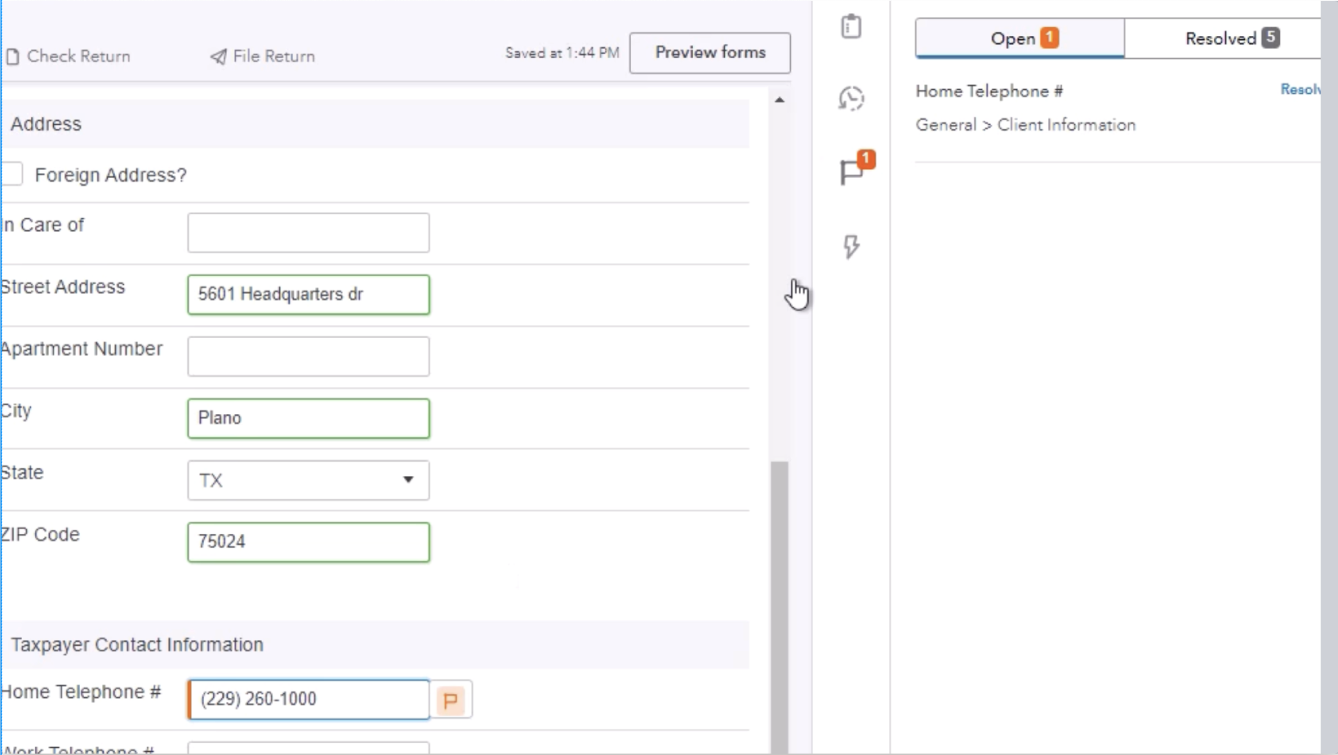

Flagged items

If a field is missing information, you can fill in the amount you want (like last year's number) and "flag it." This way, you can discuss it with your clients later.

