- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: How to resolve a form 2555 error message resulting from a recent Proseries software update

How to resolve a form 2555 error message resulting from a recent Proseries software update

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The error states that dates are needed on line 10 or line 16 in order to properly calculate the exclusion. Dates are already entered. This error message is showing up with all my tax clients who claim a foreign earnings exclusion - even with one that I have successfully e-filed earlier this month. How can I resolve this error?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

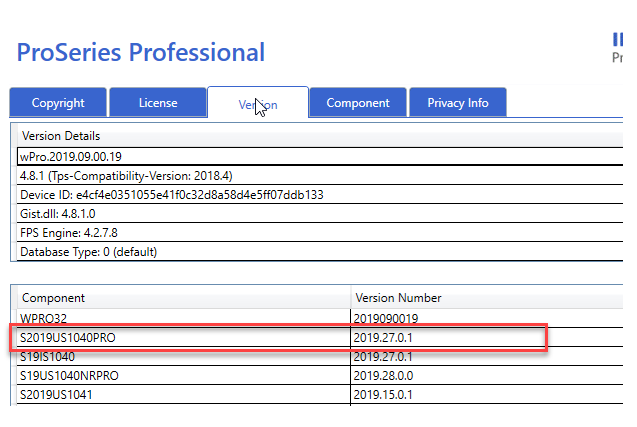

If you were experiencing an error on the address field of the Form 2555, that issue is now resolved. Please note you will need to update your ProSeries product.

ProSeries Professional 1040 version should now be 2019.27.0.1 or higher.

ProSeries Basic 1040 version should now be 2019.27.0.2 or higher.

You can locate your 1040 version by going to HELP> ABOUT PROSERIES, selecting the VERSIONS tab, and looking for the section in the bottom table labeled: S2019US1040PRO (pictured below is a screenshot from ProSeries Professional)

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Any update yet? I lost some clients already since I can't efile their tax return on time to get their stimulus payment direct deposited.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My Case number is 000546812851

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Same problem here. Error states "must enter foreign address" on 2555 "entries on foreign earned income worksheet".

Can't find any entry on the worksheet. The taxpayer isn't claiming the exclusion and doesn't have foreign earned income.

Tried deleting 2555 and error immediately comes back. Program won't allow me to efile.

The only foreign income on the return is a small amount for foreign tax credit Form 1116.

Please let me know if there is a work around or update to fix this.

Thanks

Gary Petrash [email address removed]

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There are several posts. It appears the solution is to simply remove the 2555 form.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Hammer wrote:

Any update yet? I lost some clients already since I can't efile their tax return on time to get their stimulus payment direct deposited.

What time limit are you referring to?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I had same issue. I efiled return with the error, unchecking the error check box. The return was accepted by IRS. But I would love to know the real fix.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did your client file a 2018 return with direct deposit? If yes, then there shouldn't be any issue with them receiving the stimulus check even though 2019 isn't filed yet. What "on time" date were they expecting that made you lose them as a client? The error with Form 2555 was after April 15th.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi @JeffV

The unexpected behavior in regards to the Federal form 2555-T has been reported and determined to be working as designed. If your client does not qualify for the exclusion, do not enter a date in box 10 or 16, only enter in Part III of the 2555, Smart worksheet for calculating number of days less than requirement, the number for days they traveled. This will remove the error.

Hope this helps.

Cheers!

Betty Jo

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The form does not work. If the client does qualify for the exclusion dates need to be entered.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks BettyJo for your response. I am trying to fully understand your recommendation. For example, my one client claims foreign earnings exclusion through meeting the bona fide residence test. On the 2555 form (pages 1 - 3), the only date fields that I have information in are:

Part I line 9 - date tax home was established

Part II line 10 date bona fide residence began and ended

This client hasn't traveled during the year. All other date fields have no data entered. I do not have any information entered into Part III (Physical Presence Test).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I called tech support. It seems this issue relates to the recent software update that automatically populates 365 in a "Smart Worksheet" box just below line 18 in Part III (Taxpayers Qualifying Under Physical Presence Test). According to Tech Support I need to wait until Proseries fixes the bug. There doesn't seem to be any work around currently available. I have to wait to install & refresh updates.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks Jeff, hopefully the bug will fixed soon.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IntuitBettyJo What's a 2555-T?

