New automations, integrations, and innovations in ProConnect Tax

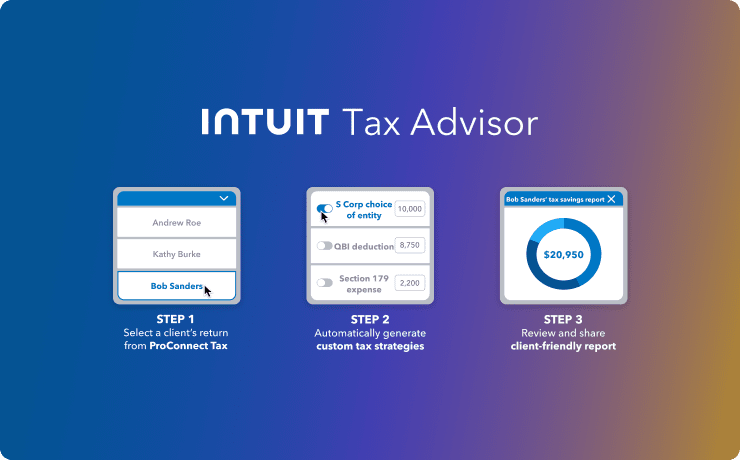

Intuit Tax Advisor

ProConnect Tax is the only pro-tax software that includes tax-planning strategies thanks to the inclusion of Intuit Tax Advisor for tax year 2024. Now you can create custom tax plans in minutes to show clients valuable savings by using tax strategies automatically generated from their ProConnect Tax returns.

- Client-friendly reports that quantifies tax savings

- Leverage a whole new additional revenue stream

- No manual data entry—ever

Protection Plus for Business Returns

Cover your individual and business return clients (1065, 1120, 1120-S) with Protection Plus. Our team of EAs and CPAs will help your business clients with IRS notices and audits to save you time. Protection Plus also comes with identity theft restoration services. Learn more.

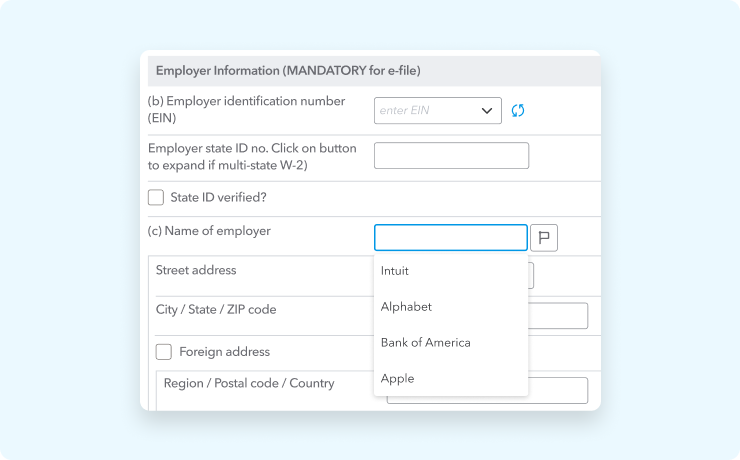

Autofill

ProConnect's most recent update enables the automation of filling in details, such as addresses and contact information, once a specific client is selected from the database.

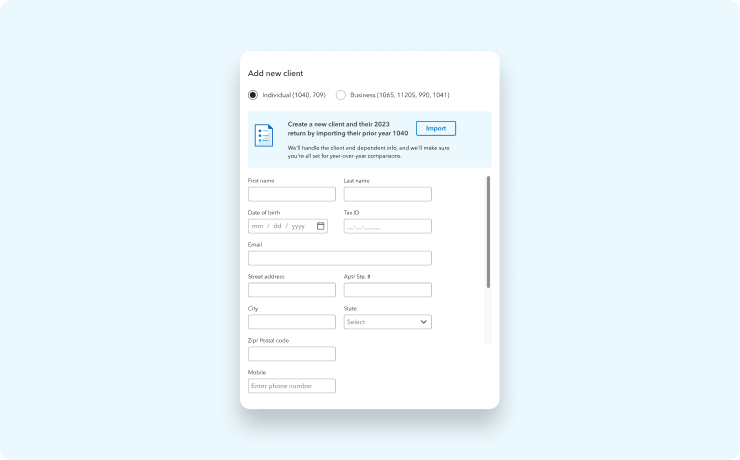

Prior Year 1040 Import

Generate a tax summary comparison for the current tax year by creating a new client in ProConnect and utilizing the relevant information from their previous year's 1040 form.

