- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: 8915F

8915F

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am totaly confused. Going by some of the answers regarding form 8915F am I going to have to wait untill March of 2022 to file a taxreturn for my clients who had an early tax distribution to be spread over 3 years in 2020

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just checked and Proseries says the form will be available March31? As a work around, could you enter the 1/3 as a new 1099R, distribution code 2 not subject to the penalty. IRS wouldn't have this in their system, but it would match up to the 8915-E from 2020. Just an idea, what do you think?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

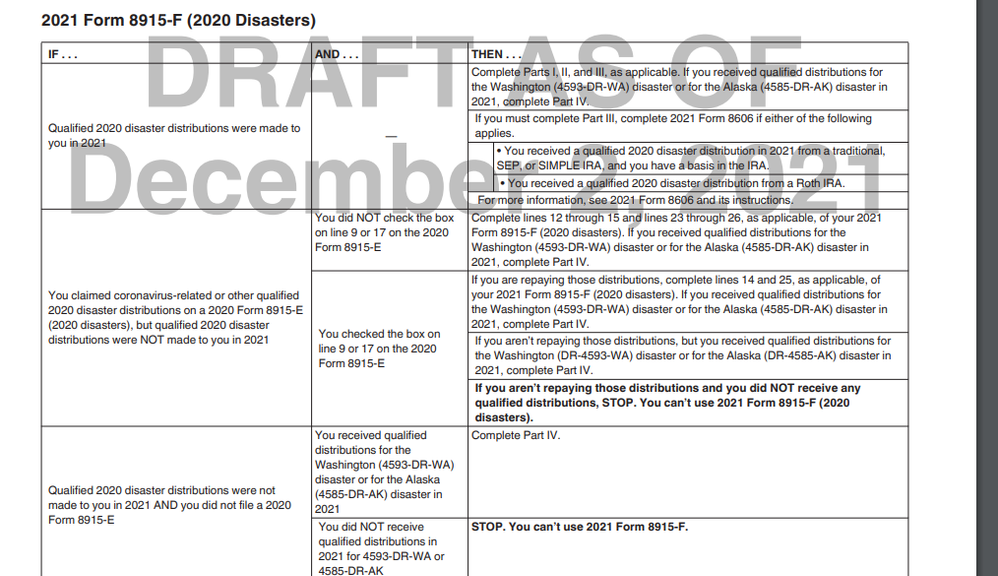

The draft instructions say

When Should I Not Use a Form

8915-F?

Reporting coronavirus-related and other

distributions for qualified 2020 disasters

made or received in 2020. This form

replaces Form 8915-E for tax years

beginning after 2020. Do not use a Form

8915-F to report qualified 2020 disaster

distributions made in 2020 or qualified

distributions received in 2020 for 2020

disasters.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That little paragraph is misleading, I reads like we still use the 8915E, but that's only for tax year 2020 returns.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You report a distribution from 2020 on 8915E which is in the program, but not ready yet. From Q&A IRS:

A13. If you are a qualified individual, you may designate any eligible distribution as a coronavirus-related distribution as long as the total amount that you designate as coronavirus-related distributions is not more than $100,000. As noted earlier, a qualified individual may treat a distribution that meets the requirements to be a coronavirus-related distribution as such a distribution, regardless of whether the eligible retirement plan treats the distribution as a coronavirus-related distribution. A coronavirus-related distribution should be reported on your individual federal income tax return for 2020. You must include the taxable portion of the distribution in income ratably over the 3-year period – 2020, 2021, and 2022 – unless you elect to include the entire amount in income in 2020. Whether or not you are required to file a federal income tax return, you would use Form 8915-E (which is expected to be available before the end of 2020) to report any repayment of a coronavirus-related distribution and to determine the amount of any coronavirus-related distribution includible in income for a year. See generally section 4 of Notice 2005-92.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree it's misleading. IRS hires accountants, not English majors.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Assuming we transfer the clients before form 8915F is ready when the form does get added then the carryover for year 2 of the 3 year spread will hopefully appear!

