Monday—Friday, 6 AM to 3 PM PT

A full spectrum of new features

Here’s to setting the standard and then raising it. Time and again.

Automated dependent returns

Automated ERO signature

Automated K-1 delivery*

Revise e-Signature envelope

Background updates

Automated ERO signature

Multi-year access

Revise e-Signature envelope

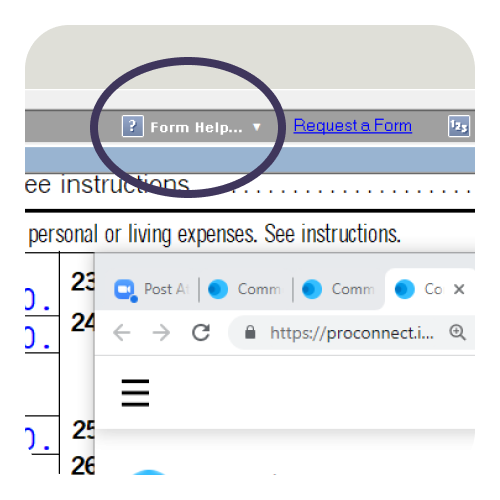

Forms help

Batch e-Signature requests

Tax scan and import

Cryptocurrency support

Intuit Link client portal

Time tracker*

Gather client tax documents through a secure online portal that offers seamless collaboration. Plus, save time on data entry with ability to review and import all client data directly into their return.

Document management options

Financial institution download (FIDO) enhancements

Choose between SmartVault® or Document Management System (DMS) to go paperless and easily store or share almost any type of document.

Have a product suggestion?

Please share you thoughts with us. We’re always looking for new ways

to improve our product and your experience.

Education resource center

Access articles, self-paced training, webinars, and more in one convenient location.

Keeping you up to date

Earn CPE/CE credits* while learning how Lacerte can help optimize your firm's operations or staying up to date with tax law changes. Learn at your own pace with both live and recorded training.

Free live and prerecorded webinars

Attend live or prerecorded webinars on topics that matter most to you (at times that work best with your schedule). More than 30,000 pros signed up last year, and new sessions like tax law, ethics, and product courses keep being added.