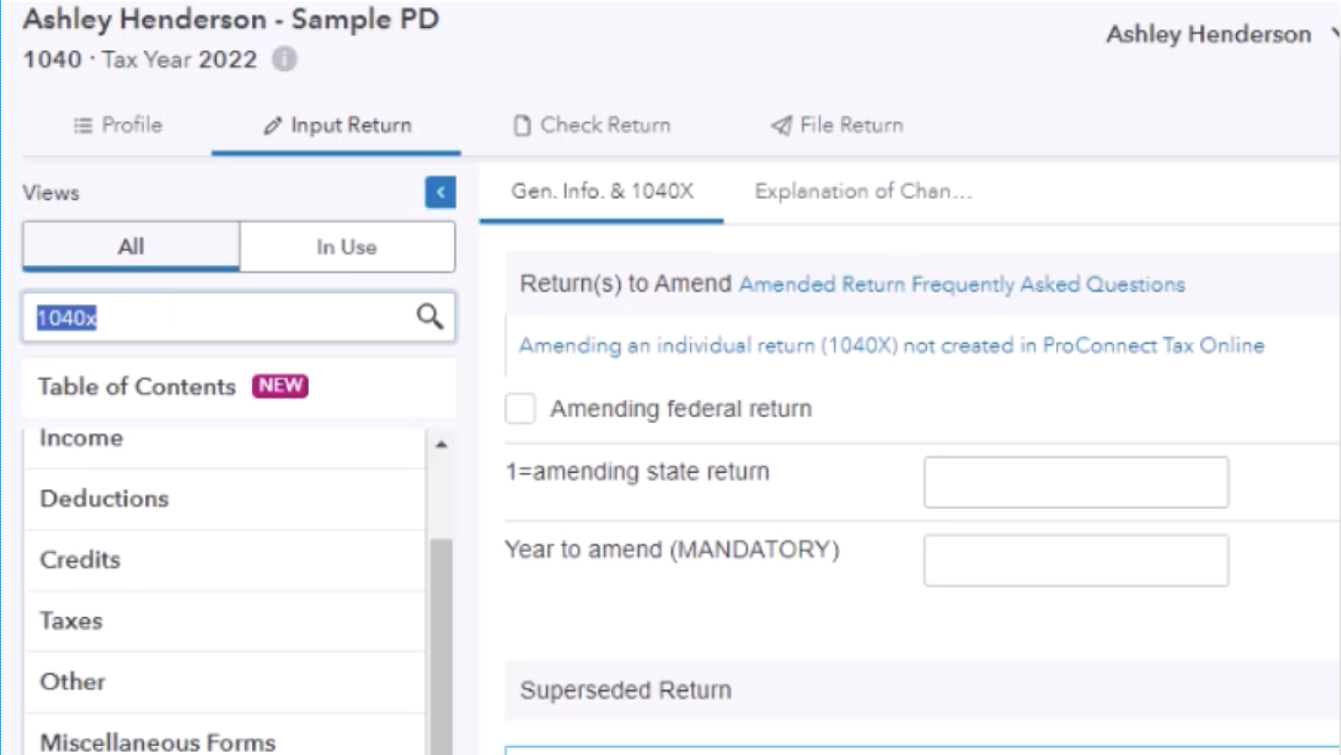

Quick search

Inside the input return tab, access the search field. There, you can type in a form number or a specific word, such as alimony or dependent. Input fields that include your search query will be presented promptly so you can easily locate what you need.

