Unleash the power of Intuit ProSeries Tax with enhanced features and new tax preparation capabilities.

Get the most out of tax season with these enhanced features

Consolidated K-1

This feature conveniently prints the entire K1 for multiple partners with multiple states in just one click, eliminating the need to manually print and merge copies.

Automated ERO Signature

Automatically generate and print on the 8879 with full confidence, as automated ERO signatures are accepted as a valid signature method by the IRS.

Revise eSignature Envelope

Revise an eSignature request you’ve already sent a client without voiding the request. Learn more

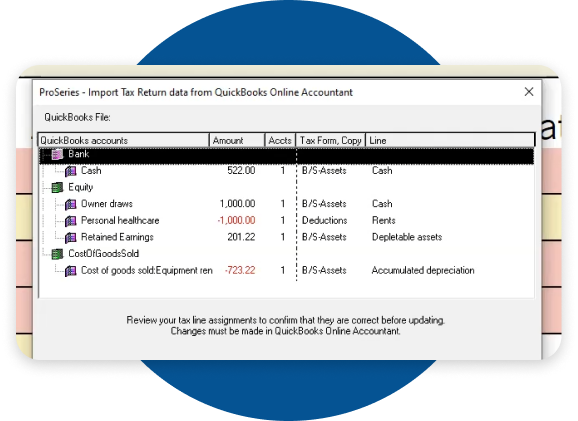

QuickBooks Online Accountant import

Import tax line values from a QuickBooks Online company into a ProSeries tax return. Now, you can transfer current-year TurboTax individual 1040 returns to current-year ProSeries returns using the same tool you've used for other TurboTax returns.

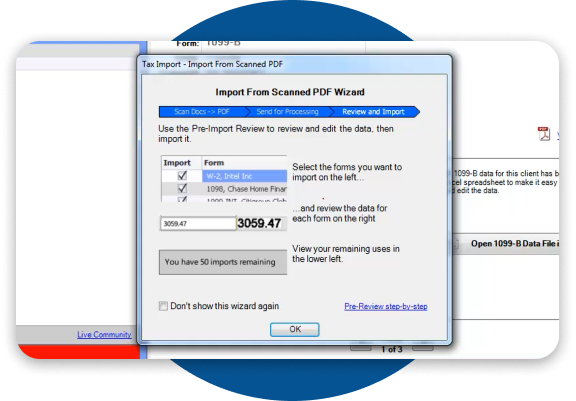

Tax scan and import ($)

Quickly and reliably import data into your return with just a few clicks. The form reviewer tool allows you to check and edit data before importing.

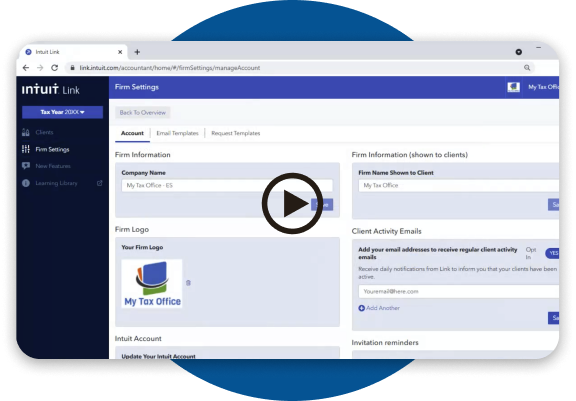

Link client portal

Gather client tax documents securely, cut down on data entry with smart integrations, and make the whole process much simpler for your clients with new enhancements to your virtual organizer.

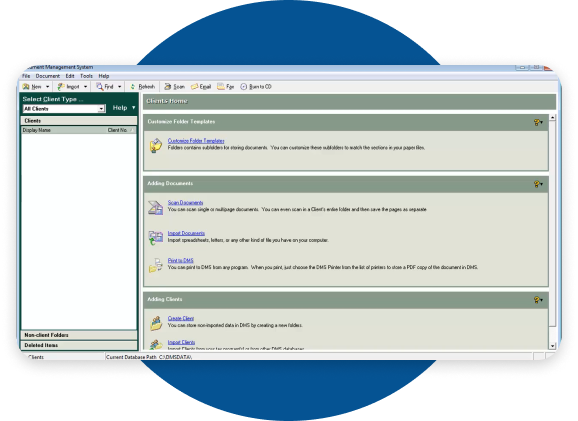

Document management ($)

Choose between SmartVault® or Document Management System (DMS) to go paperless and easily store and share almost any type of document.

Fixed asset manager

Import fixed assets from an Excel spreadsheet—great for new clients or existing clients with several asset purchases in a given year.

Get in touch. Our team is always here to help provide

one-on-one and self-serve assistance.

Get support on your schedule

Save time by scheduling an appointment, requesting a callback, or getting in line without having to leave ProSeries.

Intelligent voice assistant

Your time matters. Get what you need faster with this listening tool that directs you to self-serve solutions so you don't have to stay on hold to talk to an agent.

Tool hub application

Quickly resolve common system issues and errors with this tool, so you can get back to serving your clients.

Elevate your firm with integrated tools to maximize productivity

Get anytime, anywhere access with Hosting

Use the software you love, now online with enterprise-level security, easy backups and updates, and fully remote capabilities.*

- Host powerful tax and accounting apps like Quickbooks Desktop*

- Work from anywhere, at any time, on any device

- Hire top talent no matter where they are, and keep growing your firm

Elevate your signature game with eSignature

Request IRS-compliant signatures with quick clicks, and track them with real-time updates right from your dashboard.

- Collect eSignatures on any form or document

- Save time with pre-populated tax forms

- Expedite the process with customizable reminders

Protect your clients with Firm-Level Protection Plus

Go above and beyond typical tax return preparation and defend your clients from tax notices, audits, and identity theft, all while saving time.

- Remove the burden of dealing with administrative work so you can focus on your clients

- Receive access to a bilingual team of expert CPA and EA case resolution specialists

- Get 24/7 access to identity theft restoration advocates who’ll help your clients restore stolen identities and remediate refund fraudulent claims