- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Roth IRA distribution tax and penalty

Roth IRA distribution tax and penalty

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

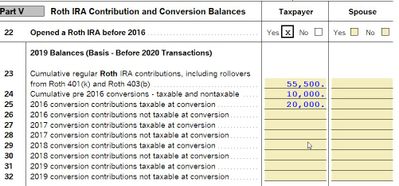

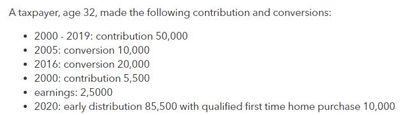

IRS Pub 590-B P33 example has an example, which I summarize as below:

A taxpayer, age 32, made the following contribution and conversions:

- 2000 - 2019: contribution 50,000

- 2005: conversion 10,000

- 2016: conversion 20,000

- 2000: contribution 5,500

- earnings: 2,5000

- 2020: early distribution 85,500 with qualified first time home purchase 10,000

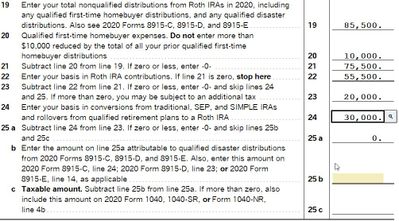

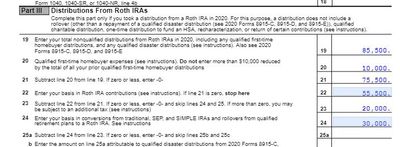

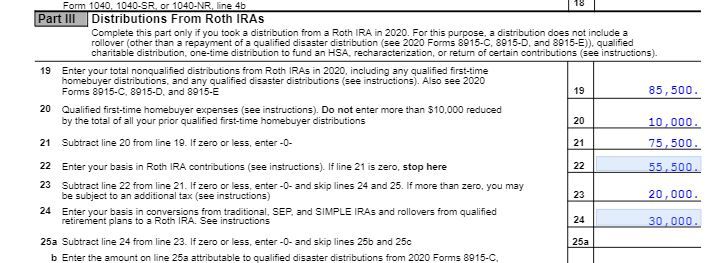

I completed the form 8606 and 5329 using ProConnect Tax and the form 8606 results are:

- Line 19: 85.500 (non-qualified distribution including first time home distribution)

- Line 20: 10,000 (as in the example)

- Line 21: 75,500 (math)

- Line 22: 55,500 (as in the example)

- Line 23: 20,000 (math, subject to penalty)

I doubt it is correct because supposedly the 2005 conversion 10,000 is outside of the 5 year window and the distribution of it should not be subject to penalty, but I could not see where I should indicate this in the input field of the software, nor I see where it should appear in these lines.

