Check out all the innovative features coming your way with ProConnect Tax.

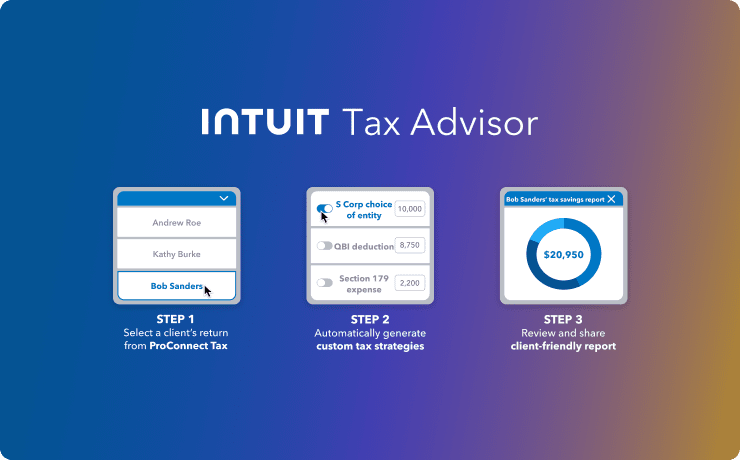

Intuit Tax Advisor*

Create custom tax plans in minutes that deliver clients more savings—all thanks to built-in advisory strategies automatically generated inside every ProConnect tax return (Now fully integrated.)

- Quantify tax savings in client-friendly reports

- Leverage a whole new additional revenue stream

- Eliminate data entry and streamline scenario planning

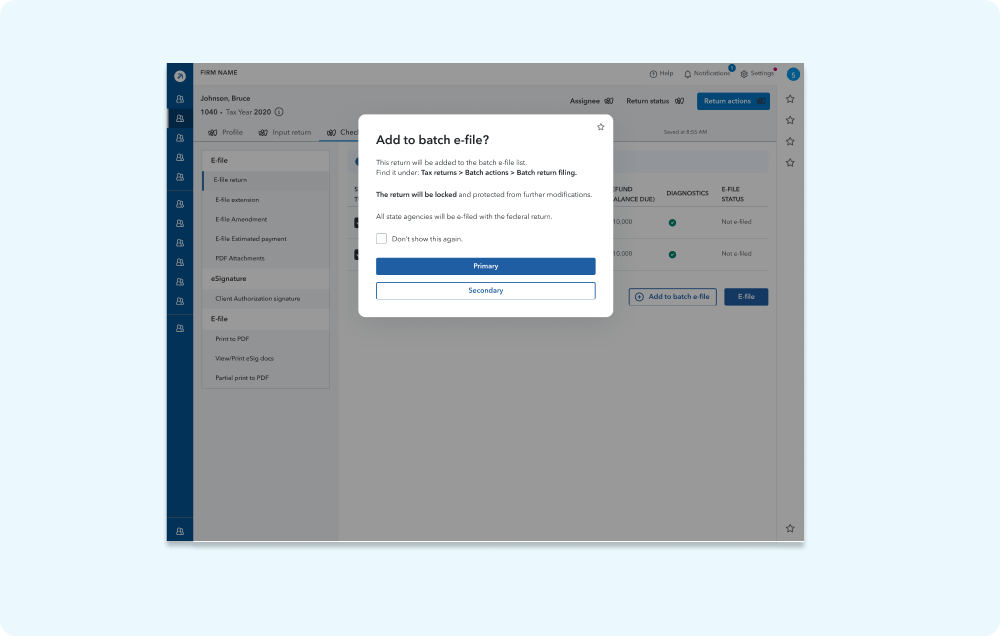

Batch e-filing

Start filing multiple returns in one seamless process that saves time and reduces errors. It’s a helpful way to handle high volume.

Protection Plus for business returns

Cover your individual and business return clients (1065, 1120, 1120-S) with Protection Plus. Our team of EAs and CPAs will help your business clients with IRS notices and audits to save you time. Protection Plus also comes with identity theft restoration services. Get more info.

K-1 package delivery*

Access your clients' transcripts directly from the IRS in ProConnect.

*User Access is required.

