- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Why does Form 8453 disappear when you use a single code M but when you add a second code W Form 8453 re-appears although totally blank

Why does Form 8453 disappear when you use a single code M but when you add a second code W Form 8453 re-appears although totally blank

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There seems to be a difference this year when inputting multiple Capital gains worksheet codes including M for attached PDF files. When you add a second code W say for wash sales Form 8453 pops up again in the Forms in Use column although it is totally blank. In prior years Form 8453 would disappear altogether once you indicated you were attaching a PDF. If you only have a single code M Form 8453 will disappear from the forms in use column.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

M = attaching a PDF

If you want to mail in the 1099B, check the box at the top of the worksheet

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm not mailing. I am attaching a PDF file and have checked no in that box. It is when I add a second code W for wash sales that the Form 8453 pops up again although blank with no boxes checked on that form.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Orlando I dont think this is officially your department, but I havent been getting much response to things I report in the Lounge or tag Austin in, so maybe you could hand this off to the correct place?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm wondering, does the form go away when you attach the PDF? Maybe the software is "smart" enough to ass-u-me that if you're summarizing but haven't attached anything then you must be mailing it in.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

nope, pdf file is attached

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Okay, just a shot in the dark. Like Lisa, I'd ignore it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The Form 8453 does print out with the return and it looks like the blank form wants to go with the e-filed return. Technical Support was of no use at all when I called this morning.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi!

I'm standing in for Orlando. I'll take a look at this...

Can you help me understand impact. We just get a blank 8453 when there shouldn't be one? Everything else works as expected?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Correct. I can get the correct tax result. The wash sale adj amount is properly making an adjustment to the loss and the correct multiple codes (MW) are showing. It's just that Form 8453 won't go away and it looks like it will get sent blank to IRS. So I'm not sure if IRS will send client a notice saying no Form 8453 was received. (well, the reason is that the 1099-B activity was attached as a PDF.) The Form 8453 also prints out on the client copy so I have to remove that otherwise client might get confused. This has never happened in the 30 years I have had ProSeries. It's only because Intuit changed the input forms and hasn't noticed this program glitch. There has to be others who are having this problem. Whenever you get a 20-25 page 1099-B it is not unusual at all to have some wash sale activity.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can you go into Control Which Forms print and set the 8453 to Never?

I dont think it will get sent to IRS its for paper filing only, but the Never setting might get rid of it in your Client copy.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Gotcha. Yeah that sounds frustrating. Not my domain, but I'll have someone take a look at it from my end.

Thanks for calling this out to us!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for reporting this issue. I've reported to the appropriate development team for review.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This Form is not listed under either Filing Copy or Client Copy for elimination. I could pull the client copy but it is the Filing Copy I am trying to eliminate.But thanks for the suggestion. Intuit needs to fix this. Please Intuit can you fix this??

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi -

We're currently working on this 🙂

We should have a fix out to you soon, but I don't have an exact date.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you so much

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm having the same issue: A blank Form 8453 being generated. Any update on this as I'm going to have quite a few clients uploading Form 1099Bs this season.

Thanks,

Tim

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for looking at getting this issue fixed!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK, it's been 3 weeks, when will Intuit fix this bug. I have returns to file with this issue. I dont feel comfortable sending IRS e-filed forms incorrectly. The form 8453 should NOT be attached as nothing is being mailed

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have same issue - apparently tech support isn't going to fix?? It's been 3 weeks since they've been notified.....:-(

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have the same issue. When will Intuit fix it? I think it is a program glitch.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When will this error be fixed?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This issue was fixed and released a couple weeks ago. Can you confirm if you are still the issue?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Problem still has not gone away on returns that I already had prepared with MW codes. Was the Form 8453 supposed to all of a sudden go away under this fix you mention? Not happening.

Also for several returns I have done in the last few days I also get a blank Form 8453 whenever I have use code M for an attached PDF file and a code B or E is used indicating basis not reported to IRS. I think your programmers need to take another look at the problem.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, I am still having the problem. I spent several hours on tech support a couple days ago. they finally through up their hands and said file with the erroneous form - not a good answer/solution.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I've given up with the blank Form 8453 being generated for any client that has a Form 1099 attached.

I do include this in my client email:

If you see a blank Form 8453, please ignore. This is a program glitch and ProSeries is aware of it. It has no bearing on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I've taken it one step further. I have a note that goes to IRS with the tax return

stating Form 8453 is included however client will not be mailing it it. The forms are attached as a .pdf. Software glitch, etc. etc,

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just to reply that the "new" sch D is awful...I do hope it gets improved

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

AMEN!!! Previous years it all worked great and entry made sense - this year its awful! Wish they'd follow rule - if it's not broke - don't fix it .

They tried to fix something that wasn't broken, and in the process they broke it! I HATE the new data entry for Sch D.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On the phone with support for almost 3 hours today on this issue. Updated the program six ways to Sunday, but still generating blank 8453. Per technician, not a big deal to send IRS a blank 8453.

Same issue as others have mentioned - MW codes. Also, the checkbox at the bottom of the Form 1099-B worksheet does not check yes even with Code M unless Code W is included. Code W toggles that checkbox. What a mess!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for letting us know it's still not fixed.

How frustrating to lose 3 hours and not even get a resolution!