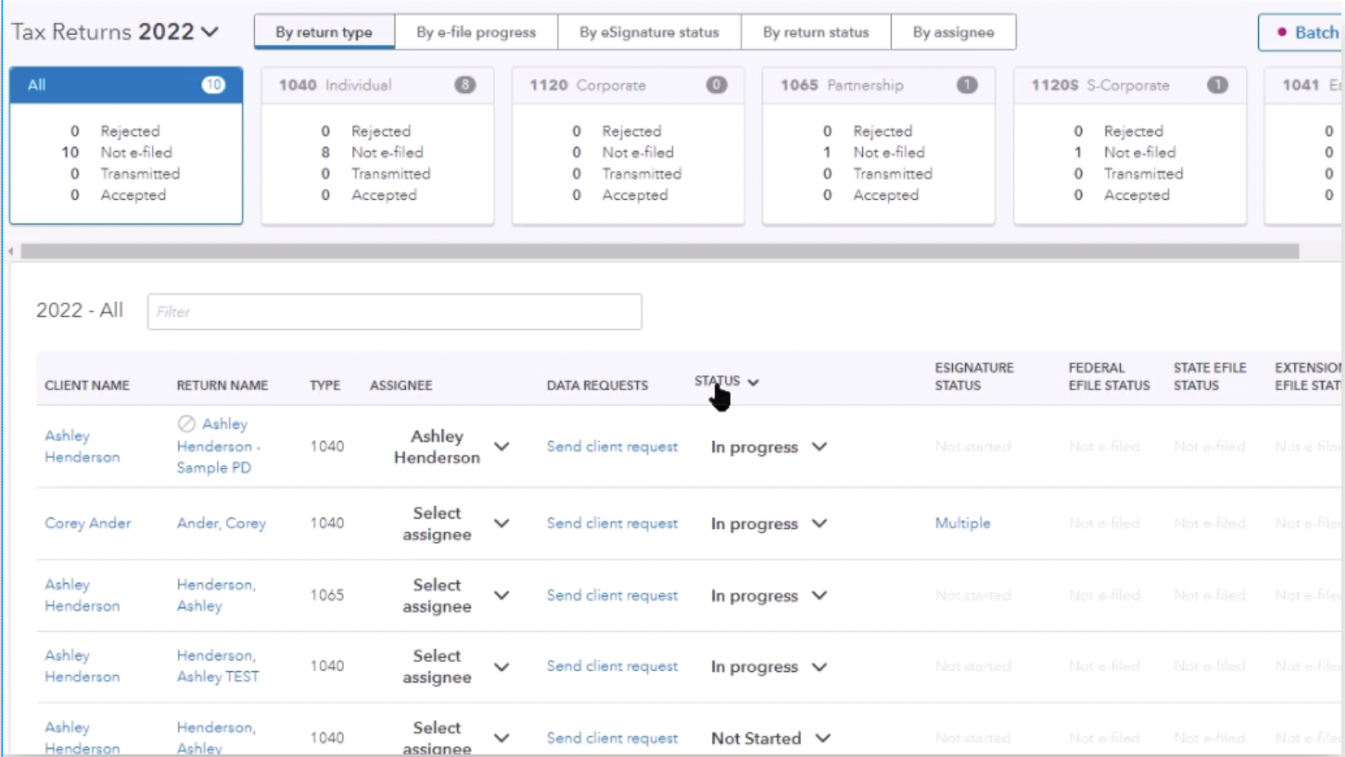

Filter and sort

Choose between column header names on the tax return or the client view to sort the information. If needed, you can also sort by status.