Judging from all the posts, every return is getting a 2555 error, i.e. ones that don't even have a 2555.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

2555-T = 2555-TROUBLE

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am having the same problem

please INTUIT fix this problem ASAP, there is no time for this kind of surprises. 😞

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Working as designed? Please explain in plain english how I can file a return that requires form 2555...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am embarrassed for you, Betty Jo. Either you are not a tax professional or an incompetent one.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I concur that all returns with Form 2555 whether transmitted or not is receiving this false message after last update. I have found no workaround. Even after deleting form and starting over. Everything on form and allocatoion sheet is complete and accurate. Very frustrating for it stops all my returns dead in their tracks and now unable to transmit any. Proseries please hear the plea and 'debug' prompt with a fix.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Not sure what causes the problem but I think its related to efile.

I was getting an error message that foreign address was missing. Tried deleting the form but the message reselected it with same error.

Since it didn't occur until I tried to efile, I thought I'd try unchecking efile, F9 to recalculate, F10 to save without efile.

Then I was able to delete form 2555 and efile the return.

Don't know what caused it but it seems to be related to e-filing.

This isn't a fix but it was a work around for my situation. Which was no foreign earned income yet still getting an error for Form 2555 when attempting to efile the return

It may help to fix your problem.

GLP

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On form 2555 I get an error message box 10 or 16 must have dates entered. On line 16 I do have the starting and ending dates for the qualifying period. Prior to the recent software update, this error message do not exist. Is there going to be another software update soon to fix this error.

Thank you for your help and assistance.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This works! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This error affects EVERY return using form 2555. I am currently unable to file 7 returns, and am receiving constant requests for clients to confirm submission. As accountants, we work many of us 7 days/week during the tax season - even though Pro Series has not acknowledged this by changing its technical support schedule, we are IN THE MIDST of tax season now 15 hours/day because of all things connected to COVID-19. WHY DOESN'T PROSERIES HAVE EXTENDED HOURS ALSO!? Proseries' initial denial and later delay in resolving what must be a relatively simply software issue demonstrates the company's classic TONE DEAF approach to tax professionals. On the other hand, HUGE APPRECIATION for establishing a new system for dealing with issues like this that purportedly links tax pro individual case# to an investigation# and provides for broadcast updates to all who self-identify without requiring us to call in repeatedly and walk a new customer support tech through the SAME information again and again. Have not received any update yet, but am looking forward to doing see and seeing this model for application-wide error correction adopted as standard.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm having this same issue. I think I will need to disable error-checking to submit.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You can do that or I think you can just delete the 2555 form. Both methods work for me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Deleting the form does not work for me. Moreover, this would not be a solution if you need to file form 2555. Error appears regardless of whether your use bona fide residence or physical presence test. Pro Series customer service confirmed this error still not resolved as of Friday afternoon EST.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am unable to file the return even if I disable error-checking. This is really a colossal problem for me, where 98% of all returns are foreign.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hopefully @IntuitAustin or @IntuitBettyJo or @AshleyatIntuit can come back with more accurate information and an update on when to expect the programming to be repaired. They have been very responsive employees of Intuit.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I can't delete the 2555. I need it to exclude my client's foreign earned income! All my clients are expats and close to half use Form 2555. I've been racing to get these filed to provide the IRS with updated address and direct deposit info. I hope this is resolved FAST!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I removed the election to efile or unclicked the button where you choose to efile. Then hit F9 to recalculate, and F10 to save.

Then the program allowed me to delete form 2555 and the error didn't return.

Then I was able to go back select efile again and filed it with no errors. It worked for my situation.

I haven't tried to correct a 2555 but if your problem is related to efile you should try making after you unselect efile, recalculate, and save, before making you corrections and then again after the corrections before you elect or hit the button to efile.

I don't know if that will work for you but I think the problem is related to efile. So I would 1)shut efile off 2) make your corrections 3)calculate and 4)save before you select efile.

Hope it helps you with your situation. If it works I'm a genius. If not then I guess my wife and kids were right after all and I'll just shut it.

GLP

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes this seems to work if you do not need to file 2555. Unfortunately, does not work if you do. Can't understand how PS could let a massive problem like this go unresolved for more than 1 day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi all, so yes, the date range issue for the 2555 was reported, and a fix was released. However, now the error is going off whether or not Foreign EI Alloc Wks line 29 (# of days in qualifying period) has a value. This has been reported to our development team, and so you should anticipate in an upcoming release resolution. I do not have an ETA on release at this time, but note that the fix must be implemented, tested, and rolled out, so please be patient. Hope that helps.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@AshleyatIntuit thank you for that plain vanilla answer. No "unexpected behavior" and actual plain english explanation. There is nothing wrong with a simple "we screwed up and we are working hard to fix it as soon as possible". I know BettyJo means well, but introducing a new form to the mix and not coming back to correct it is really bad form. Most of us here know the complexity of what the programmers are trying to do and recognize that poking that can break some other totally unrelated things. STUFF HAPPENS, so just say so.

