Compare features to see which desktop tax software is right for you

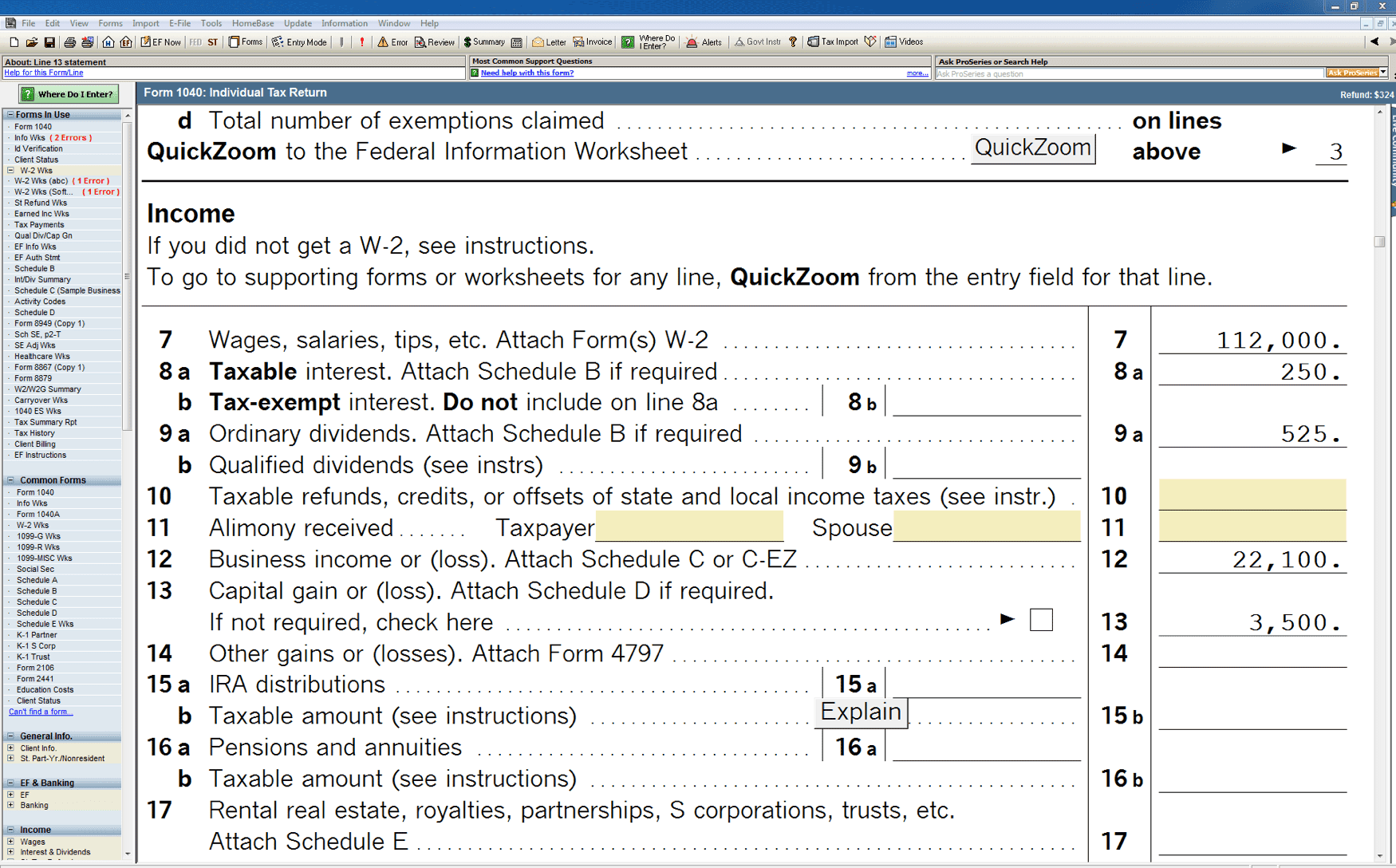

Compare ProSeries Professional and Basic

1

Prepare 1040 returns with ease using intuitive forms-based entry. (Professional only: Plus, complete business returns)

2

Click any line on the form to see all the associated data.