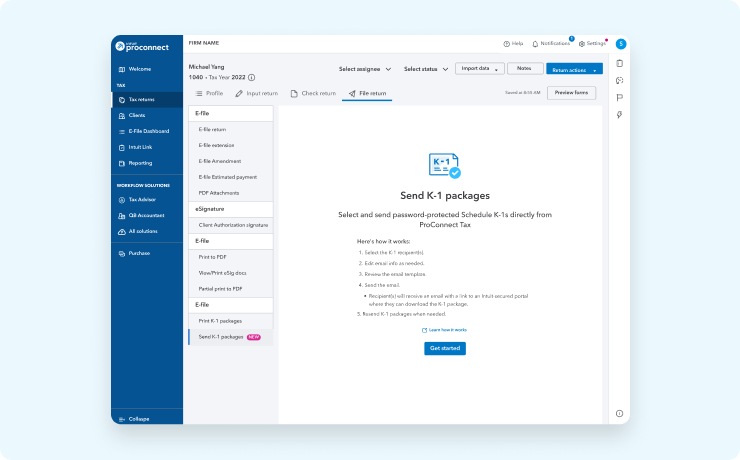

K-1 package delivery

Easily distribute and import K-1 packages by emailing a secure download links to partners, with no need for passwords or postage.

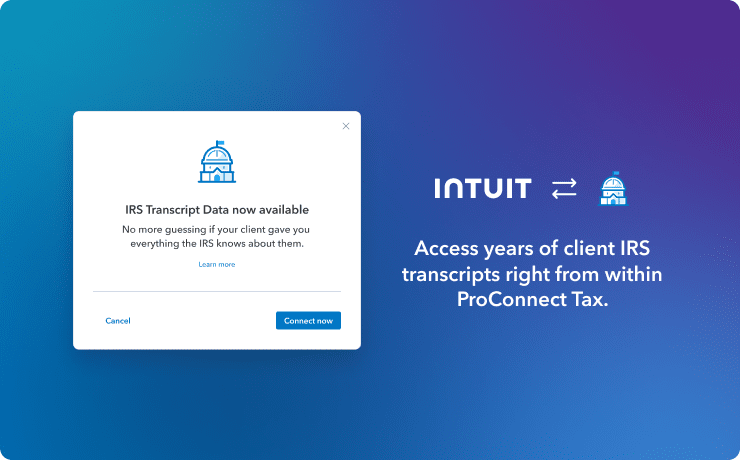

Enhanced direct access to IRS transcripts

Access your clients' transcripts directly from the IRS in ProConnect Tax.

Bulk apply

Merge data from various source documents into one workflow instead of importing them individually.

Auto-populated interest rates

Auto-populate IRS federal interest rates for penalties and interest.

SmartVault

Share, request, and manage documents, letters, forms, proposals, signatures, and more. This client portal integration offers secure online storage with anytime, anywhere access.