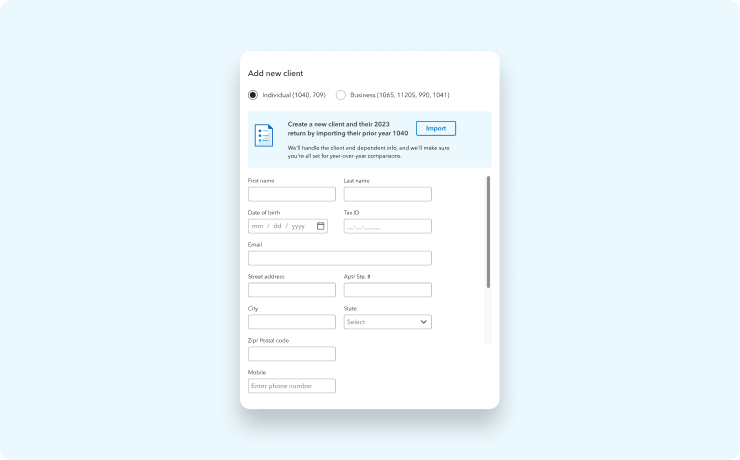

Prior-Year 1040 import

Apply data from a prior-year 1040 tax return to create a new return (or update an existing one) and generate a tax summary comparison.

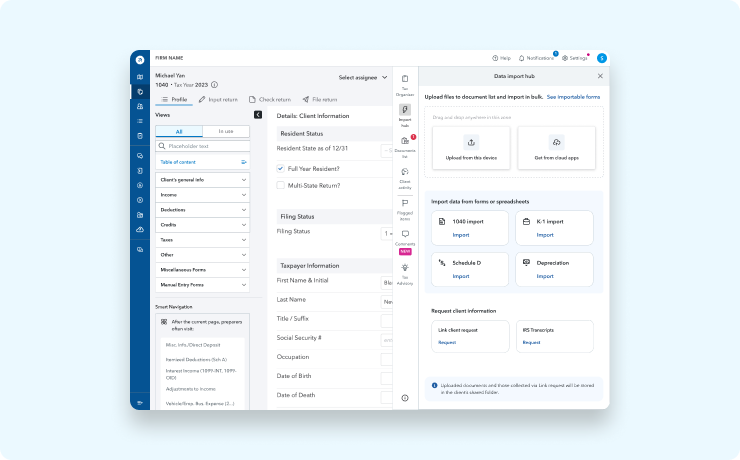

Bulk apply

Import data from multiple documents all at once, rather than one source at a time.

Import hub

Access all of your import tools from a central hub in the right panel.

In-return guidance

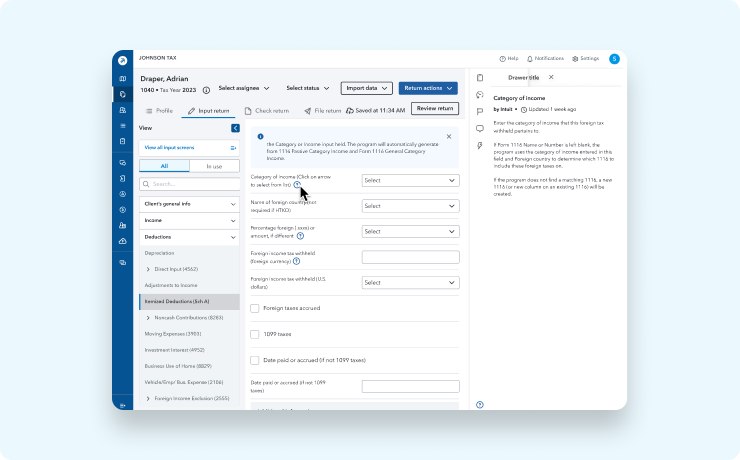

Starting in Intuit ProConnect Tax 2024, a new help section with articles, videos, and contacts are built into the right panel to guide you.

Review checkmarks

Use tick marks to designate key fields in client returns you want to keep an eye on during the review process. (You can generate a full report of these fields to see all changes at once.)

