- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: 2020 EIC USING 2019 INCOME - WITH NO 2020 INCOME

2020 EIC USING 2019 INCOME - WITH NO 2020 INCOME

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Wouldn't you know the first return of the season is a BIG HEAD-SCRATCHER.

Have someone who had no 2020 income and two kids and qualifies for the EIC and additional Child credit based on 2019 income. Set this up correctly on the worksheets and a $k refund is generating but Proseries is stating that I can not e-file due to all income used to qualify for EIC is coming from undocumented sources!

What do I do??

Adam Gladstone, CPA

Warminster, PA

[ph# removed]

[email address removed]

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For an earlier discussion on the topic:

Earned Income Tax Credit - Intuit Accountants Community

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi, we had a long discussion about it but as of today I am still not sure about this. It seems that even with ) 0 income somebody qualifies for the EITC using the 2019 earned income amount. As you said, why the program marked wrong. A group of people are calling PS and IRS to clarify this. It has to be solved quickly this week or it is going to be a mess. I already had people with did not work and had earned income last year. A mess.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On Saturday, I saw a tax professional in a FB tax group say that his office had something from IRS stating that it was allowed, I asked him for a link to the info or whatever he had from IRS, he said he'd add it to the group discussion once he was back in the office on Monday....if he comes back, I'll add that info to this discussion.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"... I can not e-file"

NO one can e-file right now. Wait for an update to see if it gets fixed. We've got three weeks for Intuit to make this work.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A group of tax people from NJ are calling the IRS today about this and other things. this is crazy.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would like to know from PS too about this. Any Proseries employee please.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Nobody is talking about efiling, it is about the EITC I guess with 0 income

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The OP specifically stated "....I can not e-file". Reread it, please.

I understand what the issue is. It's only 1.25.21 - there are, and will continue, to be bugs in the programming.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK, he came back...it wasnt from IRS, it was from his tax software telling them you could use 2019 earned income if 2020 had none....so I think we're all just waiting for actual guidance from IRS to know for sure (if they even know!)

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

what gets me confused is the Proseries will mark an error if you had 0 income (earned income) in 2020, but as soon as you include at least 1 as earned income in 2020 the error disappears. It does not make any sense. To me, you do not need any income at all, but nobody it is talking about it, even the IRS. Thanks God the efiling is delayed because I know a lot of tax preparers that are not aware of this Prior Year Earned Income provision.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would like to hear from Pro series as soon as possible. Does anybody know how to have them in the chat?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The problem it that PS is encouraging us to start efiling on the 28 to avoid traffic jam when the IRS starts receiving in February 12, but with this problem, it is better to wait.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It does not make any sense.

It's a programming error/bug. It happens. It will get fixed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

PS is NOT "encouraging", they are offering.

If you think PS isn't aware of this issue, contact them. No one here can do anything about the programming.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sending returns in before Jan 28th and Feb 11th only makes them sit at Intuit

(and locks you out of them if a client comes in and says "Oh wait, this just arrived, I forgot about it", then youre stuck having to amend later once the 1040X forms get finalized usually at the end of February/beginning of March),

they'll be sent to IRS in the same traffic jam as everyone else on the 12th.

I always wait 3 days after opening day to send any of my clients returns in...I want no part of that opening day mess.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"The problem it that PS is encouraging us to start efiling on the 28 to avoid traffic jam when the IRS starts receiving in February 12, but with this problem, it is better to wait."

They are not encouraging. They are offering the service because there would be too many people here whining that "such and such software is accepting returns, why can't Intuit". Personally, I'm not hopping on that bus because I don't want to have to deal with the issues if that bus misses a turn and goes off a cliff. I'm patient. I'll gladly wait for things to open up ---------------- and then give it a little more time ------------- I sleep better at night going that route.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@abctax55 "there are, and will continue, to be bugs in the programming."

The program can do only what IRS allows it to do. Let's not curse the stopped cars at the intersection when it's because the light is red.

I'm amazed that people want to call ProSeries with a tax question.

I'm amazed that people want to call IRS with a tax question and would accept a quick answer over the phone from someone whose productivity is evaluated by average call time.

I'm not surprised that no one mentions bringing this to the attention of the National Taxpayer Advocate, whose job description includes identifying and solving systemic problems. We all know that her job description is really just helping the IRS public-relations campaign.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Programming can mean either Intuit, or IRS.

On another list-serve, someone posted that the IRS will be scrutinizing returns using 2019 amounts for EIC veddy, veddy, veddy carefully (which translates to holding up those refunds). Who knows, but it would make sense. And that's going to make a lot of folks unhappy, especially in Turbo Tax land.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Earned Income Tax Credit (EITC) Relief

If your earned income was higher in 2019 than in 2020, you can use the 2019 amount to figure your EITC for 2020. This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020.

To figure the credit, see Publication 596, Earned Income Credit.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sooo, do you have to have enough earned income to qualify for EIC in 2020, before you have the option to use the lower 2019 earned income amount ?

Or does having 0 earned income in 2020, still allow you to choose the 2019 higher amount of earned income for EIC (like PS is allowing?)

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is not much here for those who want to guess at legislative intent. But which do you think it's more likely, that Congress wanted to accomplish?

1) "As long as you worked a little bit in 2020, even if you only made $10, we are going to give you EIC based on your 2019 earnings."