Certain returns need to have some other/early inputting done, (ie. rental properties or Sch C). Hopefully the former occurs.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Neither I nor the software are ready for prime time yet, but I am continuing to check it out. When I Transfer a 2020 F1040 (which had 8915E) into 2021, F8915A-T appears in the Forms in Use listing, and 0 appears in green in line 1.

F8915-E appears in the LOAF(List Of All Forms) but has nothing on it.

For later exploration: does the one-third amount go on 1099-R, code 2 for no penalty?

(FYI: F8915-E appears when looking at the LOAF, and when using F6, but it does NOT appear when searching using the green "Where do I enter?" button.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi

Could you look at the 2020 return and transfer the 1/3 to the Form 1040 making sure of inputting the code for no penalty for that amount? and Maybe we do not have to wait for 8915F. At the end of the day, I only have two or three cases who split the distributions in 2020. Just asking?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

8915F is the FINAL 8915 form we will see. Its called the forever form by the IRS, meaning you will not see a 8915G etc. (Of course that can change but this is what is being put out now). So anyone who had a distribution that was over the 3 year spread will need the 8915F to use to spread to the second year & third year. There is a part of the form that will be used for this as well as any paybacks that may occur. My question is this form needs to be installed before we can complete any returns that had this situation and will all of these returns be transferred to this from 2020? My educated guess is that it will have to be or this would make for a convuluted situation. As for a new client who had this 3 year spread one will have to find how to manually carryover the remaining balance with or without a payback occurring.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Should not need a 1099R if this carryover via transfer from 2020. This is where Proseries fails in my opinion. This type of situation that will be occurring often needs to be put out in an alert such as, "form 8915F not present and will be needed to carryover the 3 year spread and/or any payback that may occur". This was similar to what happened last year with the 8915E as well as the NYC 1127 last year. Their messaging is not the best in regards to these situations.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

8915F is for 2021 and beyond

If you are doing a late 2020 return it is 8915E

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you get a new client for 2021, input the 2020 return into your system, then transfer into 2021. If the transfer works, it will be done.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That may be good to do but there must be a way to input this without having to transfer from 2020. The issue I have with proseries now is lack of guidance on this. This is the same issue we had with the 8915E last year. We all assumed how it would work. My friends who use other software, such as Drake, have the form in there program already, albeit not printable yet because its not released from the IRS. I like Proseries but they are sometimes late to the party.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I did read somewhere on the intuit website that you will have to manually enter the carry over amount once you have 8915F, sounds very easy enough, but when is this form ever going to appear!!!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

March 17th we are told it will be here. Entering the information maually shoild be simple enough as long as the final form is different from the rough draft that appears on line.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just checked and Proseries says the form will be available March31? As a work around, could you enter the 1/3 as a new 1099R, distribution code 2 not subject to the penalty. IRS wouldn't have this in their system, but it would match up to the 8915-E from 2020. Just an idea, what do you think?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think that is a great idea and I have been conteplating that very thing myself. But beforeI do that I would like to discuss with some of my felow preparers to see if there could be anything unpleasant with the IRS if we do things that way.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That might be a good idea for the bottom line however you need to use 8915 F in order to send the return otherwise you’re more likely to get a letter from the IRS that you didn’t include the 2nd of the 3 year spread. They Would be looking at this as a new distribution not a carryover. Also if you have any clients that have paid back some or all of this distribution you still need form 8915 F

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for your response. WE dont know for sure if the IRS would send us a letter and March 31st is a longway to be hanging up about 100 tax returns that I have that need this done. I am not going to do this right away. I am gong to take a few days to think about it some more before making a decision. Any other preparers that might be reading this please feel free to comment.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think it's a bad idea, I would wait for ProSeries to be updated. Now that the form is finalized I would expect PS to be updated within the next week or two at the latest. But then I'm not one to be first to jump into the deep end (I like to wait and see if any sharks are there first).