THANK YOU

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When I talked to them on Friday, they said it would be fixed later that day. I told the person today that I needed to be updated on the progress and not spend my time on the phone trying to get updates on the fix. (Which I was told would happen....)

At any rate.... hopefully soon this is corrected and I can efile those returns waiting in the queue (British term) ....

I really want to get outside while we have beautiful weather here in Colorado. Maybe a round of golf.....

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think the team is getting ready to roll out the testing at any time now.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'd like to request ProSeries to put together a project to capture TAX PRO ideas on improving the communication process between ProSeries and Taxpros, especially with respect to solving software errors. For example,

1) the idea of establishing an Investigation and then linking concrete case #s to it to facilitate communication of progress on solving a problem to those affected is FANTASTIC. But 1) after being told my case was added last week, I have YET to receive any sort of email confirmation including the case #, the investigation # and summary of the issue. 2) I have received no update, even to say that "after two days we have been unable to resolve the issue but we think we know where the issue is an will be in touch in two days with an update". Etc. Who knows if this investigation really exists?

2) I had a case open for two months, and apparently a single message was left on my voicemail that i did not hear, and found out when following up two weeks later that the case had been closed without resolution. !? Problem not resolved. Why wouldn't an email go out? or two? The issue is a SOFTWARE issue, has been confirmed by ProSeries as such. That means the problem remains UNRESOLVED until ProSeries solves it. Neither I nor others can file this return (fincen114) with this particular problem until it is fixed. Why on earth would ProSeries not follow through to solve an admitted software issue?

I know Pro Series mines customer responses etc on an ad hoc basis as part of an overall improvement process. But I think if Pro Series were serious about it, were to directly engage us on how to improve the quality of communication, Pro Series might learn of many many ideas, just one or two of which might SIGNIFICANTLY build brand loyalty. I'd much rather be praising Pro Series to others all the time than looking for a reason NOT to switch software every year.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Not to nitpick, but I will anyway. I brought this up early on and I will bring it up again. Why is someone other than the person asking the original question allowed to mark posts as "solved". Only the person with the original question really knows if their problem has been solved so why not leave it to them to mark it accordingly? Unless of course, we are trying impress someone on how well the new forum is working due to the number of "solved" problems. 😕

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi @IRonMaN

The reason why we mark solutions as "Accepted Solutions" is so that you are able to see the solution when asking the question through the product; it helps surface the solution.

I hope this clears up the confusion.

Cheers!

Betty Jo

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But that really doesn't clear the confusion for me. In due respect to Ashley, JeffV hasn't said "wow - that solved my problem and I'm back to work". It was definitely informational but it didn't solve anything. I have seen numerous times how a post has been "solved", but most of the time it was Intuit's interpretation of the problem being solved. Why not leave it up to the person asking the question if their problem is actually solved? Instead of worrying about "solutions" showing up, why not just fix the search function so somebody can actually find helpful information when they do a simple search?

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Exactly. Like I wrote above. This is why Pro Series really needs to approach the tax pro community and ask us how to improve communication. Responses like those IronMan is talking about may seem like solutions to Intuit, but they are not solutions to us.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just to satisfy my own twisted sense of curiosity, which team would that be?

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@George4Tacks wrote:

And to think, you coulda been a CHAMPION!

What do you think the odds are that they will ever make that offer to me again?

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think they want to keep more than 6 feet 3.28 inches away from you.

-------------------------

Hi there,

You’ve come to an Intuit site supporting tax professionals, and you may be looking for support as an individual taxpayer. Please visit the TurboTax Help site for support.

Cheers!

------------------------

Sorry, I just have been waiting forever to give that a try. I hope you enjoy.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good - then my social distancing efforts are working 😷

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is my original post

On form 2555 I get an error message box 10 or 16 must have dates entered. On line 16, I do have the starting and ending dates for the qualifying period. Prior to the recent software update, this error message did not exist.

I downloaded the new updates tonight 4-27-20, I am still receiving the same error message. Is anyone else continuing to experience this issue?

Thank you for your help and assistance.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Nothing is solved. The update did not resolve the problem with Form 2555. BettyJoe needs a new job.

I will call the help line every hour until the problem is fixed. I advise all of you to do the same.

All my clients require Form 2555. Proseries has no excuse for this silly error at such a critical time.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

how do you uncheck the error box in Pro Series.

thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Doesn't work for me either, even after the update. When is this software company going to get its act together?