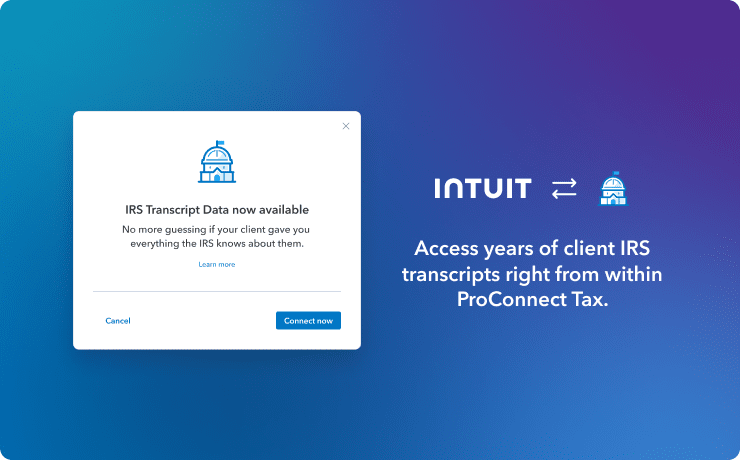

Enhanced direct access to IRS transcripts*

Access your clients' transcripts directly from the IRS in ProConnect.

*User Access is required.

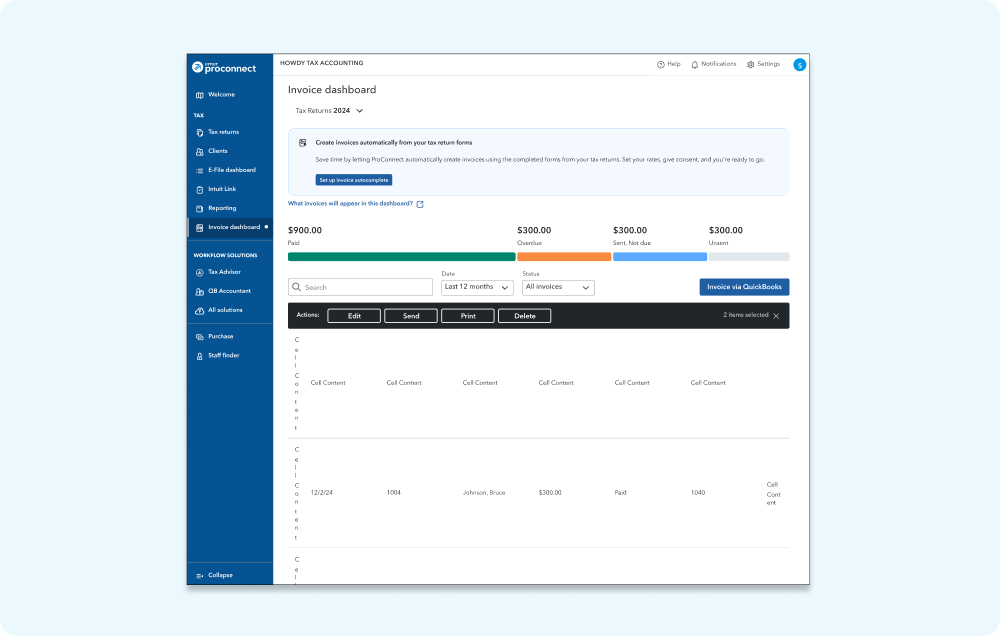

Invoice status

Save time with no switching back and forth between software - now you can see the status of QuickBooks invoices at a glance in your ProConnect client list.

SmartVault

Share, request, and manage documents, letters, forms, proposals, signatures, and more. This client portal integration offers secure online storage with anytime, anywhere access. Get more info.

Past product releases

In case you missed it, here are some of the features we launched in the past year.