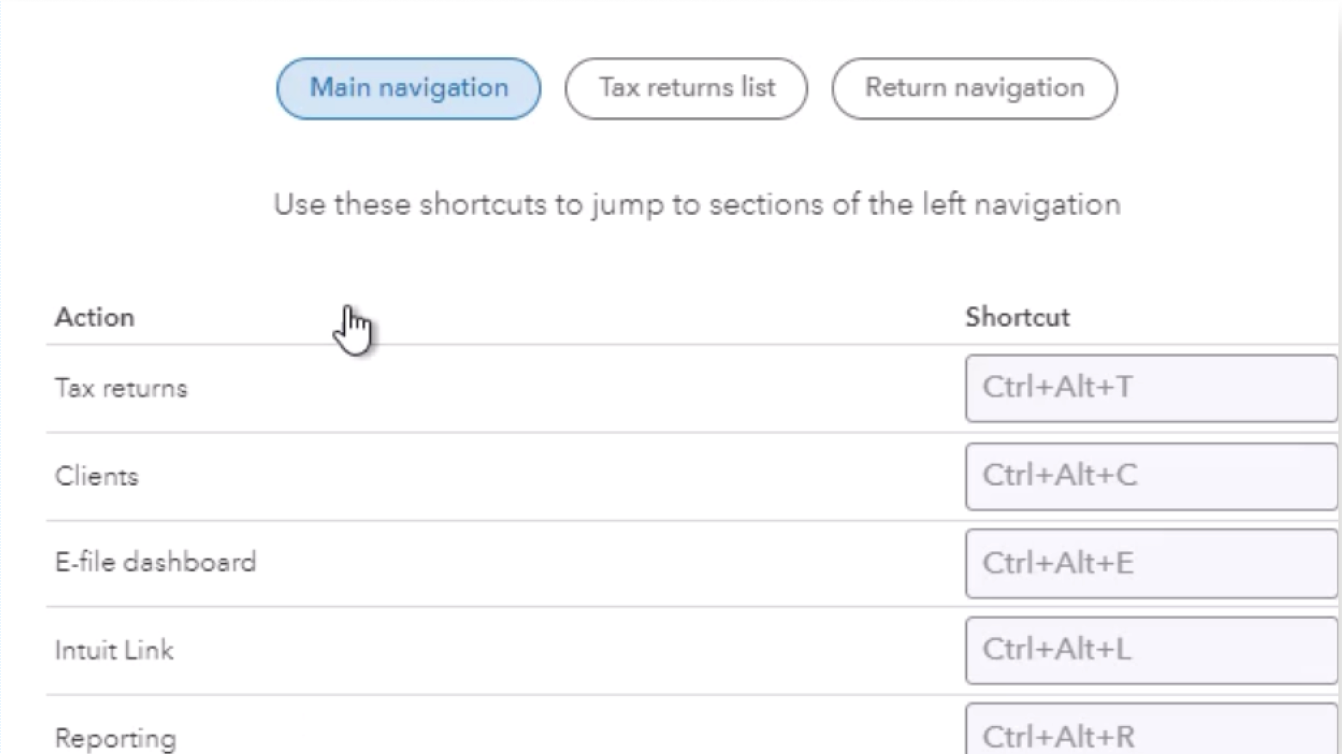

NEW Hot keys shortcuts

Work more quickly and efficiently with ProConnect keyboard shortcuts.

