Intuit has the solutions you’ve been looking for to make next tax season your easiest yet

Break free from software that’s holding you back

Stay competitive in a changing industry with Intuit’s pro tax software. Read on to learn how our solutions can help you automate tasks, ensure accuracy, and focus on what matters most—your clients and your firm’s growth.

Let automation do the heavy lifting

“I spend too much time on data entry.”

You’re not alone; countless preparers feel their software is slowing them down. But with advanced tools that use automated workflows, you can breeze through filings without sacrificing accuracy. In fact, Intuit users report saving an average of 25+ minutes per return* with automation.

Peace of mind, built in

“I need to trust that every return is accurate—at scale.”

With Intuit professional tax software, you can. Built-in diagnostics and automated error-checking helps firms of all sizes ensure consistency and compliance across every client file—so accuracy scales right alongside your growth.

Onboarding made easy

“I don't want to go through a painful software switch.”

Whether you have 2 clients or 2,000, our Easy Start team makes switching effortless, quickly converting client data and offering onboarding services to get you up and running quickly. Don’t suffer through another laborious season—the grass actually is greener over here.

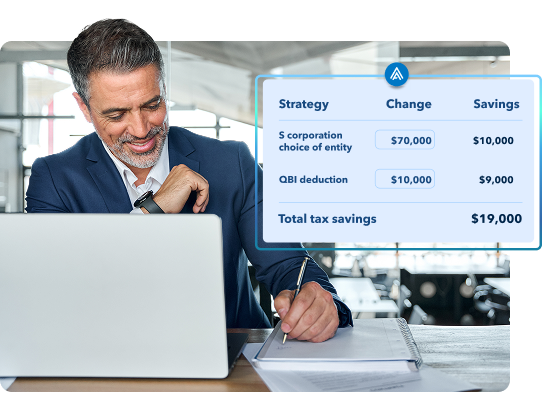

Empowered advisory capabilities

“I want to deliver more value for my clients.”

The future of accounting demands more than box-checking. Amplify your advisory services with AI-powered tech seamlessly integrated into the software so you can create custom tax plans and generate reports in minutes—not hours.

Help every step of the way

“I need support I can count on.”

We’ve got you covered. As part of our community of tax professionals, you’ll have access to free on-demand training, practical tools, and expert tips to help your team master your software and work confidently all season long.

Three innovative products, one trusted brand

Find the ideal option for your practice—whether you’re a solo preparer or a multi-office firm—and start breezing through tax season.

Smart integrations

Intuit ProConnect Tax

The only cloud-based tax software with built-in advisory and an AI-powered workflow.*

Complex returns

Intuit Lacerte Tax

Optimized for complex returns and includes advisory insights and planning tools.

Efficiency and speed

Intuit ProSeries Tax

Uses an intuitive, forms-based data input and reliable compliance diagnostics.

This tax season can be your easiest yet

Ready to discover how much better tax season can be? Fill out the form below and one of our experts will be in touch soon to discuss your options.

Thank you for your interest

A qualified specialist will reach out to you soon.

Have questions? We’ve got answers.

ProConnect Tax, Lacerte Tax, and ProSeries Tax consistently rank among the highest-rated professional tax software solutions, earning trust through proven accuracy, unmatched reliability, and support that understands the realities of tax practice. Our platforms maintain strong ratings because we built them specifically for what matters most to strategic firms: diagnostic error detection that catches issues before they reach the IRS, infrastructure delivering 100% uptime for over 10 years through the most critical filing deadlines, and Easy Start Teams who guide you through transitions instead of leaving you with generic tutorials. High ratings reflect something deeper than features. They show that thousands of tax professionals trust Intuit with their reputation and their clients' most sensitive financial information. When software consistently earns top ratings year after year, it's because the provider understands what keeps you up at night during busy season and has built solutions that actually address those concerns.