2) "We recognize that many people had no income in 2020. They may have worked seasonal jobs for the last 20 years, but the jobs disappeared when the pandemic arrived. So we will let them claim EIC based on their 2019 income."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@athaureaux6 "Nobody is talking about efiling, it is about the EITC I guess with 0 income"

That's because someone changed the subject from efiling, which is the question posted.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Lisa, this is exactly what I have been asking all this time? I have talked to many people, well, not many, because to tell you the truth, many tax people, do not even know about this, they think that yes, with 0 income you would still qualify.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Well said Bob. You are right, good analysis. They probably will allow somebody with no income use this provision. I understand the purpose. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Programming can mean either Intuit, or IRS.

IRS tells software companies how to program for returns to be accepted for e-filing. That's policy, not software.

On another list-serve, someone posted that the IRS will be scrutinizing returns using 2019 amounts for EIC veddy, veddy, veddy carefully (which translates to holding up those refunds).

Well, that settles it then. Someone on a listserv is always right. I bet they even called it a "red flag."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just got more confused reading an article that said you will need at least 1 dollar of earned income to use the provision. Can somebody explain that to me?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So if you need $1 of earned income in 2020, suddenly everyone will be self employed and earned $200 selling crafts on Etsy to qualify for using the 2019 earned income for EIC. SMH , what a mess.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Bob, I just got more confused, I just read an article updated in the 23rd, that says you need at least 1 dollar of earned income to use the provision. So confusing. That is the reason, maybe, why PS shows an error if there is no income. I do not know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Exactly what I have been saying. This does not make any sense. My CPA friend and I called PS and they do not have any idea what we were talking about, and we just called the IRS and there is no way to talk to any of them. The IRS needs to step up and clarify this soon.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"suddenly everyone will be self employed and earned $200 selling crafts on Etsy"

That isn't fair to say that. I earned $219 on Etsy. I believe I would have only earned $200 but I think I picked up a couple of extra sales from folks who didn't want to leave home to shop due to COVID.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

delete.... I'm outta' here.

Good luck, everyone

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Don't be afraid to post a link to that article. Or at least name the publication and author.

"I've Got A Secret" is an old TV game show, not a way to discuss federal law.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Well, that settles it then. Someone on a listserv is always right. I bet they even called it a "red flag."

Nope... it's a professional forum. One that not every Tom, *Dick*, and Harry get to post their uniformed opinions on. Not one where knee-jerk reactions are the norm.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi everybody

I am on the line with the IRS EITC Department on the Tax Practitioners Help Line. Let me see what they say if I get to talk to them.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But remember to call three times to see if you get the same answer each time.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi everybody,

you will not believe what happened to me, they got me even more confused. He said that with 0 income you will not get the credit, then I aksed, what about if you had 1 or 10 earned income, and he started getting mad and said you will not get it. I really do not understand anything. I do not know what to tell you anymore.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN "But remember to call three times to see if you get the same answer each time."

So now we know why there are 7 million unprocessed 2019 returns. Too many people assigned to the EIC Department. I thought the phone people were still working at home these days, but maybe we should picture six people sitting around a large conference table. It's in a room, down a long hallway marked "Bureau of Tax Credits." The EIC experts look at the law, and then they look at each other. Then they look at the clock and notice it's time to go home. They figure the caller didn't write down anyone's name or badge number, so they make up a quick answer and there is another satisfied customer.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Lisa, please if you find a definitive answer to this EITC provision let me know, I have talked to many people and there are multiple opinions about it. I even talked to the IRS, Practitioner Line, Department of the EITC and the guy seemed to be mad when I asked questions about low income or not income in 2020, he just get too offensive. I will appreciate if you get to find the clarification of this mess.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

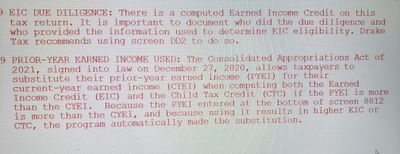

I have a friend who has Drake software and she gets this message.So does this also apply to child tax credit? If so do people who have a ITIN number also qualify?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

thank you Lisa ! we really appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sorry that I am so late into looking at the question you had.

I have filed three returns where I used 2019 income for EIC and for CTC.

If there is no earned income on 2020 tax return then you cannot e-file. Using the 2019 income does not go to 1040 LINE 1 (W2) so there is no verified earned income.

Also make sure that you are claiming both, EIC and CTC. I had to go to Form 1040 and click on CTC line to be able to claim the CTC.

I had to mail the tax returns attaching 2019 tax copy and 2019 W2 to avoid any verification from IRS for 2019 income.

I hope this will help you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

IS IT GOING TO AFFECT THE STATE REFUND ? I REALIZED THAT STATE REFUND STAYS THE SAME .

THANKS!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

I am having the same issue and can't seem to find a solution to this situation. Would you please be so kind to let me know if you were able to find a solution or a workaround?

Looking forward to your response,

Claudia Castillo, EA

Cleveland, OH

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good Morning

Can you tell me if you know how to know to get more credits using using the income form 2019 and 2020

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

EITC video link sent by the IRS through the e-newsletter system you can sign up to get, for yourself:

https://www.youtube.com/watch?v=0c_wQgyDMDI

I know you might be hesitant to click links. They forgot to give it an Issue Number.

Issue Number: Earned Income Tax Credit (EITC) Can Put More Money in Your Pocket

Inside This Issue

Here is a video tax tip from the IRS:

Earned Income Tax Credit (EITC) Can Put More Money in Your Pocket English | Spanish

Subscribe today: The IRS YouTube channels provide short, informative videos on various tax related topics in English, Spanish and ASL.

Don't yell at us; we're volunteers