- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Entering data on 1099- B worksheet on the 2020 version of ProSeries Basic

Entering data on 1099- B worksheet on the 2020 version of ProSeries Basic

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

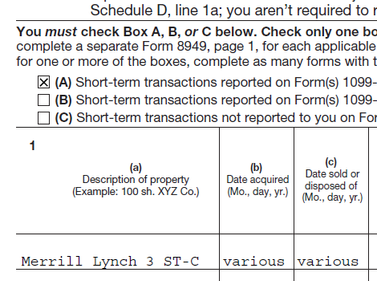

The 2019 version of ProSeries Basic allows us to enter the aggregate total of the transactions by category ( Box A, B, C or D) on the worksheet without entering any data on the Date Sold and Date Acquired boxes so long as we mark the holding period as either S ( for short-term) and L ( long-term). On the 2020 version, I can enter " VARIOUS" on the Date Acquired box but it requires a specific date input on the Date Sold box. Last year, if the client has numerous 1099-B transactions, I just entered the Summary total and then paper filed the details using form 8543.

Is there a work around to bypass the "Date Acquired" box without the program giving an error?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Doesn't the 1099-B worksheet have a place at the top to enter Box A and Box D transaction totals? I haven't used it much yet this year because the broker statements are usually either late or corrected. But it looks to me like it might be easier than last year if you have multiple Forms 1099-B. You can go to a worksheet to total them. You could do that last year too but it required copying the first set of entries if you didn't know there was going to be a second set.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That's what I did too but I am not sure if fudging in a sale date is a good idea. If "Various" is an ok input for Date Acquired" why can't they make it ok too for the "Date Sold".

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The place at the top you are referring to I think are for Sch D transactions that bypasses form 8949.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have this same question. I have always aggregated in the past few years (for those stocks where basis is being tracked by broker of course) and used various sales date and various purchase date to report multiple stock sales together.

This year Proseries has changed and doesn't allow various for sales date. AND at the link below it says "The IRS does not allow Various as a date sold, even if reported a summary of the stock."

| https://proconnect.intuit.com/community/form-1099-b/help/methods-for-entering-stock-transactions-for... |

Is this true? I can't find guidance from the IRS to that point.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

They have never allowed "Various" for sales date. But most of the transactions now don't need it, because they are Box A or D. Those with basis not reported, are supposed to be listed separately. These rules are made by IRS employees who go to H&R Block for tax return preparation. The worst cases are when withdrawals are being made monthly from a mutual-fund account. The purchase date might go back to the 1980s. Just because the software doesn't allow for common sense, doesn't mean you are forbidden to use it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Happy day,

Unless it is a STCG, I've used 12/31 as the sale date when it is various. Its hard to see the IRS questioning it as the information is already provided to them by the brokerage as LTCG and your math is the same.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you use these two spots, then where would you list the 'Wash sale loss disallowed'?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for the clarification.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For codes A & D (ST & LT basis reported to IRS) there should be no reason why the summary information can’t be used regardless of the wash sales. The IRS has all of this information.

The instructions for Form 8949 do not explicitly state you can’t use Various for the Sale Date. For many years I’ve used Various for the sale date and attached a PDF of the client’s 1099-B summary information without any complaints from the IRS so I don’t see why it can’t be done for 2020 other than the software won’t allow it.

I do notice you can put in an Adjustment Code M (Summary of multiple transactions on a single row 0- attach statement) and this will allow you to leave the Sales Date blank.

Would be nice if the powers that be (IRS/Intuit) could start making our lives easier for transactions that are reported to IRS

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is the best way to approach the problem

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is just an FYI - 2019 Form 8949 - I entered various for both dates.

In the end we should be able to enter various or leave off the dates and just mark Short or Long as Just-Lisa-Now suggested.

We certainly have beaten this topic to death 🙂 Onwards & Upwards...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for the response. I would like to be able to leave the dates blank for the summary total and just mark the transaction as either S or L but the program would flag this an error and you won't be able to transmit. You can do this in the prior years version of the program without flagging this as an error

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I mentioned using Code M in a previous post but this then requires you to mail in the paper 1099-B forms so I don't recommend that

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just verifying, I have been entering summary amounts from 1099 B that are reported to the IRS on the 1099 B worksheet in the 8949 reporting exceptions transactions Box just above the quick entry table. Box A for short term, and Box D for long term. Then there is no need to include a acquired date or a sold date since the IRS already has that info. For sales not reported to the IRS I complete the quick entry table. Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Correct

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If there’s like 100 wash sales, have to manually input those? There’s no way we can upload them?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Happy day...you can import a .txf (dot-txf) file. Alternatively, I just group the wash sale amount for each category type and brokerage statement on a line and attach the statement as a PDF.