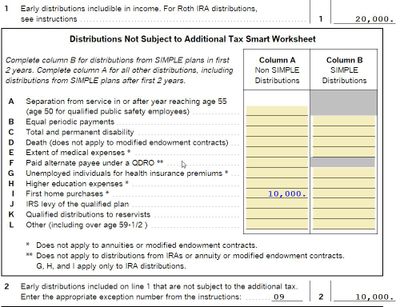

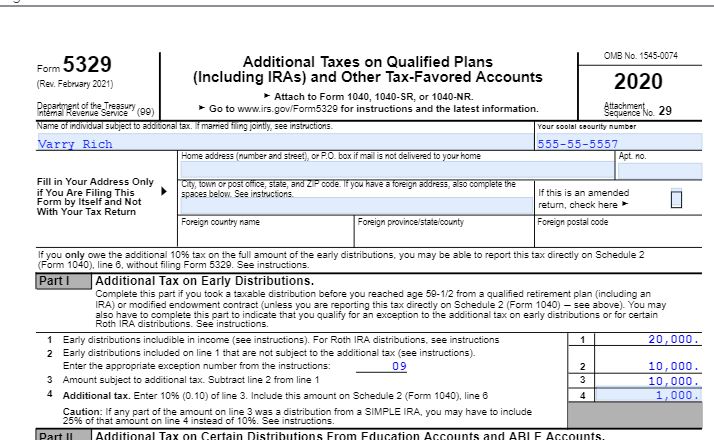

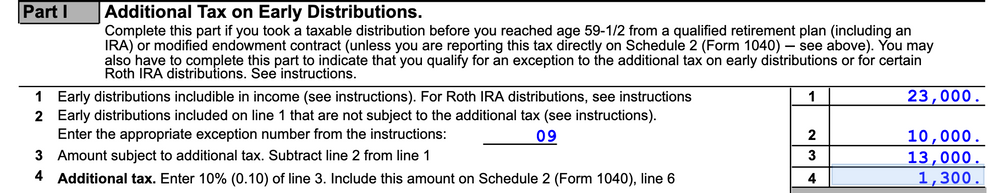

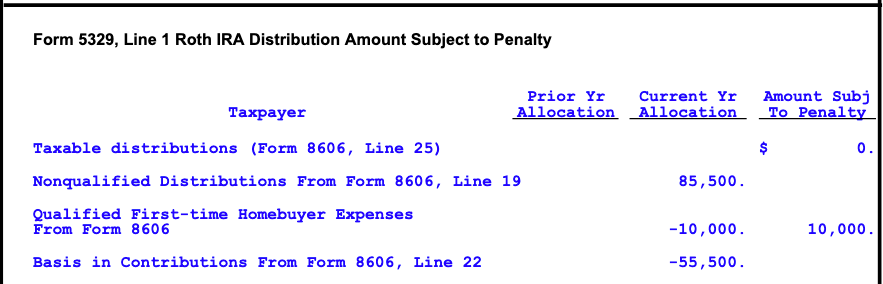

The form 5329 results are:

- Line 1: 10,000

- Line 2: 10,000 (code 09)

This is not correct either, the line 1 is supposed to be 20,000. Could you please try it? There are just a few numbers and easy to do, thanks a lot!

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@puravidapto wrote:

The form 8606 line 23 amount 20,000 subject to penalty has the first time home purchase exception factored in (10,000 in line 20), does it?

amount subject to penalty as shown on line 23 of the form 8606? Is that 30,000? If so, then how can the first time home purchase reduce the amount from 30,000 to 10,000 as shown in your form 5329?

Line 23 is NOT the amount subject to a penalty and that does NOT automatically go to Line 1 of the 5329. Line 1 of the 5329 is going coming from the post 2006 conversion of $20,000.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From Pub 590-B I believe your basis is the full 85,500 - contributions and rollovers.

What Are Qualified Distributions?

A qualified distribution is any payment or distribution from your Roth IRA that meets the following requirements.

-

It is made after the 5-year period beginning with the first tax year for which a contribution was made to a Roth IRA set up for your benefit.

-

The payment or distribution is:

-

Made on or after the date you reach age 59½,

-

Made because you are disabled (defined earlier),

-

Made to a beneficiary or to your estate after your death, or

-

One that meets the requirements listed under First home under Exceptions in chapter 1 (up to a $10,000 lifetime limit).

-

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"From Pub 590-B I believe your basis is the full 85,500 - contributions and rollovers" - it is true for computing taxable amounts. The amount subject to tax and to penalty are computed separately, for example, you do not pay tax for conversion within 5 years, but you do pay penalty, please see form 8606 Part III.

The question is: non-qualified distribution on conversion outside of 5 year window is or is not subject to penalty? I am not clear from reading the Pub 590-B. If not, how should we input the data in the software to fill out the form 8606 Part III, as there is no place to enter the conversion outside of 5 years?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is there a reason you are not treating the distribution as covid qualified?

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Each conversion has its own five-year period, but IRS rules stipulate the oldest conversions are withdrawn first. The order of withdrawals for Roth IRAs are contributions first, followed by conversions, and then earnings."

"Exceptions to the 5-Year Rule

Under certain conditions, you may withdraw earnings without meeting the five-year rule, regardless of your age. You may use up to $10,000 to pay for your first home or use the money to pay for higher education for yourself or for a spouse, child, or grandchild."

https://www.investopedia.com/ask/answers/05/waitingperiodroth.asp

https://www.investopedia.com/terms/f/fiveyearrule.asp

https://www.investopedia.com/terms/o/orderingrules.asp

All of which is moot if the taxpayer characterizes this as covid disaster qualified, which is good up to $100k. Read the Form 8915-E instructions.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Let us forget about COVID but just concentrate on the example in the IRS pub, can you work out the software input and the amounts on the form 8606 and 5329 to agree with what in the sample? I cannot. There is no place to indicate the first conversion is more than 5 years.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I can enter it fine in ProSeries. My Basis worksheet has a year-by-year entry for conversions. So $30,000 should show up on Line 24 of the 8606, and as you say, $20,000 should be on Line 1 of the 5329.

