Explore the latest enhancements to help you deliver more value for your clients.

Available Now

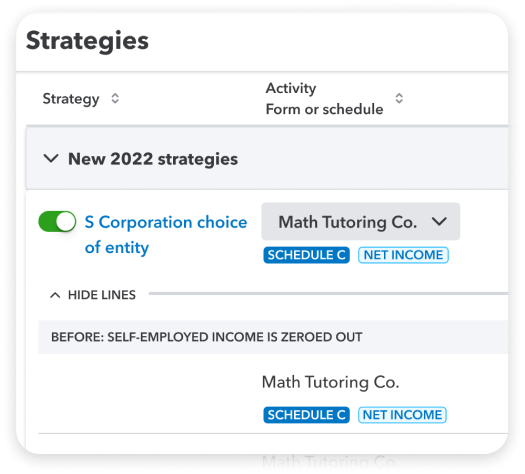

S Corporation choice of entity

The ability to estimate the self-employment tax savings realized by changing entity types from a sole proprietorship to an S corporation that pays a reasonable wage to the owner is one of the most requested strategies by tax advisors.

Available Now

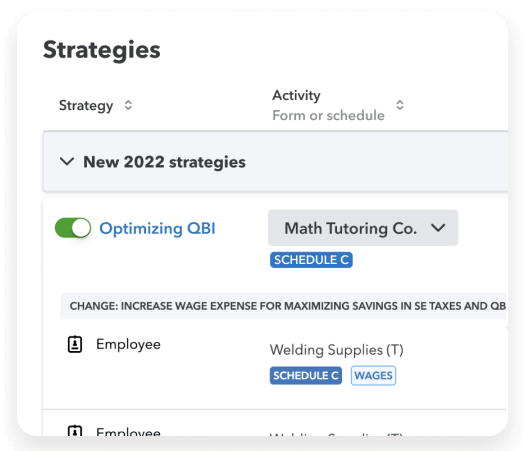

QBI optimization

When the taxable income on the return causes the qualified business income (QBI) deduction to be limited on IRS Form 8995-A, this strategy allows the user to modify the wage expenses and/or unadjusted basis in qualified property immediately after acquisition (UBIA) to optimize the available QBI deduction.

Available Now

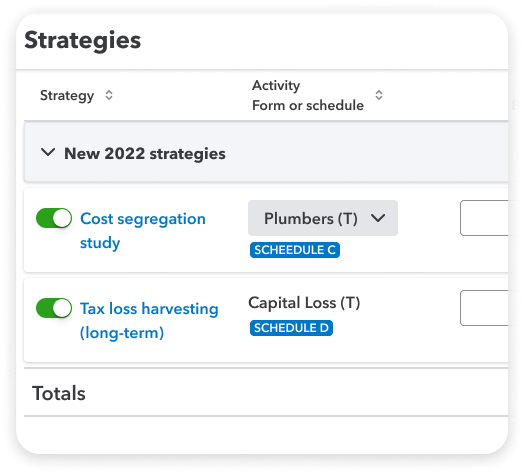

Cost segregation study

Cost segregation study reports by engineering and/or accounting specialists to identify and reclassify personal property assets that are part of real property can result in accelerated deductions, lower taxes, and improved cash flow.

Available Now

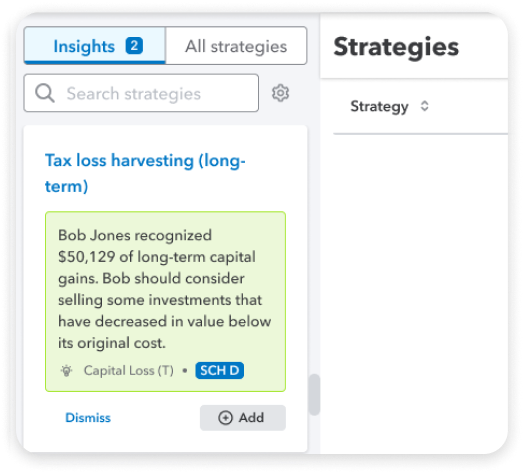

Tax loss harvesting

Tax loss harvesting allows taxpayers to sell some long-term investments at a loss to offset capital gains and potentially lower taxes.