If it's any consolation, Drake's implementation is to simply attach a PDF of the 8915-F. That tells me that no data is flowing directly into the IRS computers from this form (there will likely be a flag generated saying that Form 8915-F is "attached" which may be enough to ward off nastigrams later). So I suspect the only info the IRS computer has to match with the prior year 8915-E will be the amount reported as taxable income for pensions/IRAs on the 1040.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree. You might have the right amount for the carryover but the wrong form. Yes you could probably respond to a CP 2000 saying what you did but it’s just going to be more work down the road. I agree with waiting. That’s why I wish the form was already in the system and you can keep the returns on hold until it’s released. But that’s beating a dead horse especially on this venue

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for your response. If you are right and that form is in our software in another week or two I dont have a problem waiting that long. But that March 31st date that Intuit is currently putting out there really has me worried. Besides waiting a long time there is also the danger of March 31st getting here and hearing that it will take longer. But for now I am going to take your advice and wait another two weeks and see what happens.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"That tells me that no data is flowing directly into the IRS computers from this form (there will likely be a flag generated saying that Form 8915-F is "attached" which may be enough to ward off nastigrams later)."

Yes, that is what is going on, because the IRS schema info has stated in the file "Known Issues and Solutions:"

"Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments was not developed in XML for TY2021 as expected. Software developers who cannot attach a PDF binary attachment can use a 'GeneralDependencyMedium'."

And it can happen behind the scenes:

"Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments, will be accepted in MeF as a PDF attachment for tax year 2021. “Form8915F” must be used as the binary attachment description when including Form 8915-F as a PDF attachment."

"Schema will be developed for Tax year 2022/Processing Year 2023"

And that is dated December 9, 2021. I previously copied this info to this forum in the past, but there are too many topics on "Form 8915-F" to copy it into all of them.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lets see if I understand you correctly. You say XML for Ty2021 was not delveloped as expected and some software companies will have to use General Dependency Mediumn.

I dont always understand computer talk but are you saying this why pro series is taking so long in getting this into our software and that is why we might have to wait untill March 31st?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is no "You say." The IRS has recognized that coding never happened for the tax filing year of 2021, to be filed in 2022. They expect to provide it for tax year 2022, filed in 2023. In the meantime, they give two alternative ways for software providers to include the info in the E-file data stream. It is either as Attachment (following the IRS naming protocol) or as the "raw data" as noted: Software developers who cannot attach a PDF binary attachment can use a 'GeneralDependencyMedium.'

I've been posting this all along. Yes, it is why providers such as Intuit have had this delay.

You can watch it for yourself. Just google:

IRS schema

And then open or download or otherwise access the files you see, naming will often include tax year and forms, so that you get the right file(s) and the Known Problems file is an Excel file, so unlock it to search for the forms or other info you are curious about. All of this is public info, and available from the IRS.

Your tax dollars at work.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for the info. While I am not the least bit happy about the situation we are in that at least explains why we are in the situation we are in.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"that at least explains why we are in the situation we are in."

It's the same thing that I provided to this forum, oh, maybe 3 weeks ago, or even back to early Jan. I really can't remember. If this one finally makes you realize that asking the same thing every day doesn't control Intuit, that would be great.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

And as I said before I will keep on this untill the matter is resolved. While the matter is not resolved I now understand why this is happening. You have to understand that I am a world war 2 baby and much of this computer talk is all greek to me (no offense to anyone) So now we are at this -point I guess I can back off now. I hope all my fellow preparers dont miss me too much.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would also like to see a Query added to the 2020 program so that we can search for files that included the Form 8915. We have 900 clients and remembering who all was involved with the 3-year spread is concerning me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Go here and Vote:

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So it looks like it is still March 31 release? Gosh that is too late, everything is held up!