Sorry, I don't know how to do it in PTO.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@TaxGuyBill Thank you so much for doing this. The form 8606 line 23 amount 20,000 subject to penalty has the first time home purchase exception factored in (10,000 in line 20), does it?

Suppose the distribution is not for home purchase, can you remove the first time home purchase and find what would be the amount subject to penalty as shown on line 23 of the form 8606? Is that 30,000? If so, then how can the first time home purchase reduce the amount from 30,000 to 10,000 as shown in your form 5329?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

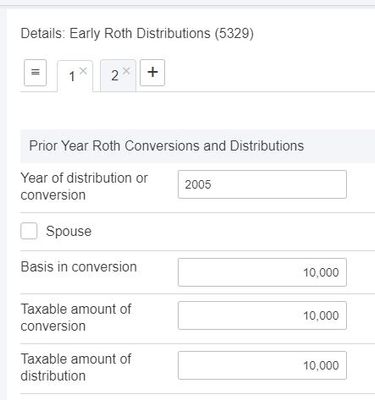

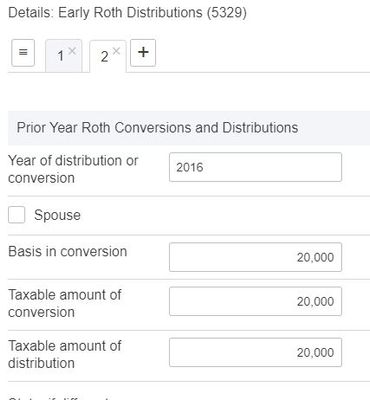

I believe I made some misstatements earlier, my apologies. I think I now have your input for the original scenario. I was a bit confused by your original number

I now figured out add the 2000 contribution to the 2000-2019 contribution = 55,500. I assume the earnings was a mistype and it does not seem to come into the computations at all. It appears the earning were NOT distributed.

Here are my input screens

And this is what I ended up with

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@puravidapto wrote:

The form 8606 line 23 amount 20,000 subject to penalty has the first time home purchase exception factored in (10,000 in line 20), does it?

amount subject to penalty as shown on line 23 of the form 8606? Is that 30,000? If so, then how can the first time home purchase reduce the amount from 30,000 to 10,000 as shown in your form 5329?

Line 23 is NOT the amount subject to a penalty and that does NOT automatically go to Line 1 of the 5329. Line 1 of the 5329 is going coming from the post 2006 conversion of $20,000.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