Updated

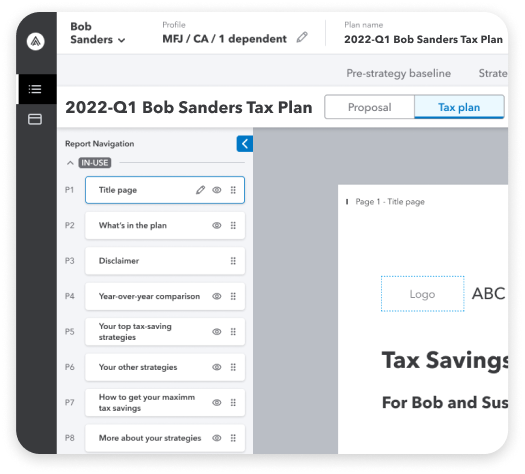

Reports

We have added more options to personalize the client reports, including the ability to change the taxpayer’s name and other information on the title page, hide certain pages of the report, and rearrange the order that pages appear.

Updated

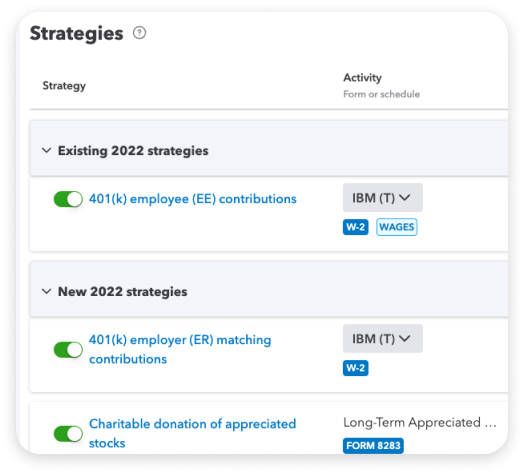

Strategies

To provide better visibility on how a strategy works, we improved the strategy card with four tabs of information about the strategy, including Overview, Research & Considerations, Formulas and Client materials. Under the 2022 strategy change value, we added a ‘Details’ link with more information about the annual limits. Under the strategy tax savings calculation, we added a ‘Formula’ link with details about how the savings were calculated for the specific strategy.

Updated

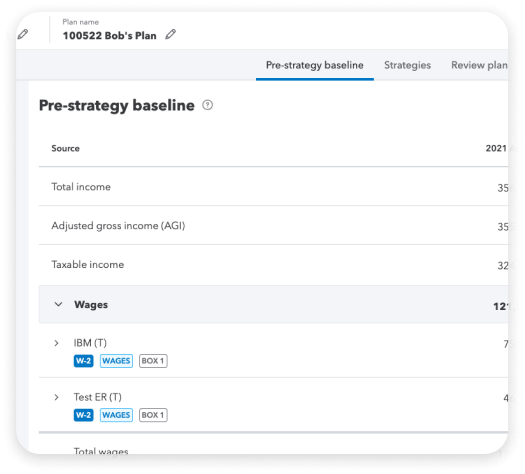

Pre-Strategy Baseline

Activity screens may now be edited completely before recalculating, and we added the ability to zero out all the fields in an activity, or restore the prior year values. We also increased the number of available fields to edit, to provide more control.

Did you know?

22:20 minutes

That’s the median time to create a tax plan with Intuit Tax Advisor.

Median time and projected average client tax savings captured December 7, 2022 is based on Tax Professionals completion of TY2022 tax plans using their clients’ TY2021 tax return data from their Lacerte or ProConnect Tax products. User experience may vary.