ProConnect Tax and Lacerte Tax are purpose-built for accounting firms, offering seamless integration with QuickBooks and major practice management platforms that enable year-round client workflow continuity. These solutions understand that your practice doesn't stop at tax season. You're managing ongoing client relationships, coordinating bookkeeping workflows, and delivering advisory services that set your firm apart. We designed these integrations knowing that strategic firms can't afford duplicate data entry between systems. Trial balances transfer automatically, business income figures sync without reconciliation, and depreciation schedules populate without manual keying. This integration enables you to focus on tax strategy and advisory conversations rather than data management. We built software for how accounting firms actually operate rather than forcing you to rebuild workflows around the technology, which is why firms managing comprehensive client relationships choose platforms designed for their complete service model.

Lacerte Tax and ProSeries Tax deliver comprehensive multi-state capabilities that systematically manage the complexity of 50 different state filing requirements, varying tax codes, and jurisdiction-specific apportionment calculations. We built these platforms knowing that strategic firms handling multi-state returns can't afford state filing errors or missed apportionment rules that trigger penalties and damage client trust. The software automatically handles state-specific calculations, tracks changing filing requirements across jurisdictions, and alerts preparers to state-level compliance issues before e-filing. Multi-state complexity multiplies fast, and manual tracking of different state rules becomes impossible at scale. Intuit's Professional Tax software platforms catch nuances that manual review might miss under deadline pressure, eliminating costly state-level amendments. When you're managing clients across multiple states, you need software built by a provider who understands that state tax complexity deserves the same sophisticated handling as federal returns.

ProConnect Tax ranks as one of the most user-friendly cloud tax solutions for strategic firms because we designed it to balance powerful capabilities with intuitive workflows that don't require constant training or frequent interruptions in support. User-friendly means your team can work confidently under deadline pressure, access returns from any device, and collaborate in real time without steep learning curves that slow down experienced preparers. Intuit built ProConnect Tax knowing that cloud solutions should enable your practice rather than complicate it. The platform provides the sophisticated calculation power that strategic firms require while maintaining accessibility that keeps teams productive whether working in the office or remotely. True user-friendliness shows when software feels intuitive during April deadline rushes, allowing preparers to focus on tax expertise rather than fighting the technology. We designed ProConnect Tax specifically for tax professionals who need cloud flexibility without sacrificing the advanced capabilities that strategic practices demand.

ProConnect Tax maintains enterprise-grade security through data encryption, multi-factor authentication, continuously monitored cloud infrastructure, and systematic backup protocols that exceed what individual practices can implement locally. We treat client data protection with the same seriousness that tax professionals treat confidentiality, because a single security breach can destroy years of trust. Cloud security from established providers actually delivers stronger protection than locally managed desktop systems: automatic security updates happen without user intervention, professional infrastructure management operates 24/7, and backup systems protect against data loss from hardware failures or disasters. We invested in security infrastructure specifically because we understand what's at stake. Your clients trust you with their most sensitive financial information, Social Security numbers, and business records. That trust demands security that never becomes your vulnerability, which is why Intuit's cloud platforms deliver protection that individual practices couldn't achieve on their own.

Intuit Professional Tax software provides industry-leading support for ProConnect Tax, Lacerte Tax, and ProSeries Tax through priority access to tax experts who understand both software functionality and tax code complexities, not script-reading agents. These experienced professionals troubleshoot complex scenarios, interpret changes in tax law, and optimize workflows when you're under deadline pressure. We know that 3 am questions during extension deadlines can't wait for callback schedules and that losing two hours to system issues on April 14th constitutes a crisis for your practice. Beyond direct support, Intuit connects you to a community of thousands of fellow practitioners, provides free on-demand training, and offers practical tools to help your team work confidently during busy season. Support quality reveals whether a provider has been in your shoes. Intuit built this comprehensive support ecosystem because we've seen what tax professionals need when the stakes are highest, and we designed support that actually keeps your practice moving forward.