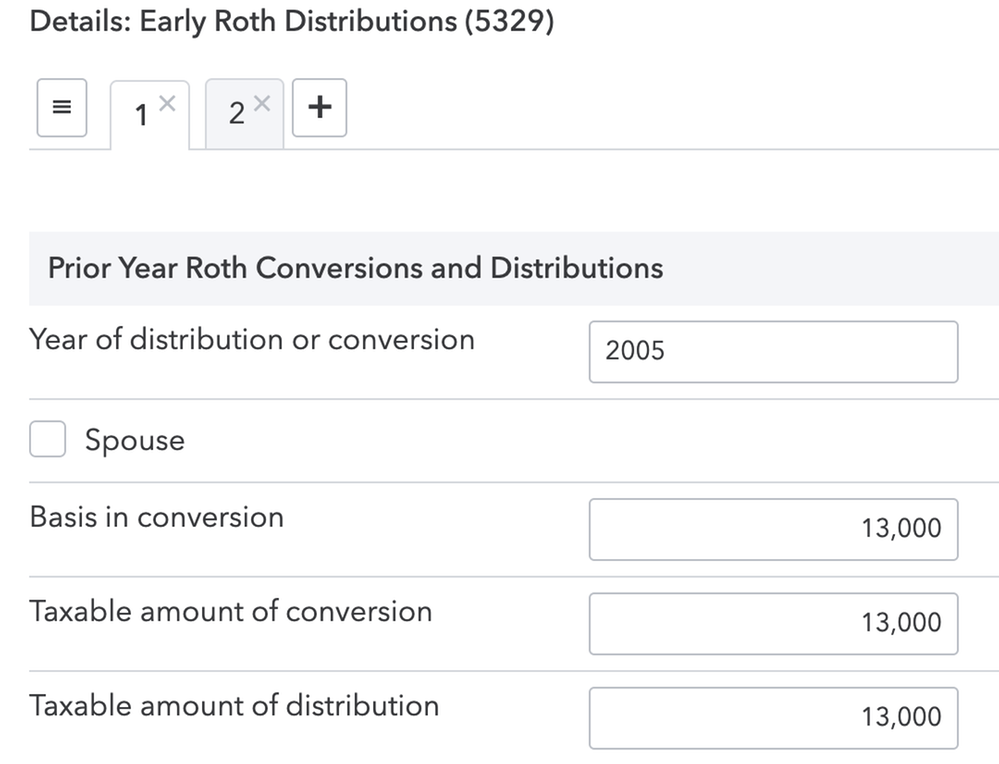

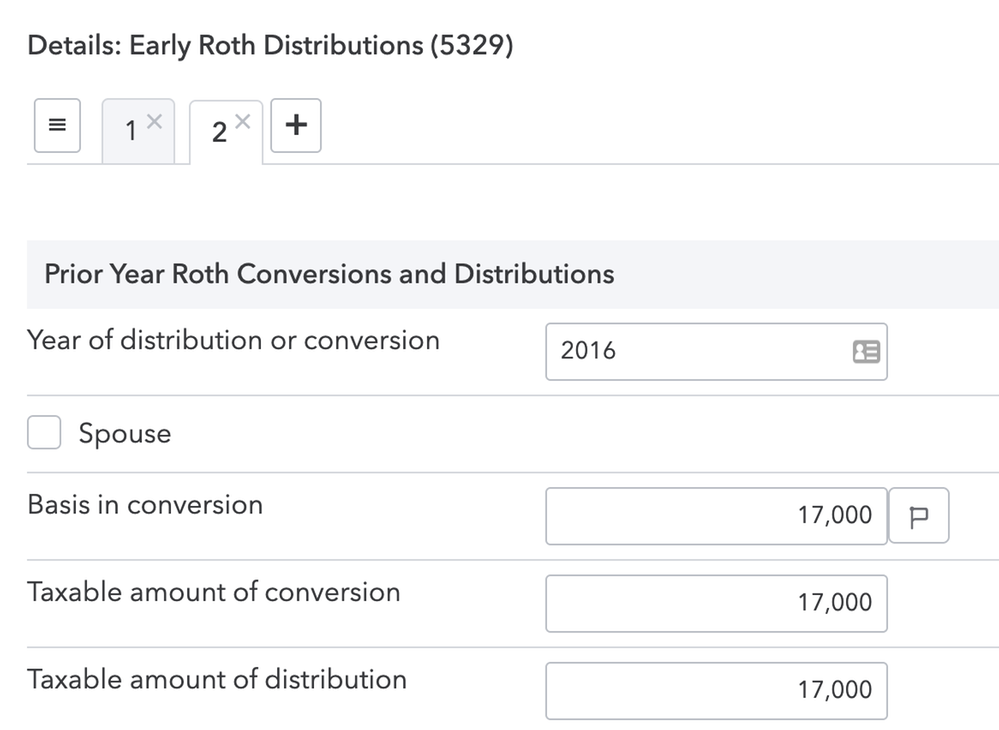

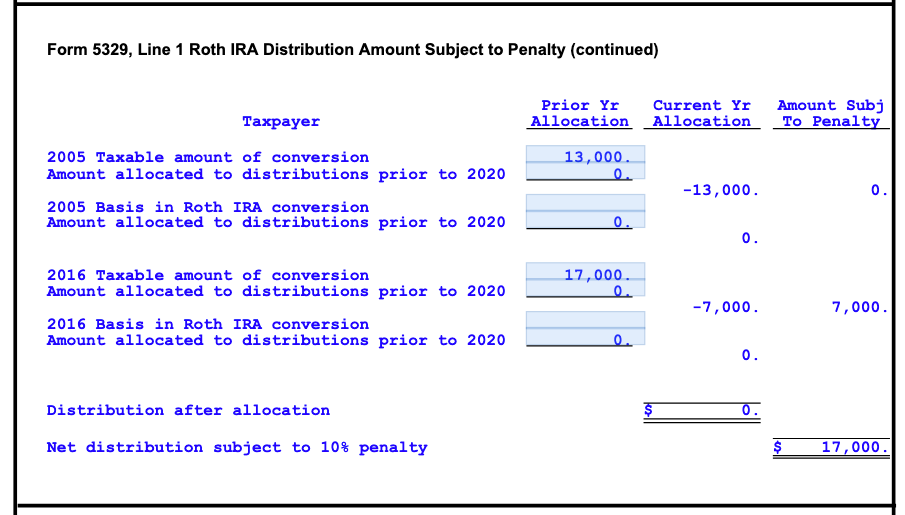

@George4TacksThank you so much do doing the exercise. The original numbers in the IRS example may cause coincident. Can you change the 2015 conversion amount to 13,000 and 2016 conversion amount to 17,000, and see what the form 5329 look like? Is that what you are expecting?

PS: I assume the form 8606 will not change.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@TaxGuyBillYou are right that Line 23 [of form 8606] is NOT the amount subject to a penalty and that does NOT automatically go to Line 1 of the 5329. It is just in this example, the two number are coincidentally the same.

If we were to change the 2015 and 2016 conversion amount to 13,000 and 17,000 respectively instead of 10,000 and 20,000. Then the Line 1 of the 5329 should be 17,000 and line 2 still 10,000? Does your software produce this?

I am getting 23,000 and 10,000 for form 5329 line 1 and line when I filled out as @George4Tacks has shown, which does not make sense.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Play with it all you want, but I have done all that I am willing to do.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@George4TacksI meant to say 2005. I want to change the numbers because with the original questions the form 5329 line 1 equals to form 8606 line 23 coincidentally which obscure the true origin of the source.

I have done it myself before I asked you, as I posted in my previous comment and shown in images blow, and the result does not make sense. I expect form 5329 line 1 and 2 to show 17,000 and 10,000 respectively. I would like to know if you have the same result, or I input incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do the ratios work out?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The "Prior Year Roth Conversions and Distributions" has three input fields:

- Basis in conversion - that is the basis before the conversion

- Taxable amount of conversion - the amount you paid taxes in that year

- Taxable amount of distribution - that is the distribution in that year

