- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Tidbits for the week

Tidbits for the week

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So Ironwoman gets an e-mail this morning from a client - here are "some" of our gambling winnings (W-2Gs) - but I don't know if you need them since we have losses to offset the winnings.

Just opened up a package with a client's tax stuff. She has her 1099s, mortgage interest, etc and a post-it note with "donations?" written on it. No amounts anywhere in her stuff so is she asking us if we make charitable donations?

Ironwoman had an e-mail from another client earlier in the week that runs a schedule C business asking how things are looking. Um, you haven't given us anything yet, not even a post-it note with "donations" written on it, so things aren't really looking good for you at this point.

Received two e-mails in the last couple of days starting with "I know you are busy, but". But what? But we are never too busy too answer your stupid questions that could wait a few more days.

Had a phone call from a client on Thursday. She doesn't know where we got the numbers that are on the return. Um, the numbers came from your 1099s. Take a good look at them and get a calculator out if need be.

Received an e-mail from a investment guru the other day. Wanted me to send an electronic copy of the client's return to her "at my earliest convenience". You mean the return that we gave him two weeks ago? Do you own a scanner, try scanning the paper copy he has if you want electronic. Plus, you decided to send me his 1099 electronically ------- something you obviously didn't know how to do because I wasted a half hour of my life between failed attempts at opening it plus multiple e-mails to you before you finally faxed it. Hey, that's an idea, I'll fax you a copy of his return.

How come nobody has ever come up with a sitcom for a tax preparation office? Now that I think of it, I guess they have never done one because only tax preparers would get the jokes.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's the time of year when otherwise sane people need to be reminded that April 15 is just another fine spring day. There is absolutely no urgency to filing your return last week, or this week, or next week. If you expect to owe money, you can pay a small amount of interest for the privilege of leaving your cash in the money market at 5% for a while, or you could have sent it with an extension at some time in the last three months.

So many tax practitioners encourage this kind of irrational behavior. Traditions die hard.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You are correct about one thing, some clients feel no urgency since things just magically happen without any effort on their part. As a side note regarding the client with the contributions survey question. Last year's return had a note saying to "take the maximum that is allowed without any receipts". So there you have it. I just have to ask someone here what that maximum amount is for 2023.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

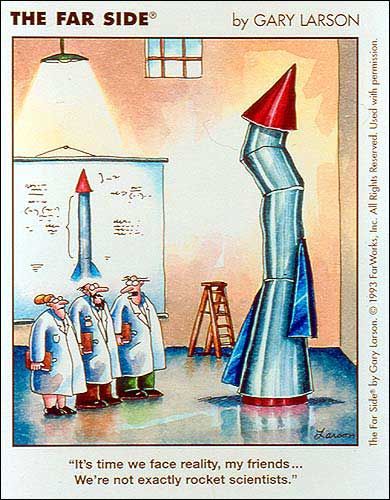

Some of them are not rocket scientists and that's for sure. But like Bob said, if they were Albert Einstein Juniors and Nikola Tesla Juniors then they would do their own returns. But others are arrogant, rude, and condescending, and those are the ones to get rid of.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This morning’s voicemail…… I dropped off my papers yesterday, but forgot to tell you about the rentals… Had a couple of vacancies so the rent is a bit lower… expenses about the same except water bill went up a bunch… I’ll be able to stop by Monday and sign… I’d don’t want to make an extension

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree with dkh. That is definitely extension material. I had a new client that was supposed to stop today or maybe tomorrow with a very simple return, I already do her mom's return, which I have already extended. I told her that I'm probably going to have to file an extension, she said okay.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That's comedy gold right there, and I've certainly endured all the things you mentioned. As for the sitcom, I'm in! There would be enough material to ensure the show ran longer than Seinfield-

Hard to say which is my favorite, you've got to love the clients who, despite you having sent pdf copy of their return(s) every year, will nonetheless contact you repeatedly to ask "Can you send me a copy of my 20__ return and send one to my bank for a loan I'm trying to get?" I've always obliged, but now I charge them a hefty fee for doing so. And apparently I'm not the only one with clients who can be relied on to ask "Do you think I'll get a refund this year?" to which I answer "I don't know, why don't you meet me halfway and send me your info?" And why are so many non-tax professionals convinced we have the power of clairvoyance? Can't remember how many I've had to set straight on that, I ask them why, since I have the gift of prophecy, I'm not in

Vegas or on Wall Street instead of putting up with them?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I love the clients who tell you, 4 days prior to the deadline, they're going to leave for an overseas trip on 4/14 and don't want to extend. To which I say, too freakin' bad. Those kind don't make the cut for the following filing season...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just had client just send me a text message they're going to drop off the e-file signature forms now. 8:00 p.m. on a Saturday. Real nice. In the past this client forgot to bring in W-2 one year, 1099R another year, brokerage statement another year, and God knows what else.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@dkh

I filed an extension for him over a week ago…. I do every year,…. Just a little dance… I’ll get the rest of the info from his wife…

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Long-time client, divorced several years ago, and the hubby always handled things. This is the first year she's had liabilities to pay. Federal, CA and one other state/

Her question - Can I just write one check for all of them?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@abctax55 wrote:

Long-time client, divorced several years ago, and the hubby always handled things. This is the first year she's had liabilities to pay. Federal, CA and one other state/

Her question - Can I just write one check for all of them?

Back home I believe this would be a "Bless her heart" moment . . .

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think we all pretty much could finish the story that another preparer starts. We all see and hear the same nonsense if you do this job long enough. But every now and then you hear a new story like the Godfather and his glitter lady. Sometimes during the heat of the battle we call tax season, you get the overwhelming urge to want to strangle an occasional client. But after things have cooled down you have to just sit back and smile at some of the stuff the circus has brought to your office.😀

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Almost finished.... while waiting for my computer to update, sync, etc.... I thought I'd share my season's favorite....

Confession

I prepare returns for a Priest; Fr. Ed (I call him Fred).... He's actually a Vicar, which is pretty high up the clerical food chain, and I try not to bother him during Holy week,... I completed and mailed his returns so he would receive them after Easter... he promptly signed and return the forms. Just before efile, I reviewed them again... oops, there's a 4K mistake in his income... No problem, thinks me.... I had applied his refund to 2024 and there'd be more than enough to cover the additional tax, so I figured I'd just send him the revised returns and a new 8879.

When I made the adjustment, the new refund/amount to be applied was six hundred sixty six..... no way am I sending him that.... so, I fudged his return a bit to get a different result..... Forgive me father for I have sinned.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Skylane Speaking of confessions, how many of us can remember the time when the catechism taught was that IRS could reject an extension request if the estimated tax owed was not paid with the 4868? I still catch myself filling them out to show no balance due when that is unlikely. The instructions to Form 4868, however, show that redemption and forgiveness is available:

Line 7—Amount You’re Paying

If you find you can’t pay the amount shown on line 6, you can still

get the extension. But you should pay as much as you can to limit

the amount of interest you’ll owe. Also, you may be charged the late

payment penalty on the unpaid tax from the regular due date of

your return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have to say this was great reading - I've had basically all of this so far except for the 666 in some form or another. If I get the I know your busy but one more time my head might explode but I guess I will feel better after a 2-week nap.

And why am I more concerned on 4/15 that you haven't sent you 8879 back than you are? Will spend half the day calling everyone AGAIN for their papers. Doors closed and locked at 5pm see you in May.