ProConnect Tax and Lacerte Tax deliver seamless integration with QuickBooks and other major accounting platforms, enabling automatic data flow without manual file imports or reconciliation. Real integration means trial balance transfers without re-keying, business income figures sync without verification loops, and depreciation schedules populate without duplicate entries. We built these integrations recognizing that strategic firms can't afford to manually re-enter information that already exists in their bookkeeping systems. Your practice runs smoothly or drowns in duplicate data entry, depending on how well tax software integrates with your complete client workflow. Intuit understands the full scope of what accounting firms do, not just return preparation, which is why our integrations actually save time rather than create new reconciliation headaches. When you choose software from the same company that built your accounting platform, integration isn't an afterthought. It's fundamental to how the system works.

Intuit Professional Tax software offers ProSeries Tax, ProConnect Tax, and Lacerte Tax at different price points that reflect deployment models and capability levels, but strategic firms evaluate cost through ROI rather than just upfront fees. Software that saves 80 or more hours per season through automation, prevents costly amendments through diagnostic error detection, and enables advisory services beyond compliance typically pays for itself within the first tax season. Intuit designed pricing to match different operational models: ProSeries Tax for established desktop practices, ProConnect Tax for cloud flexibility, and Lacerte Tax for maximum customization and volume capacity. The "lowest fees" question assumes all software delivers equal value and saves equal time. Smart firms calculate which solution delivers the fastest ROI through efficiency gains that let you handle more returns with existing staff, quality improvements that eliminate amendment work, and advisory capabilities that command premium fees. Intuit's platforms save substantially more than they cost when you measure the full productivity impact.

ProConnect Tax leads professional online tax platforms by combining cloud flexibility with capabilities strategic firms require: sophisticated multi-state handling, detailed audit trails, team collaboration features, and diagnostic tools that maintain accuracy across substantial return volumes. Intuit built ProConnect Tax specifically for tax practices rather than adapting consumer software, recognizing that professional firms need capabilities beyond those required for individual tax preparation. The platform manages practices where accuracy at scale determines reputation and profitability through systematic diagnostics, enables distributed teams to collaborate in real-time regardless of location, and integrates with practice management systems that support year-round client relationships. Top platforms emerge from providers who understand the realities of professional practice beyond just software development. Intuit's decades of serving tax professionals inform how ProConnect Tax handles the business challenges of running a strategic practice, not just the technical requirements of completing returns.

ProConnect Tax excels as a cloud-based professional tax solution by eliminating the friction that holds strategic firms back: time wasted on data entry, accuracy concerns at scale, and limitations on team collaboration. The platform saves firms hours per season through intelligent automation, maintains diagnostic accuracy whether you're processing your 50th or 1,000th return, and enables distributed teams to work seamlessly from any location. Intuit built ProConnect Tax specifically for tax professionals who refuse to compromise between cloud flexibility and professional-grade capabilities. The software delivers 100% uptime through critical deadlines, provides Easy Start Team migration support that removes switching friction, and integrates with QuickBooks to eliminate duplicate data entry between systems. ProConnect Tax is a leader because it solves the exact problems that cause tax professionals to ask, "Is my software holding me back?" Your team works faster through automation, files with confidence through systematic diagnostics, and delivers better client service through advisory capabilities that move you beyond compliance work.

ProConnect Tax and Lacerte Tax rank among the top cloud-capable professional platforms by understanding that accounting practices need more than just tax software. They need year-round client workflow support, seamless integration with bookkeeping systems, and the flexibility to serve clients regardless of location. ProConnect Tax delivers full cloud deployment with access from any device, real-time collaboration for distributed teams, and automatic updates without user intervention. Lacerte Tax offers cloud hosting options that provide desktop power with cloud accessibility for firms that need maximum customization while embracing modern deployment. Intuit built these solutions knowing that accounting platforms must support your complete practice, not just tax season. The platforms integrate with QuickBooks and other accounting systems to eliminate duplicate data entry, enable advisory services through sophisticated calculation tools, and maintain the diagnostic accuracy that protects your reputation across all client work. Top platforms come from providers who understand that accounting firms operate 12 months a year, not just during filing season.