For the problem in question, the "Basis in conversion" and "Taxable amount of distribution" are both zeros for both years 2005 and 2016, only the "Taxable amount of conversion" needs to be filled out which are 10,000 and 20,000 in original problem, or 13,000 and 17,000 in my modification. This will produce the expected result and the worksheet make sense, which I will attach below. The worksheet shows how form 8606 line 1 is derived, it is based form 8606 line 23 adjusted by the prior year conversions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

One (of many) advantages of Lacerte is the F1 button for help - Here are the help for those 3 entry points:

Basis in Conversion

| Early Roth Distributions (5329) | Screen 41; Code 3 |

If the taxpayer or spouse received an early Roth distribution in 2020 and converted a traditional IRA to a Roth IRA in a prior year, enter the basis in the conversion from the taxpayer or spouse’s prior year Form 8606. The program uses this amount to calculate Form 5329, line 1, early distributions included in gross income and generates a worksheet to support this calculation. Use the following as a guide to locate the amount to input.

- 1998 through 2000 – Form 8606, line 15.

- 2001 through 2019 - Form 8606, line 17.

------------------------

Taxable Amount of Conversion

| Early Roth Distributions (5329) | Screen 41; Code 4 |

If the taxpayer or spouse received an early Roth distribution in 2020 and converted a traditional IRA to a Roth IRA in a prior year, enter the taxable amount of conversions from the taxpayer or spouse’s prior year Form 8606. The program uses this amount to calculate Form 5329, line 1, Early distributions included in gross income and generates a worksheet to support the calculation. Use the following as a guide when determining what amount to enter.

- 1998 through 2000 – Form 8606, line 16.

- 1999 through 2019 - Form 8606, line 18.

-----------------------------------

Taxable Amount of Distribution

| Early Roth Distributions (5329) | Screen 41; Code 5 |

If the taxpayer or spouse received an early Roth distribution in 2020 and converted a traditional IRA to a Roth IRA in a prior year, enter the taxable amount of distribution from the taxpayer’s prior year Form 8606. The program uses this amount to calculate Form 5329, line 1, Early distributions included in gross income and generates a worksheet to support this calculation. Use the following as a guide to locate the amount to input.

- 1998 – Form 8606, line 20.