Yea, no big deal to the technician - he's not the one signing/submitting the tax return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Actually , the whole Intuit customer service experience is frustrating. I called about this issue a couple of months ago and the customer service person was clueless. I asked for a supervisor to call back and never got a response. What is the status of the 8453 issue as of today? The instructions say that we have the option of mailing in Forms 8453 with statements OR transmitting via PDf. However while we all know we can stop the Form from printing we don’t know if it will be transmitted to the IRS via E-file. I strongly suspect it will, and believe it is highly likely that the IRS could respond with notices to clients. Having to explain this to clients and respond to notices is time consuming process. Time is our inventory. Give the price of this software we should not have to experience this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No the issue still persists

Actually , the whole Intuit customer service experience is frustrating. I called about this issue a couple of months ago and the customer service person was clueless. I asked for a supervisor to call back and never got a response. What is the status of the 8453 issue as of today? The instructions say that we have the option of mailing in Forms 8453 with statements OR transmitting via PDf. However while we all know we can stop the Form from printing we don’t know if it will be transmitted to the IRS via E-file. I strongly suspect it will, and believe it is highly likely that the IRS could respond with notices to clients. Having to explain this to clients and respond to notices is time consuming process. Time is our inventory. Give the price of this software we should not have to experience this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Will Proseries reimburse us at our usual and customary billing rates if they are wrong and this "Glitch" results in hours of correspondence. Has Proseries been in contact with the IRS to determine that this will not be a problem? What is the status of the Glitch fix?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yup Intuit - if you ever look at this message board, the problem still persists!!! As of 2 mintutes ago. PPLLEEAASSEEEE fix this!!! Your software is not cheap - please invest an hour of a software guy's time and get this problem FIXED!!!!! It's been months now that you've know about it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Jill,

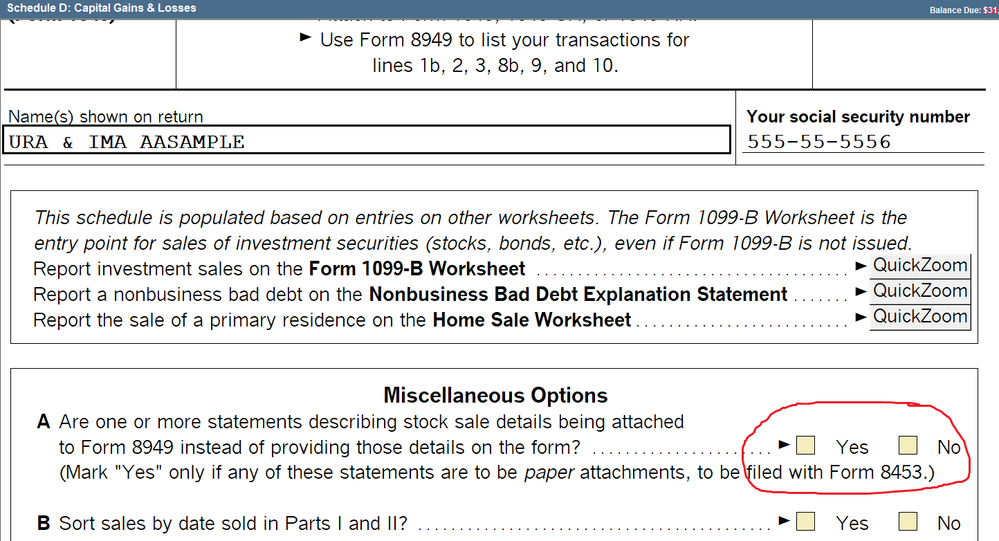

I just downloaded an update and think they might have fixed the issue. Please give it a try and let me know if it works for you. If you go to Sch D, second box from the top, Miscellaneous Options and check No on box A the 8453 vanishes from the open Forms box and does not rear its ugly head when you print. Something useful is that at the very bottom of the 1099-B worksheet there is box checked indicating a PDF does or does not have to be attached.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks! I just checked and you are right - the box is there to check no, and it gets rid of form 8453. (I don't think the box was there before - well, it was in 2019, but I think that was the problem when they removed for 2020? Or maybe it was there and just didn't work?) Anyway, it works now - yea! I saw the box on the bottom of 1099-B a while back, it would be checked that a .pdf does need to be attached. but the stupid form 8453 would still attach. Now it's a wait and see game to see if there are nasty grams from IRS regarding the returns already filed...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'd like to attached 2 separate brokers 1099B's to form 8453 and mail in separate from the e-filing of the return. I'm not quite sure how/where to enter the totals of each brokers statements for the Short term & Long term covered securities

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

hi,

May be you can help since you uploaded that picture saying yes on the check box under miscellaneous option on SCH D. I did efile my client's tax return with couple of attached statements for form 8949, but i already attached these statements to the efiled tax return as pdf. But by mistake or confusion i did say yes on the check box under miscellaneous options section A on SCH D. I saw a form 8453 attached to the return but thought IRS would disregard it or thought it was standard since i attached the stocks attached statement with return first time. Also the wording for this yes or no question in proseries is rather confusing and they dont say the word to be MAILED with 8453 to make us cautious.

My question now is, should i mail the form 8453 and attached statements with it to IRS (the statements were already attached to efiled return as pdf files) or should i count on IRS to figure out there nothing else to be sent and form 8453 was generated and sent by mistake.

Please suggest something as i am already panicking.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does this mean that a blank Form 8453 has to be completed manually?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am having same problem. Been with pro series as long as you. I am e-filing the tax return and sending 150 trades mostly with wash sales with a manually completed Form 8453. I will print it separately and fill it in manually. According to the instructions, I am to mail the 8453 along with copy of the trades wiithin 3 days following acknowledgement of receipt by IRS.. Any comments?