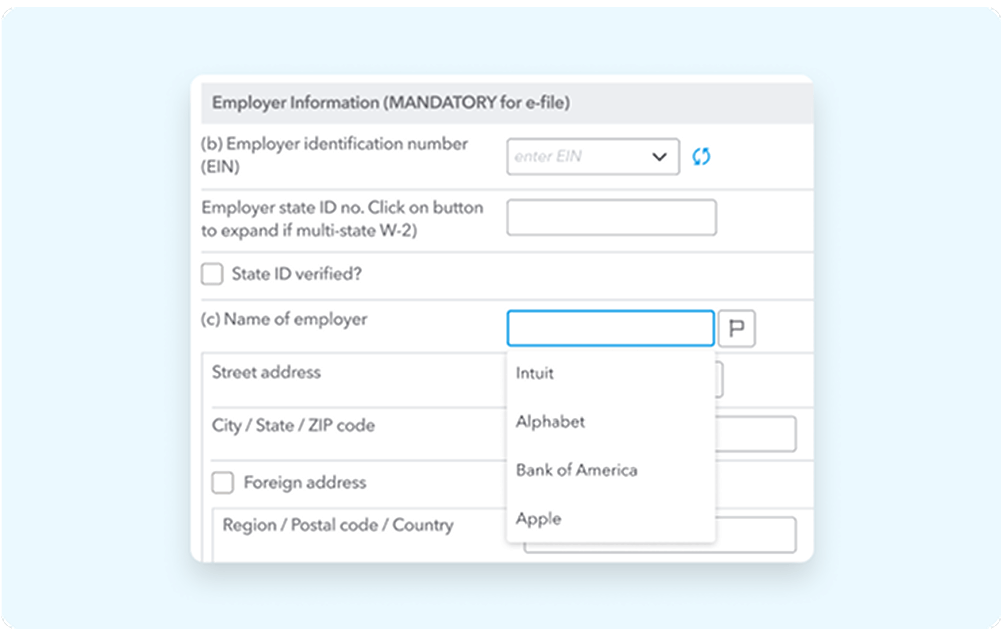

Autofill

Speed up your workflow with automation that fills in key details like addresses, contact info, and more.

Auto-populated interest rates

Auto-populate IRS federal interest rates for penalties and interest.

IRS transcripts

Access all IRS transcripts through ProConnect and complete your clients’ tax returns confidently, without the need for constant communication.

QuickBooks Online Accountant import review

Reconcile tax adjustments to QuickBooks imported trial balance in ProConnect, and update or reclassify tax mapping prior to importing books data to the tax return.

Automated 1040 data entry

Generate a tax summary comparison for the current tax year by creating a new client and utilizing the relevant information from their previous year's 1040 form.

Task accelerators

We’re automating tasks to help you manage valuable, but currently manual tasks. Start by creating an automated email notification when an e-filed return is rejected by the IRS.

Fixed assets

Seamlessly export depreciation to your external database for managing fixed assets with an improved depreciation screen for easier tracking of long-term assets.

Mark as done

Clients can now tell you when they’re done providing information and documents via Link, so you don’t have to waste time wondering when to get started on their return. You’ll receive a notification and also have the ability to mark the client activity done in the return actions.

Tax return reports

Export client data from 60+ standard tax return fields into an easy-to-configure CSV report. Available for 1040, 1120-S, 1065, and 990 tax returns.

Firm performance insights

Grow your firm with full insights into its performance. Our easy-to-read dashboard reports annual client growth, time spent on returns at both the firm and user levels, plus comparison reports that can be created for specific time periods. This performance deserves a hand.

Customized print settings

Generate PDF documents of returns to best meet the needs of your clients. Optimize which documents to include, rearrange the order, and standardize print settings by copy types — client, preparer, or government copy. You can even create a custom watermark and mask personal information like SSNs.

Customized client letters

Create and send templated letters with preset and customized tax return data fields and signatures to clients. Pro move.

Hot keys (shortcuts)

ProConnect is all about helping you streamline your workflow and maximize your time saved. That’s why we compiled a list of shortcut key combinations to accelerate your productivity while navigating the three main sections of ProConnect: main navigation, client tax returns list, and return navigation. Convenient. Accurate. Fast.

QuickBooks billing integration

Create QuickBooks Online invoices from ProConnect Tax with your tax client's billing details auto-populated, streamlining client invoicing, payment collection, and tracking accounts receivables. No separate sign-in or accounts required.

Google Drive and Dropbox integration*

Connect your Google Drive and/or Dropbox accounts to ProConnect to import your client’s tax forms directly to their tax return. Efficient.

*Google terms and conditions apply.

Client reminders

Married Filing Jointly vs. Married Filing Separately

Avoid manual entry time and opportunity for error when you automatically split a married-filing-joint return by generating two married-filing-single returns when there's a tax benefit for your clients.

Education resource center

Access articles, self-paced training, webinars, and more in one convenient location.

Free live and prerecorded webinars

Attend live and prerecorded webinars on the topics that matter most to you, at times that work best with your schedule. More than 30,000 pros signed up for webinars last year, and new sessions like tax law, ethics, and product courses are being added.

Keeping you up to date

Earn CPE/CE credits while learning how ProConnect can help optimize your firm's operations or staying up to date with tax law changes. Learn at your own pace with both live and recorded training.