- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: e-filing an amended Form 1040 1040-X rejected by IRS

e-filing an amended Form 1040 1040-X rejected by IRS

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yesterday I tried to efile an amended federal return Form 1040-X and it was rejected by IRS with the following error: "If Form 1040, AmendedReturnInd is checked, then Form 1040-X must be present in the return". The data file did include a Form 1040-X.

Taxpayer had prepared her own original return which was filed electronically with IRS, but requested that i amend it. I followed all the instructions in the ProSeries instructions "How do I amend a 1040 in Proseries?", but the return still rejected.

Please provide guidance as to a fix.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

ProSeries can only efile an amended return not efiled by you for 2020. If you are amending a return other than 2020 when someone else filed the original, then you have to mail in

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Let's walk thru the steps you took to amend the return... 1) you entered the return the same as the taxpayer had 2) You went into Form 1040X and checked the 2020 Box so the original information populated the form 3) you made the changes required This should have created the 1040X required for efiling.

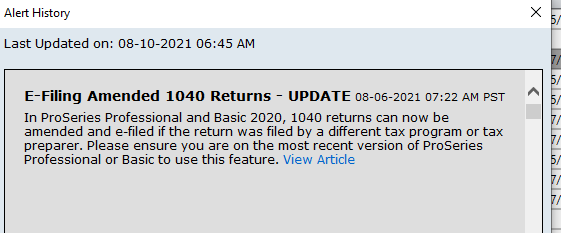

ProSeries just made available the ability to amend a return that was not originally prepared by you - have you updated the program recently?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

they sent a yellow banner announcement out last week that we could now efile amendments that we did not file the original. I saw people in the FB ProSeries group successfully do it, I havent had one to test it with though. Ohhh, but yes, its only for 2020.....if this original post is about 2019, theyre out of luck.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It was a 2020 return prepared by the taxpayer that I was amending.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

All of these steps were followed precisely, and my software was updated.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

hmmmm...... My next step would be to update again or do the Tools-Repair Updates, run review to verify no errors exists, then efile again

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I ran the Tools-Repair tool, resaved the file, ran review, and it still rejected by IRS. The software doesn't allow me to uncheck the original e-file return box without generating errors, but even though the 1040-X is present in the "filing copy", the IRS error message tells me it's not present. I also provided for electronic payment of the amount owed, but the amount to be paid doesn't flow to the Part IX of the information worksheet.

Also...I am NOT marking the return "Ready to E-file" but am efiling directly from the E-file homebase as per the instructions. I assume this is the correct method to use.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm having the same problem

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm having the same 2020 amended return problem with reject code "F1040-451" "Amended Return IND is checked, then Form 1040-X must be present". Apparently this is a software issue and Proseries doesn't recognize it??? I guess we will just have to mail it...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ive EFiled multiple 2020 1040Xs the past few weeks with no issues.

Your using the original client file as the Amended?

You marked the 1040X EF box on the Fed Info Worksheet?

You opened the 1040X and checked the 2020 box at the top of the 1040X then went back and made your corrections?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes to all. Having the same problem. The original return was prepared by taxpayers. The program wants me to check the original e-file box when checking the e-file amended box. Doesn't make sense if I did not e-file the original. I am also checking that the original return was successfully e-filed. I am getting the F1040-451 error when trying to e-file. Am I doomed to paper filing since the program doesn't do what it says it will.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You say the original was prepared by the taxpayers, was it Efiled and accepted?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The original return was e-filed by the taxpayers using Turbotax.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Lisa,

I e-filed a 2020 amended Form 1040X for a client whose return I had e-filed and accepted last year.

The first e-file went well except that it was rejected due to error in taxpayer's signature date. I corrected the error and tried to re-submit. This time, the e-file status for the federal amended return said not ready and the reason given was Federal return not completed.

Has this issue ever occurred to you?

