- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

hsa

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When I entered the HSA on the return on the w-2 it shows W and the amount but on

the 8889 when it asked their contribution it is calculating a tax. the client is over

55 and contributed the catchup amount what am I entering wrong

Thank You

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

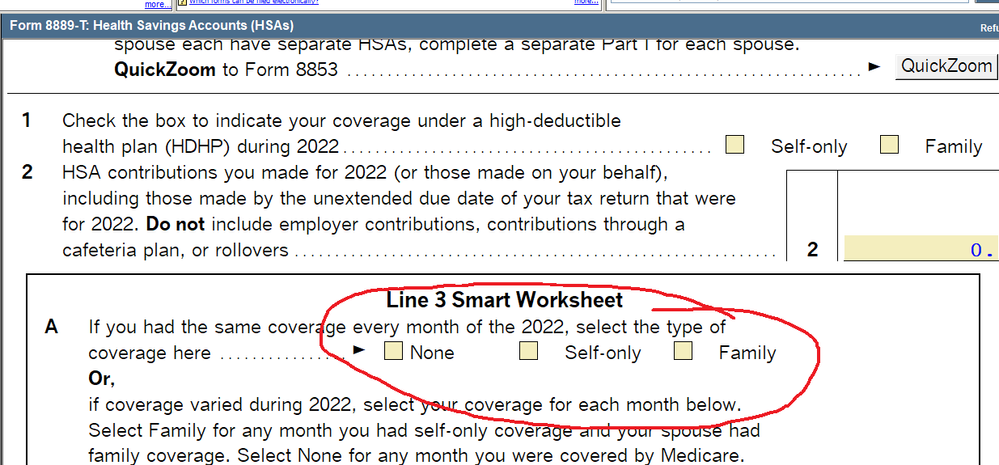

You dont enter the amount on the 8889 again, take any numbers off that 8889 that you entered, all you need to do is mark the Self or Family boxes on the Smart Worksheet below Line 1.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa probably nailed it, but if not, make sure you go through the error check process. There are boxes to check to tell the software how many months the taxpayer/spouse are HSA eligible, that may also be throwing you off. If the only contributions are through payroll you only enter the code W on the W-2 Wks. If there were additional contributions, only those "outside" contributions get entered on the 8889.

If they didn't contribute the full amount, this is when I explain how it works and suggest they might still want to make a prior-year "outside" contribution that we can deduct on the return.

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I did that and it still is showing a penalty

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Look at the 8889 and see what is incorrect. Then go back and fix the data entry.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This got started as another New Topic, but let's continue here:

When someone contributes through work, both the employer and the employee share are already on the W2. You don't make any separate entry.

The allowable amount total has to meet the coverage type. Confirm you selected the coverage type and the age of your taxpayer.

The HSA contribution limits for 2022 are $3,650 for self-only coverage and $7,300 for family coverage. Those 55 and older can contribute an additional $1,000 as a catch-up contribution.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So WHERE is the "catchup provision" (aka: $1000) inputted? Is it a checkbox? If the software can tell by the age of the taxpayer that the taxpayer is eligible for a "catchup" AND the W2 reflects the additional contribution of $1000, then WHY is a tax still be assessed (in my case the tax is $60 which is exactly 6% ((the penalty for over-contributing to an HSA of $1000). Therefore, the software is NOT automatically calculating the eligibility. Therefore, WHERE is the override screen to eliminate this penalty which should NOT exist.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the amount has already been included on the W2, Code W, you dont enter any other figures on the 8889, but scroll down to the Smart Worksheet below Line 2 and mark the Self or Family box in order for the penalty to be removed.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