3

Quickly navigate to forms in the return.

4

Easily track all current data entries.

5

Tap Where Do I Enter to find the right forms and fields fast.

6

See refund or balance in real-time with auto-calculations.

7

Get quick answers without disrupting your work.

8

Go to supporting forms fast with QuickZoom.

9

View a summary of the return with a click.

10

Keep track of e-filed returns in one place.

11

Click back and forward to swiftly move between screens.

BASIC

Follow the same flow as a 1040 by category, with checklists at each step.

12

Add common forms to the return with just a click. (Professional only)

13

Import data directly form financial institutions or scanned documents. (Professional only)

14

Choose Quick Entry or Forms Mode to fit your preference. (Professional only)

15

Access Client Checklist and Client Presentation tools. (Professional only)

1

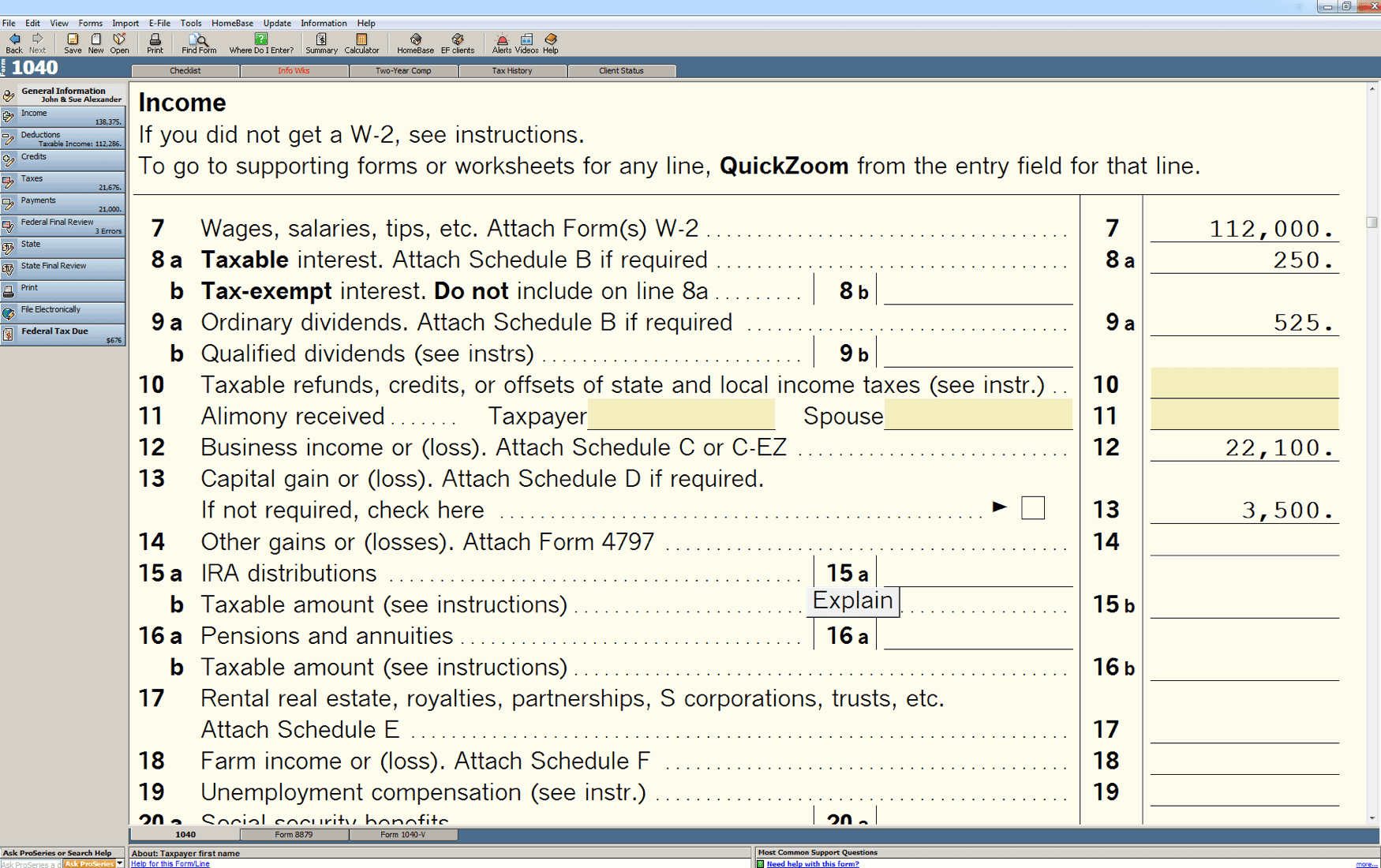

Prepare 1040 returns with ease using intuitive forms-based entry. (Professional only: Plus, complete business returns)

2

Click any line on the form to see all the associated data.

3

Quickly navigate to forms in the return.

4

Easily track all current data entries.

5

Tap Where Do I Enter to find the right forms and fields fast.

6

See refund or balance in real-time with auto-calculations.

7

Get quick answers without disrupting your work.

8

Go to supporting forms fast with QuickZoom.

9

View a summary of the return with a click.

10

Keep track of e-filed returns in one place.

11

Click back and forward to swiftly move between screens.

12

Follow the same flow as a 1040 by category, with checklists at each step.

PRO

Add common forms to the return with just a click. (Professional only)

PRO

Import data directly form financial institutions or scanned documents. (Professional only)

PRO

Choose Quick Entry or Forms Mode to fit your preference. (Professional only)

PRO

Access Client Checklist and Client Presentation tools. (Professional only)