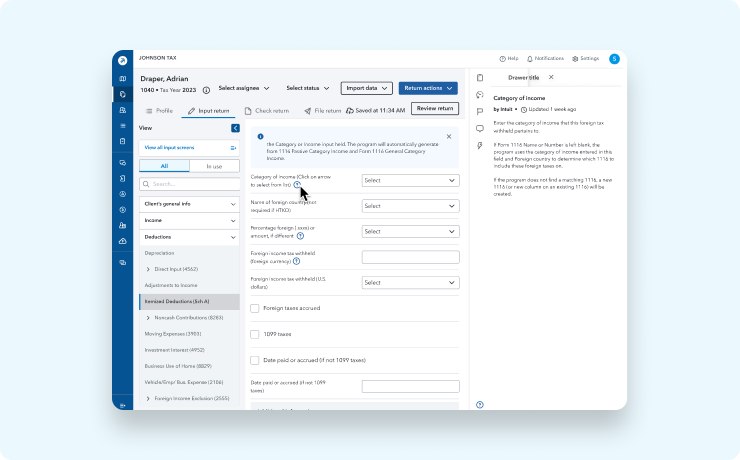

In-return guidance

Starting in Intuit ProConnect Tax 2024, a new help section with articles, videos, and contacts will be built into the right drawer to guide you.

Review checkmarks

Mark fields in clients’ returns to watch. Generate a report of marked fields to see all changes at once.

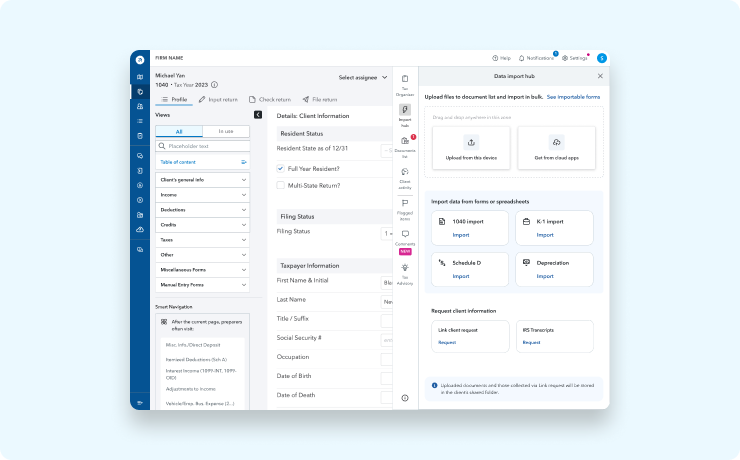

Import hub

Access all of your import tools from a central hub in the right drawer.

Past product releases

In case you missed it, here are some of the features we launched in the past year.

IRS Transcripts

Access all IRS transcripts through ProConnect and complete your clients’ tax returns confidently, without the need for constant communication.

QuickBooks Online Accountant import review

Reconcile tax adjustments to OuickBooks imported trial balance in ProConnect Tax, and update or reclassify tax mapping prior to importing books data to the tax return.

Automated 1040 data entry

Generate a tax summary comparison for the current tax year by creating a new client and utilizing the relevant information from their previous year's 1040 form.

Task accelerators

We’re automating tasks to help you manage valuable, but currently manual tasks. Start by creating an automated email notification when an eFiled return is rejected by the IRS.

Fixed assets

Seamlessly export depreciation to your external database for managing fixed assets with an improved depreciation screen for easier managing of fixed assets.

Interest rates

Use automatically populated IRS interest rates to compute penalties and interest.

Tax return reports

Export client data from 60+ standard tax return fields into an easy to configure CSV report. Available for 1040, 1120S, 1065 and 990 tax returns.

Firm performance insights

Grow your firm with full insights into its performance. Our easy-to-read dashboard reports annual client growth, time spent on returns at both the firm and user level, plus comparison reports that can be created for specific time periods. This performance deserves a hand.

Customized print settings

Generate PDF documents of returns to best meet the needs of your clients. Optimize which documents to include, rearrange the order and standardize print settings by copy types -- client, preparer or government copy. You can even create a custom watermark and mask personal information like SSNs.

Customized client letters

Create and send templated letters with preset and customized tax return data fields, and signatures to clients. Pro move.

Hot Keys (shortcuts)

ProConnect is all about helping you streamline your workflow and maximizing your time saved. That’s why we compiled a list of shortcut key combinations to accelerate your productivity while navigating three main sections of ProConnect: main navigation, client tax returns list, and return navigation. Convenient. Accurate. Fast.