- 1999 and 2000 – Form 8606, line 19.

- 2001 through 2003 – Form 8606, line 21.

- 2004 through 2009 – Form 8606, line 23.

- 2010 – Form 8606, line 30.

- 2011 through 2019 – Form 8606, line 23.

-----------------------

I hope you are able to work through what you need.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@qbteachmtet al: It is true that "each conversion has its own five-year period", but can the conversion used to establish the "5-year period" to satisfy the qualified distribution, one of the conditions is "it [the distribution] is made after the 5-year period beginning with the first tax year for which a CONTRIBUTION was made to a Roth IRA set up for your benefit" (emphasis added by me). Here the contribution includes the conversion? This is important to determine what amount is subject to tax and penalty, here is an example:

a 30-year old taxpayer made the following distribution and conversions in 2020:

- 2020: distribution 33000

- 2015: taxable conversion 5000

- 2016: taxable conversion 5000

- 2017: taxable conversion 5000

- 2018: taxable conversion 5000

- earning: 13000

- qualified first time home purchase: 10000

How much of the distribution is qualified: 0, 5000, or 10000? What is the amount subject to tax and 10% penalty?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Here the contribution includes the conversion?"

Never; that's never true. A Contribution is not also a Conversion and vice versa.

Either of these might be the first deposit to a newly established Account. But each of these is different.

"with the first tax year for which a CONTRIBUTION was made to a Roth IRA"

I believe that here, you are referring to "how long have you had a Roth account?"

One reason a good strategy is to contribute even $100 to a Roth as soon as you are a working individual, is to open and establish that Roth account, which starts the 5-year rule for having a Roth. Another strategy is putting into a Roth by the tax due date of the tax return, which establishes the Roth was opened in the prior year (the tax year, not the filing year).

A Contribution is because you have earned income which qualifies you for a contribution to a Roth. A Conversion is a different method that funds a Roth.

I like investopedia:

https://www.investopedia.com/ask/answers/05/waitingperiodroth.asp

"What is the amount subject to tax and 10% penalty?"

It still isn't clear why you don't help your taxpayer by explaining that 2020's unique covid disaster distributions rules will apply and means they can avoid the penalty. Why wouldn't you want to avoid penalty? Have you read the Form 8915-E instructions?

I hate working on math, when the math isn't even required.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@qbteachmt In my question "Here the contribution includes the conversion?", the emphasis is "Here", i.e. in the context quoted:

it [the distribution] is made after the 5-year period beginning with the first tax year for which a CONTRIBUTION was made to a Roth IRA set up for your benefit

I did not see you provided an answer and reason. Not everyone can make a direct contribution to the Roth IRA. I understand you do not like math, but math allows us to compare answer without ambiguity. Words are difficult to interpret. After reading your post, I still cannot figure out your answer to my question is yes or no, and based on what authority.

You also said you like investopedia, but it is not the authority. I believe the following quoted text from your previous post is incorrect:

"Exceptions to the 5-Year Rule

Under certain conditions, you may withdraw earnings without meeting the five-year rule, regardless of your age. You may use up to $10,000 to pay for your first home or use the money to pay for higher education for yourself or for a spouse, child, or grandchild."

I do not think there is an exception to the 5 year rule, at least I cannot find from the official record. There is exception for 10% penalty only. Again it is hard to compare through words what you meant and what I meant, so I will provide another numeric example (taxpayer's age is 30):

- 2020: distribution 33000

- 2016: direct contribution 5000

- 2017: direct contribution 5000

- 2018: direct contribution 5000

- 2019: direct contribution 5000

- earning: 13000

- qualified first time home purchase: 10000

What is the taxable amount and the amount subject to 10% penalty? I have my answers but I do not want to mislead you. After you post yours, I will post mine. This example will demonstrate there is an exception to the 5 year rule or not better than words.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you are not going to have a covid disaster qualified distribution, good for tax year 2020 and for up to $100,000 (making it entirely penalty free), then you just need to make sure you are not mixing up the provisions.

Home buyer provision: "Once you've exhausted your contributions, you can withdraw up to $10,000 of the account’s earnings or money converted from another account—without paying a 10% penalty—for a first-time home purchase.

If it's been fewer than five years since you first contributed to a Roth IRA, you'll owe income tax on the earnings. This rule, though, doesn't apply to any converted funds. But if you’ve had the Roth IRA for at least five years, the withdrawn earnings are both tax- and penalty-free."

