Collect the data you need faster and easier and help get information you'll need to prepare virtually any client return. And, help reduce time-consuming data entries and errors with its data transfer capabilities.

Collect the data you need faster and easier and help get information you'll need to prepare virtually any client return. And, help reduce time-consuming data entries and errors with its data transfer capabilities.

Available for Intuit ProSeries Tax professional only. Included in PowerTax Library, PowerTax Lite, and ProSeries Choice.

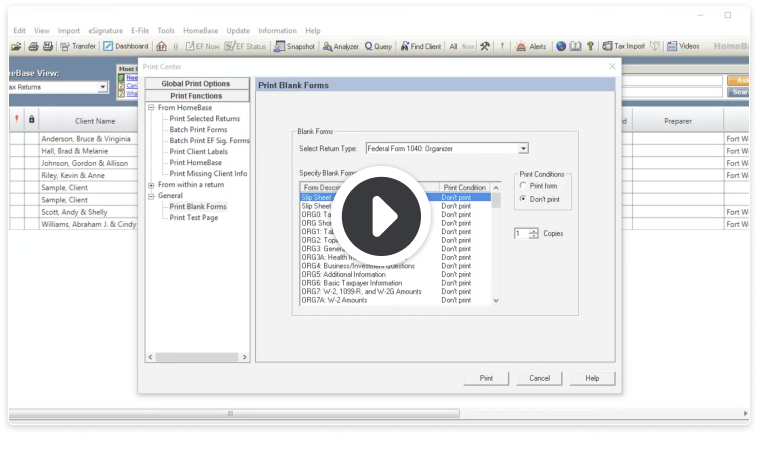

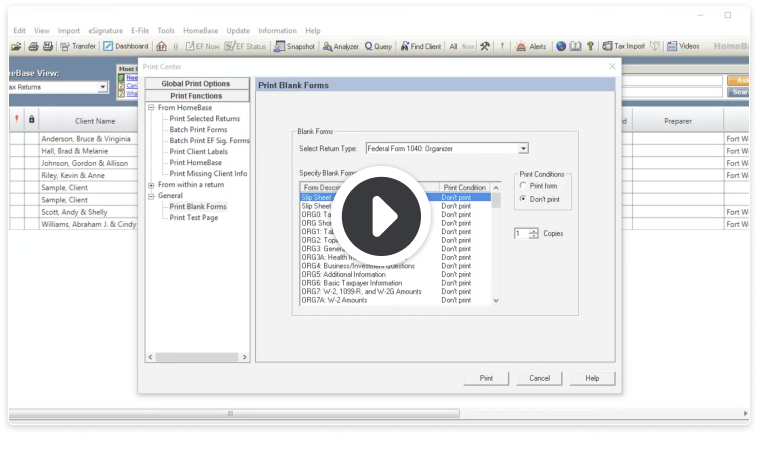

The four-page short organizer is a condensed version of Client Organizer. It's designed to include the most common taxpayer information and can be used for clients with less complicated returns. Your clients can fill out pertinent information quickly and easily, and attach the supporting documents. It may also be less costly to mail. For clients with more complicated returns, you can provide the long Client Organizer, or you can provide the Short Organizer and include relevant pages from the long Client Organizer based on the clients’ needs, such as ORG19, Business Income, and Expenses. You can use Control Which Forms Print to modify which forms you want to print. You cannot enter data directly into the Short Organizer. All data fields in the Short Organizer are duplicated in other Client Organizer forms.

Extend the functionality of your professional tax preparation software with these time-saving tools.

The only integrated tax advisory tool where you can access a library of tax strategies to build custom tax plans in minutes, not hours.

Work-from-anywhere capabilities mirror your desktop setup for a seamless integrated workflow. Plus, attract top talent with remote access.

Digital signing solution where you can manage signatures right within your tax software, and clients can sign whenever and wherever they want.