QuickBooks Billing Integration

Create QuickBooks Online invoices from ProConnect Tax with your tax client's billing details auto-populated, streamlining client invoicing, payment collection and tracking accounts receivables. No separate login or accounts required.

Google Drive & Dropbox integration*

Connect your Google Drive and or Dropbox accounts to ProConnect to import your client’s tax forms directly to their tax return. Efficient.

*Google terms and conditions apply.

Client reminders

Married Filing Jointly v. Married Filing Separately

Avoid manual entry time and opportunity for error when you automatically split a married-filed-joint return by generating two married-filing single returns when there's a tax benefit for your clients.

Mark as done

Clients can now tell you when they’re done providing information and documents via Link so you don’t have to waste time wondering when to get started on their return. You’ll receive a notification and also have the ability to mark the client activity done yourself in the return actions.

E-file summary

View a summary of information before submitting an efile, including a list of the federal and state returns, payment method, and the refund amount or balance due.

New notifications inbox

Stay informed of important news and product updates pertinent to you, sent directly to your new notifications inbox within ProConnect Tax.

View all client documents

View and manage all documents, internal to the firm and shared with the client, in one place.

Rejected return credit

When a return is rejected due to an incorrect SSN or EIN, the return will automatically unlock and an error code will generate a credit.

eSignature authorization options

View a summary of information before submitting an efile, including a list of the federal and state returns, payment method, and the refund amount or balance due.

Jump to Input

- Navigate client tax returns faster by easily moving from tax form fields to input screen in one click on more fields than ever.

- View a summary of sources and values for fields with multiple inputs.

Lock return

- Auto-locked e-filed returns prevent manual entry errors and calculation updates that may alter the original e-filed amounts.

- Returns are automatically locked after e-filing, so a copy of the e-filed version is always available for reference.

- Return data can still be viewed in read-only mode when a return is locked, but inputs cannot be edited.

Direct Data Import

- Drag and drop client tax documents from your computer directly into their return. No manual data entry or Link request required.

- Directly import popular tax forms like W-2, 1099-DIV, 1099-G, 1099-INT, 1099-Misc, 1099-R, 1098s, and more.

- Keep all your imports organized in the new data import drawer, not just client source documents. There’s a place for Schedule D, Depreciation, and K-1 imports too.

eSignature 1-click

- Now you can request eSignature with just one click!

- Go digital with eSignature and give yourself and your clients the better way to collect and submit signatures in record time.

Multiple preparer awareness

- Get a full view of any users working on the same tax return. This can keep work moving without creating version conflicts or overwriting previous versions of the return.

- The person(s) icon will appear at the top of the input return screens when another member of your firm joins. Hovering over the icon will reveal the member’s name.

- If a version conflict occurs, you will be given the choice to save your changes, overwrite the previous version, or load the latest version.

Assign and manage staff work

- Assign staff members client returns, then re-assign each return as it changes hands within your firm until it’s complete.

- Filter by assigned staff members, in the Tax Hub, to monitor return status and team workloads.

- Help your staff stay focused with personalized views of their assignments.

View e-file status for all return types

- Easily drill down to the status of each part of the return at the federal and state levels, including extended and amended returns, so you can focus on what’s important.

- Click the status in each column to get further explanation of what was rejected as well as transmission confirmation letters.

Smart navigation

- ProConnect Tax intelligently predicts tax forms frequently used next based on common workflow patterns.

- New suggestions are updated each time you navigate to a new input screen, keeping you at peak performance.

- As new workflow patterns are added, suggestions will become smarter and more personalized.

- Only available for non-proforma individual (Form 1040) returns at this time.

Education resource center

Access articles, self-paced training, webinars, and more in one convenient location.

Free live and pre-recorded webinars

Attend live and pre-recorded webinars on the topics that matter most to you, at times that work best with your schedule. More than 30,000 pros signed up for webinars last year, and new sessions like tax law, ethics, and product courses are continually added.

Keeping you up to date

Earn CPE/CE credits while learning how from Intuit experts about optimizing to ProConnect for your firm or staying up to date with tax law changes. Learn at your own pace with both live and recorded webinar training.