So now we see "tax free vs penalty free" or both, or neither. Now you do your analysis.

The/any Roth account needs to exist for at least 5 years. That really meets the same concept of "the money had to be here at least 5 years" in startup mode. What it doesn't meet is the additional 5-year rule (conversions), that "other money put in might have its own 5-year rule." That's why I gave the link to the investopedia article, because they explain there are multiple 5-year rules.

So, to review: if the/any Roth account hasn't existed at least 5 years, then there is No Money in it that type of account that has been there 5 years. By Definition. No matter how the money got there (contribution, conversion, earnings). Hence, earnings distributed are taxable, even if for Home Buying, Education, etc.

"I do not think there is an exception to the 5 year rule, at least I cannot find from the official record. There is exception for 10% penalty only."

The exception is not also Exclusion from income tax on the earnings, but Conditionally.

Consider Conversions: subject to Income Tax, but excluded from additional 10% early distribution penalty at the time of conversion; not subject to income tax again, even if distributed early. Subject to penalty if distributed early.

Earnings distributed for First Time Homebuyer is possibly excluded from both tax and penalty (it's subject to the 5-year account existence rule, as noted above, for the income tax part). Also, from a different investopedia article: "The Internal Revenue Service (IRS) defines that status rather loosely. You are considered a first-timer if you (and your spouse, if you have one) haven't owned a home at any point during the last two years."

https://www.investopedia.com/articles/personal-finance/110415/can-you-use-your-ira-buy-house.asp

In the investopedia articles, the IRS references are links given inline and at the bottom:

https://www.irs.gov/taxtopics/tc557

"Exceptions to the additional 10% tax apply for early distributions that are:

- Made to a beneficiary or estate on account of the IRA owner's death

- Made because you're totally and permanently disabled

- Made as part of a series of substantially equal periodic payments for your life (or life expectancy) or the joint lives (or joint life expectancies) of you and your designated beneficiary

- Qualified first-time homebuyer distributions

- Not in excess of your qualified higher education expenses

- Not in excess of certain medical insurance premiums paid while unemployed

- Not in excess of your unreimbursed medical expenses that are more than a certain percentage of your adjusted gross income

- Due to an IRS levy of the IRA under section 6331 of the Code

- A qualified reservist distribution

- Excepted from the additional income tax by federal legislation relating to certain emergencies and disasters (see the Instructions for Form 5329 for more information), or

- Not in excess of $5,000 and the distribution is a qualified birth or adoption distribution (see the Instructions for Form 5329 for more information)"

These numbers you want us to "do the math" are different than your first taxpayer's?

Let's state it as:

Direct contributions distributed are not subject to tax or penalty.

Any conversion has a 5-year clock, so anything put into that account from 2016 and later, removed in 2020, is Early. That = penalty (not also taxes), unless you want to show this is qualified under one of the penalty exceptions.

Earnings are taxable if early, if not having the/any Roth for 5 years, when not used for the tax exclusion purpose: Home Buying.

https://www.irs.gov/publications/p590b

I think that covers how you need to break out the funds, compare Basis to the Distribution Ordering, watch for 5-year spans, and see what comes out the other end. I've done my best to review all of this. Let me know if you see any errors.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@qbteachmtThank you so much for contributing. I do not agree with what you quoted earlier: "Exceptions to the 5-Year Rule: Under certain conditions, you may withdraw earnings without meeting the five-year rule, regardless of your age." My position is that there is no exception for five-year account open requirement, the earnings used for first home purchase will still subject to tax if the account has not been opened for 5 years. I do not think I have issues with what you said in last post, but words can be interpreted differently, so I would like to post answers to the examples I posted earlier. If we have the same answers, then it is safe to say we are on the same page, or please tell me what you do not have different answers. Thanks.

(1) a 30-year old taxpayer made the following distribution and conversions in 2020:

- 2020: distribution 33000

- 2015: taxable conversion 5000

- 2016: taxable conversion 5000

- 2017: taxable conversion 5000

- 2018: taxable conversion 5000

- earning: 13000

- qualified first time home purchase: 10000

Amount subject to tax is 3000, subject to penalty is 18000.