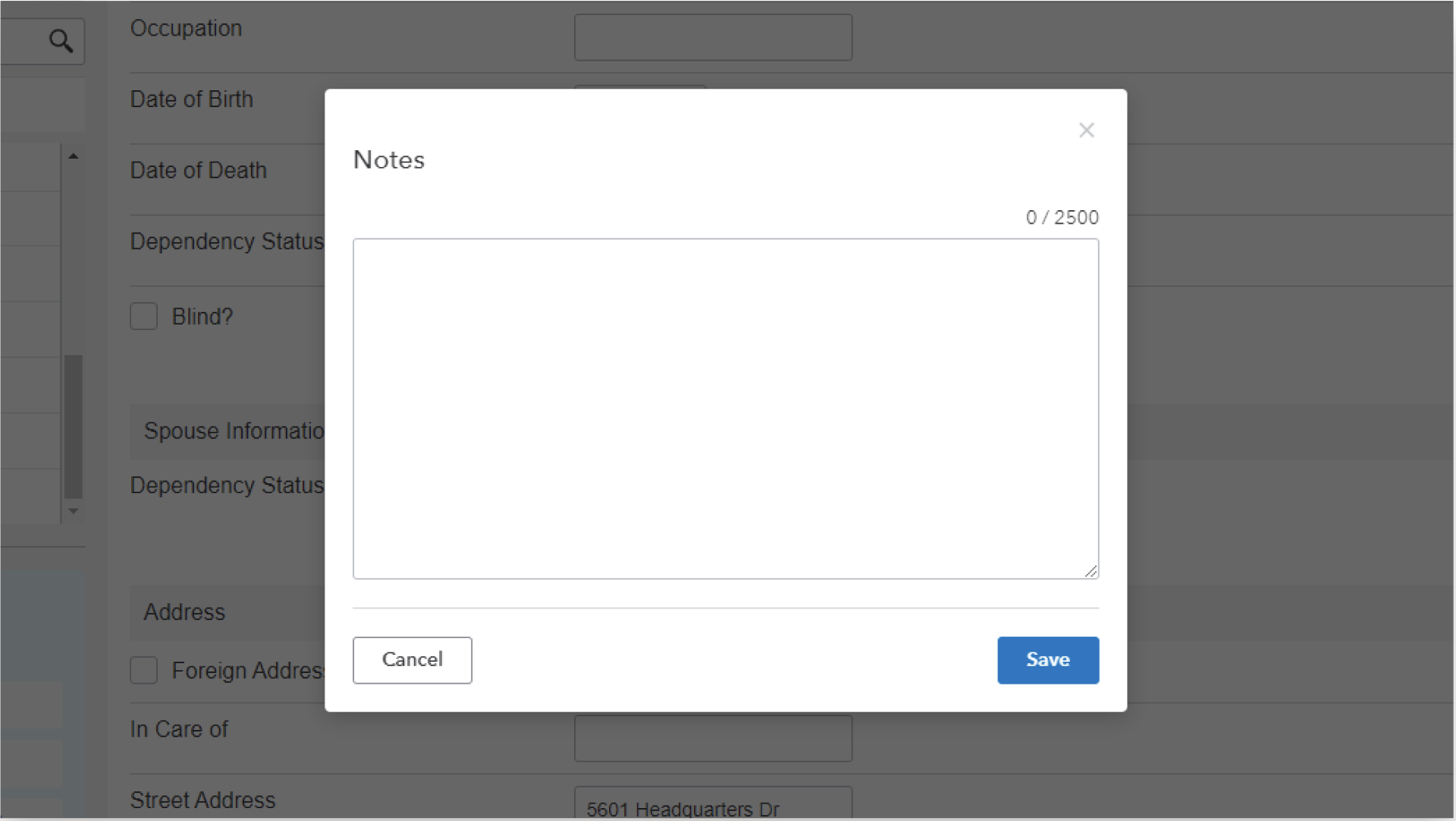

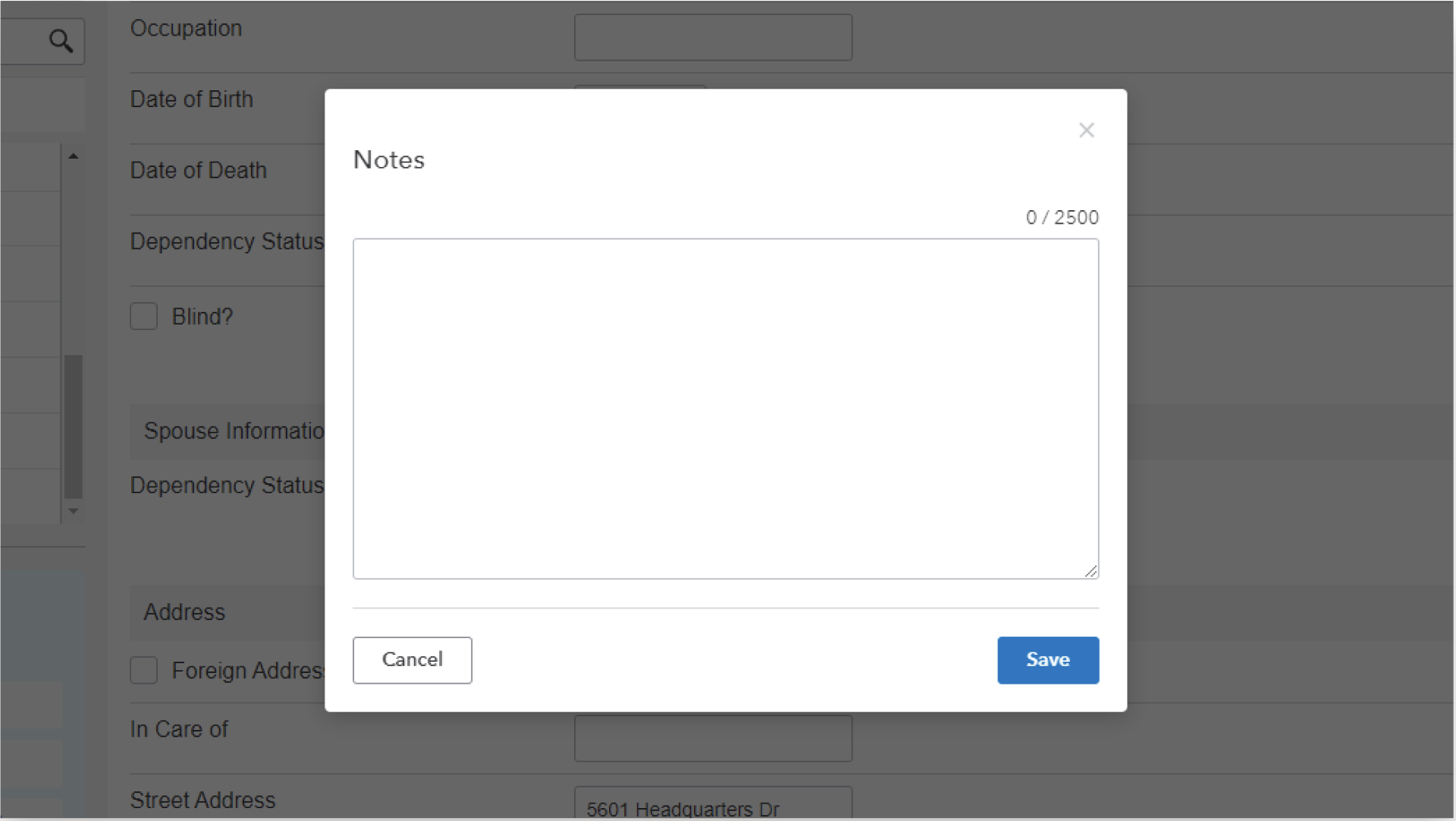

Notes

Within a client return, add a note with reminders for yourself or your co-workers, so you can go back and clear them as you complete.

STEP 5 Resources

ProConnect resources at your fingertips

ProConnect resources at your fingertips

Customer Support

- Get help with ProConnect’s online assistant, or find your answers through the help portal

- Connect with product experts and ProConnect users on the ProConnect community site >

- Speak with us for additional support information >

No-cost ongoing training

- Access short informational videos on the ProConnect training portal >

- Get software and professional training for continuing education on the training website >

- Visit the Tax Pro Center to learn about the latest industry trends and news >

- Find ProConnect specific training on the ProAdvisor training tab within QuickBooks Online Accountant

- Join the ProConnect Facebook group to learn from your peers >

Step 1 GETTING STARTED

Get set up with ProConnect

Get set up with ProConnect

Managing users and permissions

Learn how to set up preparer information, invite users, or manage them in ProConnect.

Provide your EFIN

To avoid e-file delays, register your e-File identification number (EFIN).

Secure your account

Safeguard your account and password with two-factor authentication.

Convert your data

Learn how to convert your tax returns from another software in ProConnect. To avoid duplicates, input the EIN/SSN of your current clients from QuickBook Online Accountants into ProConnect.

STEP 2 Personalize your software

Personalize your ProConnect software

Personalize your ProConnect software

Firm-level customizations

Spend less time sorting and printing documents, and more time focused on helping your clients.

Return statuses

Use default or create custom tax return status filters to implement returns statuses into your workflow. For example, you can create an “On extension” filter for post-season focus on clients with extensions.

Print setup function

Customize how you print your documents by setting up tax return and recipient type print settings.