Really appreciate your help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I submitted it within client's return. On efile clients page, the e-file status said duplicate SSN. Under the amended return column, it said rejected.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I checked with tech support and even though it says you can e-file an amended return for a return that was e-filed in another system, you cannot do it in ProSeries. Only if the original return was e-filed by you in the same software can you e-file the 1040-X. The instruction on the website is wrong.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Summer2021 wrote:

I submitted it within client's return. On efile clients page, the e-file status said duplicate SSN. Under the amended return column, it said rejected.

If it says Duplicate SSN, that means you made a copy at some point and now you have 2 returns in the EFCenter with the same SSN.

If your going to save a copy of the original (the one that's wrong), you should use Save As and give that copy a different name like JonesTomOrig.20i and uncheck the EF boxes on it (be sure to switch over to the state return before saving and exiting), that will remove it from the EFCenter.

Then you use the Original file (JonesTom.20i) that was sent originally as your amended return.

FWIW I never keep a computer copy of the wrong original, I have a printout of it (or PDF), but its wrong so I have no need for a computer copy of it. I just amend the one file I have for the client.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I did what you said by saving the originally e-filed and accepted return into a different name and unchecked e-file. I then use the originally filed name to work on my amended return.

What's different between client name & file name? At this time, the client name for both files are the same. However, the filenames are different.

I am also puzzling why I was able to select the amended return for e-file the first time. My first e-file attempt failed because taxpayer's signature date was still stayed at last year. After I corrected the date and try to re-submit, the amended file became "not ready" due to "federal return not completed".

Thank you, Lisa. Really appreciate your help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just had the same issue. I bumbled into this solution. in efile clients click on the file that shows client was efile accepted. You should see the box for amended returns and can click on that. I was bouncing around so much, I just kept trying differennt things. I think I have this right if not, check all the files for client you should find one where the amended will allow you to click. Good luck

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

YES! I have had this happen in 2020 and now in 2021 software. I spent hours on the phone with intuit and they could not figure out why it was happening. We did every update, every error check, unchecked and re-checked boxes, sanitized the file and had intuit review it, NOTHING came up as a reason it couldn't e-file.

The original return was e-filed by a different firm, I e-filed the amended return without issue. Then the IRS rejected (one for incorrect IP PIN and the other for Employer EIN# not matching database) Once you open the reject notice to see what the error is, proseries no longer has the amended return available for e-file and the reason is "Federal return not complete" It obviously IS complete or it wouldn't have been able to e-file the first time when it got rejected. The amended return doesn't even show up in the EF center anymore, just a regular federal return (even though the 1040-X is still in the file and complete). If you scroll over in the EF center you'll see a column listing that Amended return was rejected, but no reject link to view the error notice or anything. I ended up having to re-enter the entire return manually and then it let me e-file that new return. Of course you have to take the SSN out of the original file or it will stop you for duplicate SSN. Really annoying to do, but its a work around that saves you from paper filing.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Having the same issue. where you able to resolve it?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I keep getting rejects when I try to e-file a 2020 amended return that the taxpayer e-filed on another tax platform.. It does not recognize the 1040 X present in the e-file package. I have been through at least three pro series tech assistance sessions to no avail. When I try to e-file from within the tax return, it states the federal amended return is not ready because the federal return itself has not been completed. I would appreciate any help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If at first (or 2nd) you don't succeed.......................... PAPERFILE.... it ain't worth the aggravation

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Something goofy happens when an EFiled 1040X return rejects, (mine was for a stupid EIN on a W2)

I tried over and over again to get it to resubmit. Short of starting over from scratch and doing the whole thing over again, I finally gave up. It just doesnt recognize it as an amended return anymore, its not you, its a programming problem that just hasnt been addressed.

Just have the client mail it in. Efiled 1040Xs arent processed any quicker than mailed in ones, youre only saving mail processing time. Save yourself some aggravation and drop it in the mail.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Same issue. 2021 amended return rejected by IRS for lack of taxpayer PIN. Corrected with 2023 PIN. Proseries won't let me resubmit an amended return. Error messages on INFO screen that just go in circles, with eFile center only giving me an option for filing the 1040 again, not the amended return. After 3 days of messing around, finally sent paper return to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, its some weird programming problem, what a hassle!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