- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: They took two months for this?

They took two months for this?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

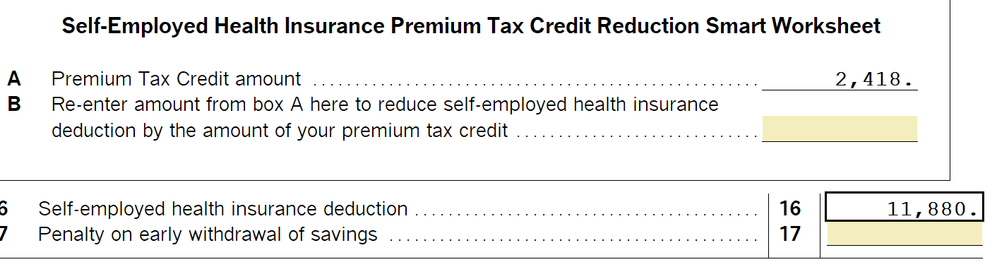

I don't know why I'm surprised, but Intuit took 2 months for this harebrained "fix" for the SEHI deduction for the non-repayment of the Premium Tax Credit? Essentially manually adjusting a number?

Despite what that article says, the way they programmed this seems to be MORE likely to screw up next year's software. Any takers for betting when they fix the 2021 software to counter-act this "fix"? 😂

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

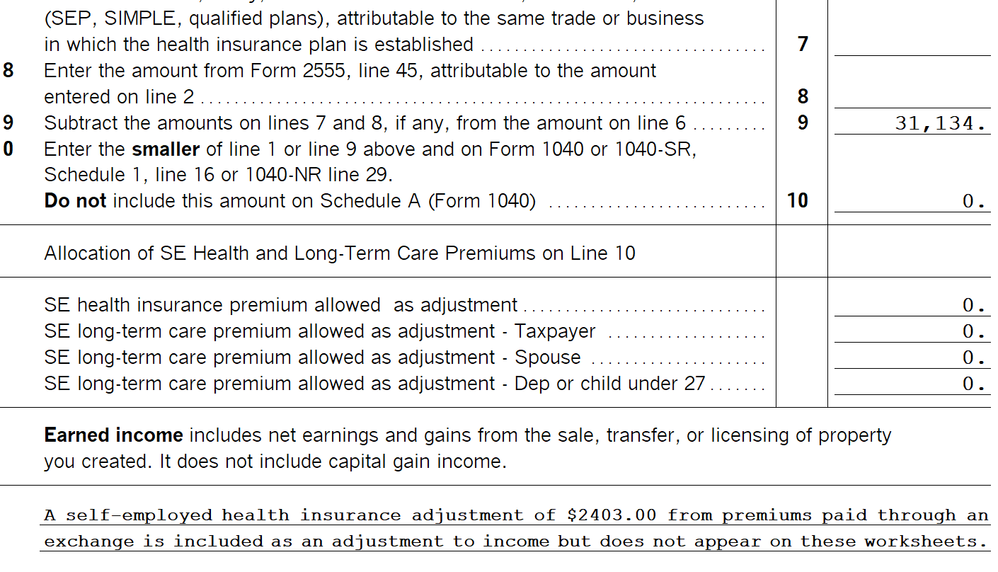

Ive only got one of these thats been sitting and waiting, Im not sure the Sch 1, Line 16 amount is correct (seems off by $3 when I take the premiums less the PTC) and the SEHI worksheet shows me no computation....my math says Line 16 should be 1200, not 1197, not sure I understand that 2403 in the paragraph at the bottom either.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Intuit is not very good at math. They tend to round numbers contrary to the IRS directions.

If you round each MONTH of the 1095-A (rather than the annual numbers), does it match what Intuit has?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It has always done that due to the annoying Iterative Calculation. The worksheet would show 'normal' math (plus and minus) to get SEHI. But that doesn't work for the Iterative Calculation. If they tried filling it out, the 'math' would not make sense when you looked at it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

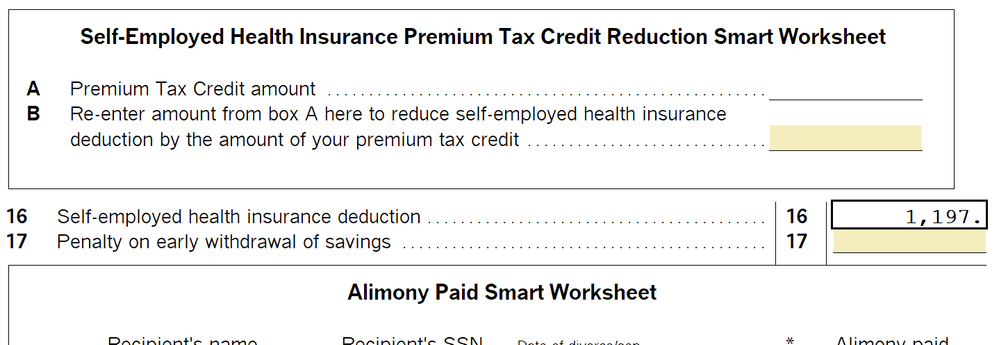

Oh, I do have 1 more, hes off by $2 so it must be rounding differences...but its failing to adjust for the net credit he getting....Line 16 is correct as paid (+/-$2), but its not adjusted for that 2418 above it...shouldnt that 2418 be deducted from that amount paid since its a credit on the return? Oh wait, I have to enter it to make that happen! But when I do, it changes the amount of credit LOL

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yep, rounding.

Yep, they require MANUAL entry, and they don't even make that a pink required field, so it will be easy to miss if you are not paying attention. In my opinion, this method is going to create more incorrect tax returns than if they had just left it alone.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Oh my, I didn't think about it. It is because of the Iterative calculation. The way they now have it set up, any tax return that has a credit will be screwed up.

I think this is far worse than before. They essentially took AWAY the Iterative calculation, so anything with a credit won't calculate correctly. What they heck were they thinking?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Seriously? Adding a diagnostic is Intuit's "fix" for their screwup? They could have EASILY fixed the original minor problem, but instead they completely disabled the Iterative calculation (which is a major issue), and all that is being done is adding a diagnostic?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am sitll trying to figure out why they try to do our thinking for us when the taxpayer has ACA insurance, but not when the taxpayer pays Medicare B or D premiums. Maybe because some of those are not withheld from Social Security checks?

And has anyone come across a situation where there are two Schedules C? How does the program know which one the insurance policy is "under"? Or does that distinction no longer exist?