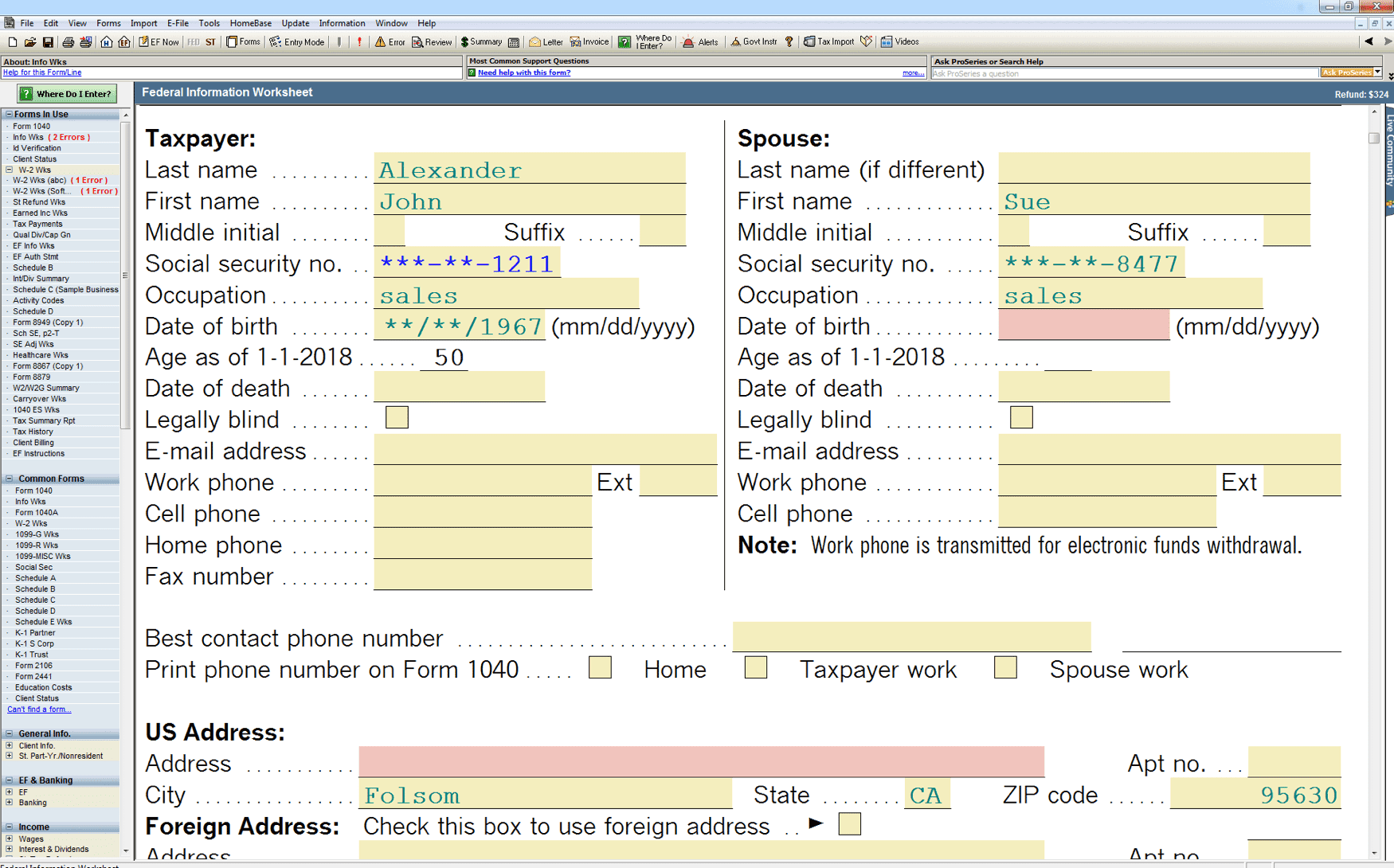

1

Check errors, diagnostics and notes in one place for final review.

2

Spot errors and required entries fast with red fields.

3

See exactly which forms have errors for easy navigation.

4

Get quick links directly to error fields. (Professional only)

