- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- <@XXXDueWPen> not properly set

<@XXXDueWPen> not properly set

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

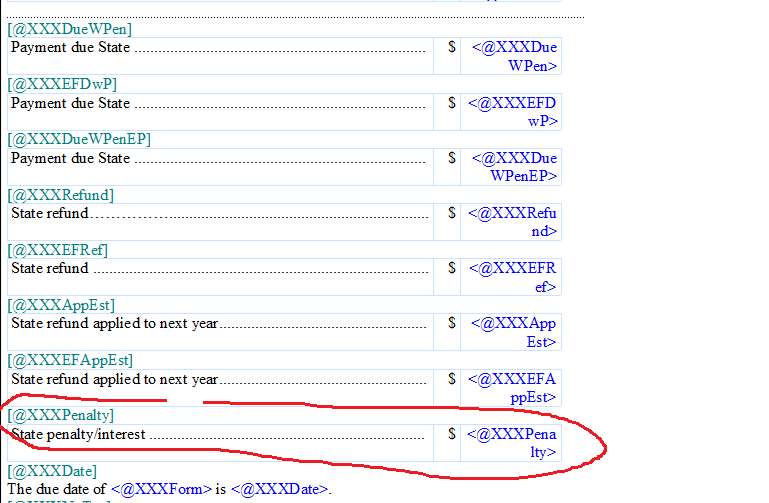

Trying to compose Standard Letter. <@XXXDueWPen> displays zero (0.0) but both <@XXXDueBfPen> and <@XXXPenalty> display non-zero values.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There are letter codes that no longer work and it's frustrating as I have a custom letter for every client.

[@FDIEFDwP] $<@FDIEFDwP>

The above works for me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What is it youre trying to accomplish? I dont want the estimated tax penalty to show separately on the letter, so I just delete that trigger code and line of text The letter then shows total balance due without breaking the penalty out on its own line.

Ohhh, but you have XXX so youre working with a state portion of the letter? Same with it, just delete that penalty line.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just-Lisa-Now,

I was not clear. There is a non-zero balance due and there is a non-zero penalty, So <XXXDueWPen> should be non-zero.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

[@BeginStateText]

[@XXXForm]

[@XXXNoEF]

Please be sure to sign and date your <@XXXStName> tax return.

[@XXXEFDo]

The <@XXXStName> income tax return will be electronically filed, do not mail the enclosed copy, but retain it for your records.

[@XXXDueBfPen]

Your balance due is <@XXXDueWPen>.<@XXXDueBfPen> <@XXXPenalty>

[@XXXOverpy]

Your refund amount is <@XXXOverpy>.

[@EndStateText]

I have the three balance due amounts for debugging. I test before penalty because using wPen produces 'false' result.