Invoicing via Quickbooks

Create QuickBooks Online invoices from ProConnect with your tax client's billing details auto-populated, streamlining client invoicing, payment collection, and tracking accounts receivables.

Client-facing customizations

Delight your clients with a streamlined workflow that keeps things moving along.

Client letters

Create client letter templates with customized salutations and signatures in ProConnect.

eSignature powered by DocuSign

Request, send, and sign documents digitally anytime, anywhere. Plus, check the status of signature requests on a single dashboard. 5 eSignatures included for new customers.*

Link client portal

Request, send, and collect client data through a secure online portal, such as asking client questions and sending documents.

STEP 3 Start your first return

Quickly e-file your first return with efficient data import capabilities

Quickly e-file your first return with efficient data import capabilities

ProConnect offers you multiple ways to help you import data and minimize the amount of time spent on manual data entry

W2 and other financial forms

Easily add information to a client’s return by automatically importing forms, such as W-2, 1099 INT, DIV, 1098, and more.

How to import a W-2 in ProConnect >Input drawer

Review flagged items and import documents from Google Drive, Intuit Link, and more. Plus, view/edit the organizer, and track Intuit Link activity without ever leaving the tax return.

How to use input drawer to import data >Prep for taxes

Seamlessly move bookkeeping information from QuickBooks Accountant to ProConnect, or export the data.

How to use Prep for Taxes >K-1 import

Import Schedule K-1s from business returns you prepared in ProConnect.

How to import a K-1 >Import from a spreadsheet

Import Excel files (.xls or .xlsx) or comma-separated value files (.csv) in ProConnect.

How to import tax data from a spreadsheet >STEP 4 Enhance Your Experience

Enhance your ProConnect experience

Enhance your ProConnect experience

Time-saving tools

new

IRS transcript direct access

Access years of clients' IRS transcripts right from within ProConnect to complete tax returns faster and more accurately with less client back-and-forth.

How to retrieve IRS transcripts in ProConnect >Tax Planner (included at no cost)

Provide year-round tax planning support for your 1040 and Schedule C clients.

How to use Tax Planner >Intuit Tax Advisor (included with User Access)

Create custom tax plans in minutes and show clients valuable savings, all by using tax strategies automatically generated from your ProConnect returns.

How Intuit Tax Advisor works >Reporting

Download tax return data you e-filed to create robust client reports in ProConnect.

How to create and export reports >Tips and tricks

Multi-monitor display

Input and preview forms on separate displays to quickly view your changes.

- Select preview forms, and choose the form you want to view.

- See the form in full screen on your second display to start inputting data.

- On your first display, select refresh forms, and the form will automatically update with the new input.

Flagged items

If a field is missing information, you can fill in the amount you want (like last year's number) and "flag it." This way, you can discuss it with your clients later.

Quick search

Inside the input return tab, access the search field. There, you can type in a form number or a specific word, such as alimony or dependent. Input fields that include your search query will be presented promptly so you can easily locate what you need.

Filter and sort

Choose between column header names on the tax return or the client view to sort the information. If needed, you can also sort by status.

NEW Hot keys shortcuts

Work more quickly and efficiently with ProConnect keyboard shortcuts.

Notes

Within a client return, add a note with reminders for yourself or your co-workers, so you can go back and clear them as you complete.

STEP 5 Resources

ProConnect resources at your fingertips

ProConnect resources at your fingertips

Customer Support

- Get help with ProConnect’s online assistant, or find your answers through the help portal

- Connect with product experts and ProConnect users on the ProConnect community site >

- Speak with us for additional support information >

No-cost ongoing training

- Access short informational videos on the ProConnect training portal >

- Get software and professional training for continuing education on the training website >

- Visit the Tax Pro Center to learn about the latest industry trends and news >

- Find ProConnect specific training on the ProAdvisor training tab within QuickBooks Online Accountant

- Join the ProConnect Facebook group to learn from your peers >