1

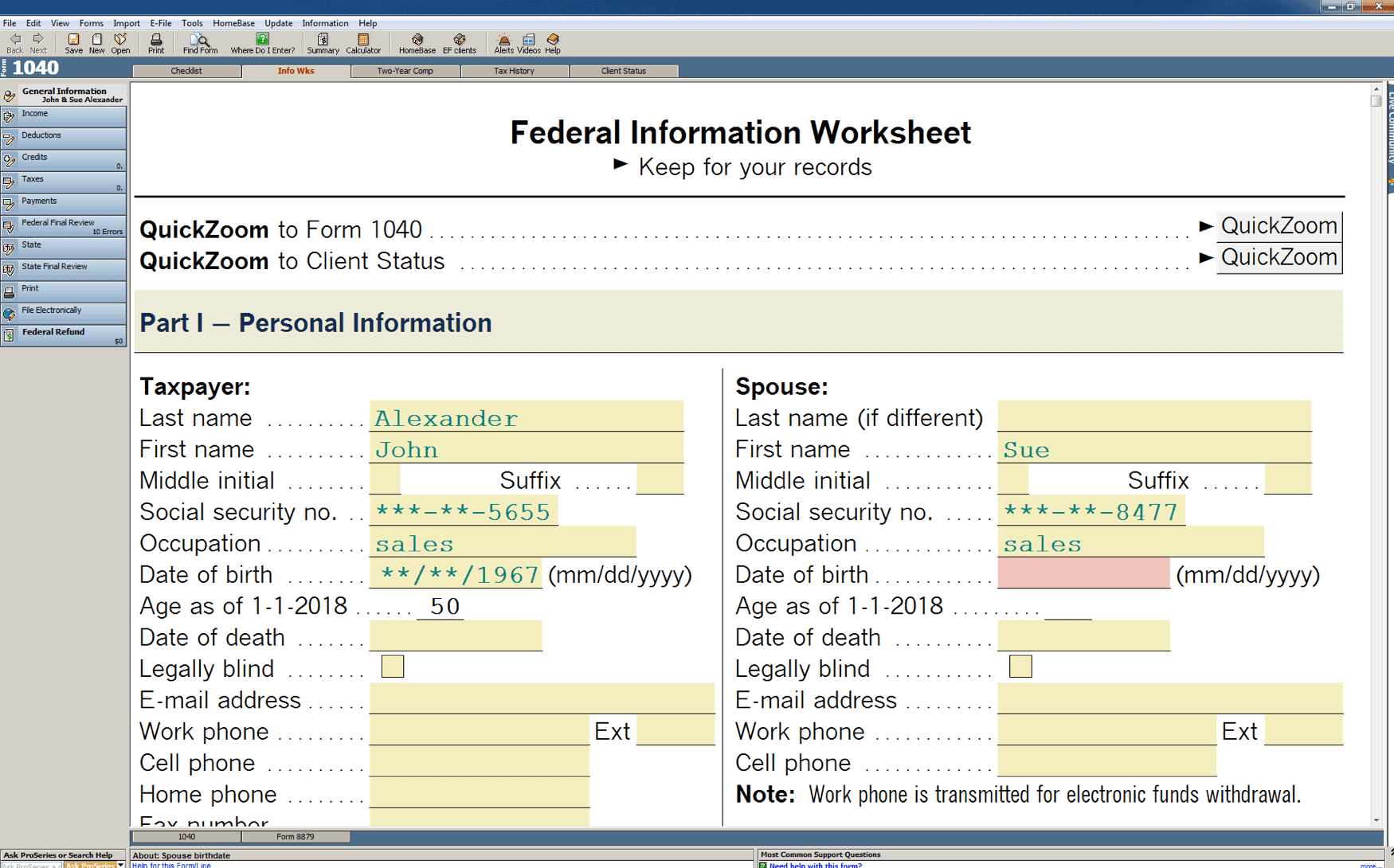

Check errors, diagnostics and notes in one place for final review.

2

Spot errors and required entries fast with red fields.

3

See exactly which forms have errors for easy navigation.

PRO

Get quick links directly to error fields. (Professional only)

Find your right fit

Compare features of ProSeries Professional and ProSeries Basic 1040

| Features | Professional | Basic 1040 |

| Additional 1040 support such as 1040NR, Net Operating Loss, Client Organizers, and more | ||

| Cloud hosting available for anytime, anywhere access | ||

| Business forms including 1120, 1120S, 1041, 1065, 990, 706, 709 | ||

| Network functionality for multiple-user access | ||

| Client Checklist helps make collecting data from clients easier | ||

| Client Presentation provides charts and graphs of the return | ||

| Client Advisor helps you offer client-specific tax planning recommendations | ||

| K-1 data import for business-to-1040 transfers | ||

| Missing Client Information utility helps you find missing data | ||

| Includes ProSeries Tax Import integrated within software | ||

| Client Analyzer identifies clients impacted by tax changes and scenarios | ||

| 1040 forms with schedules and calculations | ||

| Integrated electronic filing at no additional charge for all supported forms | ||

| Tax Planner helps you plan 1040 returns in future years | ||

| Diagnostics to help you locate errors and omissions | ||

| In-product tax help, forms search, and access to online community of peers | ||

| Integrated paperless solutions to help you streamline your office | ||

| eSignature integration | ||

| Free U.S.-based technical support with extended hours during peak season | ||

| Integration with the Link portal | ||

| Guided workflow and checklists lead you through return preparation | ||

| Deduction Finder helps identify missed deductions |