ProConnect Tax represents Intuit's cloud-first approach with anywhere access, real-time collaboration, and automatic updates, while ProSeries Tax and Lacerte Tax offer proven desktop reliability with local data control and familiar workflows, plus Lacerte includes cloud hosting options. The comparison isn't about which deployment is "better" but which matches your firm's operational reality. Cloud solutions like ProConnect Tax benefit practices with distributed teams, remote work needs, and a preference for automated infrastructure management. Desktop solutions like ProSeries Tax serve established practices that prefer traditional architecture, local data storage, and workflows developed over years of experience. Lacerte Tax bridges both worlds through desktop power with optional cloud hosting. All deployment models meet Intuit's diagnostic accuracy standards, provide comprehensive support, and offer integration capabilities. The choice reflects your firm's technology philosophy, team structure, and operational preferences. Intuit offers multiple deployment options because we understand that strategic firms have different needs, and the right technology should match how you actually work rather than forcing you to change.

ProConnect Tax delivers cloud-based flexibility that enables distributed teams to access returns from any device, collaborate in real-time regardless of location, and maintain productivity whether working in the office or remotely. The key benefits include automation that saves hours per season by eliminating repetitive data entry, diagnostic error detection that catches issues before e-filing to protect your reputation, and seamless integration with QuickBooks and practice management platforms that eliminate duplicate data entry across systems. Intuit built ProConnect Tax specifically for strategic firms that need the sophisticated calculation power of professional tax software without being tied to desktop deployment. The cloud infrastructure delivers 100% uptime through critical filing deadlines, automatic updates without user intervention, and systematic backup protection that exceeds what individual practices can implement locally. ProConnect Tax benefits extend beyond features to operational advantages: your team can work from anywhere, client data stays accessible during travel or emergencies, and collaboration happens in real time without email attachments or version control issues.

ProSeries Tax and Lacerte Tax serve startup accounting and tax practices by combining professional-grade capabilities with pricing models that scale as your firm grows. Startup practices need software that handles sophisticated returns without enterprise complexity, delivers diagnostic accuracy to protect your emerging reputation, and maintains reliability to keep you productive during your first critical tax seasons. Intuit designed these platforms knowing that startup firms can't afford the amendment work, system downtime, or learning curves that derail early growth. ProSeries Tax offers proven desktop reliability with familiar workflows that experienced preparers already know, while Lacerte Tax provides the calculation sophistication and customization that positions your startup to handle complex client work from day one. Both platforms include Easy Start Team migration support, comprehensive training resources, and access to a community of fellow practitioners who understand startup challenges. The best software for startups isn't just about initial cost. It's about platforms that protect your reputation, scale with your growth, and provide the support you need as you build a practice from the ground up.

Intuit provides comprehensive support for ProConnect Tax, Lacerte Tax, and ProSeries Tax users through priority access to tax and accounting experts, community connections with thousands of fellow practitioners, and free on-demand training designed for the busy season. The best support goes beyond technical troubleshooting to include tax code interpretation, workflow optimization, and practice management guidance from professionals who understand accounting firm operations. Intuit knows that accounting practices need support that addresses both tax preparation challenges and the year-round client workflow complexities that distinguish accounting firms from seasonal tax shops. Support quality shows when you reach someone at any time during the extension deadline who understands both the software functionality and the accounting implications of the issue you're facing. Beyond direct support, Intuit connects you to practical tools, expert tips, and a practitioner community that shares real-world solutions to the challenges accounting firms face. The best support comes from providers who've been in your shoes, understand what's at stake during critical moments, and have built support ecosystems that keep accounting practices moving forward through tax season and beyond.