(2) taxpayer's age is 30:

- 2020: distribution 33000

- 2016: direct contribution 5000

- 2017: direct contribution 5000

- 2018: direct contribution 5000

- 2019: direct contribution 5000

- earning: 13000

- qualified first time home purchase: 10000

Amount subject to tax is 13000, subject to penalty is 23000.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"words can be interpreted differently"... "I do not agree with what you quoted earlier"

It doesn't matter; you don't have to agree with me or not agree with me. I don't make the rules. I started to put another example and realized, I'm all "scenario'd" out. I can't keep copying IRS info here. And we both stated the earnings are going to be subject to income tax if there has not been a Roth account for at least 5 years, even if the purpose is an exception to the Penalty for early withdrawal.

I put this, already: "Earnings distributed for First Time Homebuyer is possibly excluded from both tax and penalty (it's subject to the 5-year account existence rule, as noted above, for the income tax part)." It is always excluded from the penalty, but would be subject to tax as income if that condition exists.

Scenario 1: Fine.

Scenario 2: "subject to penalty is 23000."

The distribution of contributions (not earnings and not conversions) are subject to neither income tax nor penalty, at any time ($20,000). That's why you see bad guidance on the web for using it as a Savings vehicle for an emergency fund.

In this scenario 2 you gave, this account existed from 2016 (2016-2019 contributions) up to the 2020 distribution, which is not 5 years. Taking $13,000 would be subject to penalty as early contribution and taxable as income, but gets the penalty exception up to $10,000 for first time home buyer. So, $3,000 is penalized = $300. $13,000 is subject to tax.

If this account had existed one year prior, there would be $3,000 subject to tax and no penalty.

I think this is where you are stuck; see if this helps (with my emphasis):

https://www.fool.com/retirement/plans/roth-ira/5-year-rule/

"1. Your first contribution

The first five-year rule states that you must wait five years after your first contribution to a Roth IRA to withdraw your earnings tax free. The five-year period starts on the first day of the tax year for which you made a contribution to any Roth IRA, not necessarily the one you're withdrawing from. So if you contributed to a Roth IRA for the first time in early 2020 but the contribution was for the 2019 tax year, then the five years will end on Jan. 1, 2024.

If you don't meet the five-year rule, that doesn't mean all of your withdrawals will be taxed. You can still withdraw the amounts you contributed without being taxed, because the money you put in was an after-tax contribution. Only the growth of the account is potentially subject to income tax.

However, this rule comes as a shock to some people because it supersedes the well-known rule that you have to wait until age 59 1/2 to take retirement account withdrawals without taxes and penalties. That means that even if you're over 59 1/2 when you withdraw, some of your withdrawal could get included in taxable income thanks to this five-year rule. You won't owe the 10% penalty in that case, but you'll still owe tax on any withdrawals above the amount contributed."

I think this horse might be dead. I hope my final edits make sense.

I sure hope that helps.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@qbteachmtI acknowledge that the amount subject to penalty I gave for scenario 2 was incorrect and I agree with your answer. I used this example to show that the first home purchase is not an exception for the 5-year rule, it does not reduce the taxable amount but only the amount subject to penalty. I made an error in amount subject for penalty because I was mistook the 2016-2019 direct contributions as conversions. So the following should be true, agree? If so, then we are on the same page.

(2) taxpayer's age is 30:

- 2020: distribution 33000

- 2016: direct contribution 5000

- 2017: direct contribution 5000

- 2018: direct contribution 5000

- 2019: direct contribution 5000

- earning: 13000

- qualified first time home purchase: 10000

Amount subject to tax is 13000, subject to penalty is 23000 3000.

(3) taxpayer's age is 30:

- 2020: distribution 33000

- 2016: conversion 5000

- 2017: conversion 5000

- 2018: conversion 5000

- 2019: conversion 5000

- earning: 13000

- qualified first time home purchase: 10000

Amount subject to tax is 13000, subject to penalty is 23000.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"I used this example to show that the first home purchase is not an exception for the 5-year rule,"

Let's restate it properly. The Early distribution of Earnings is subject to income tax, if there has not been a Roth account open for at least 5 years. That is only one of the 5-year rules and those are the two Conditions (early, earnings) that apply. It doesn't matter why you take that distribution, and attained age doesn't matter, either. Nothing else matters.

"I was mistook the 2016-2019 direct contributions as conversions"

Yes, you did.

Don't yell at us; we're volunteers