- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: The Social Security Worksheet is not showing calculations on 2020 program

The Social Security Worksheet is not showing calculations on 2020 program

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is this a glitch in the program? My clients like to see the calculations when they have taxable SS (and so do I). Will this be fixed Intuit?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's good to hear that the problem is limited instead of haunting your whole client base.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Seems to be working for me, maybe you can explain better what youre not seeing?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Mine works.... have you updated recently?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is this a case of the worksheet not being there, or a case of the worksheet just not printing with the return?

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

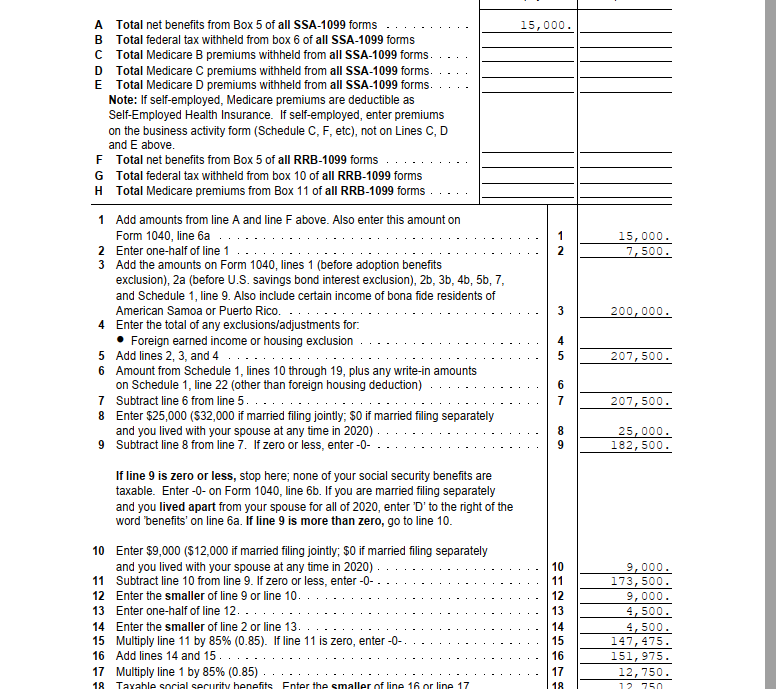

Line 1 and line 18 are filled out, nothing in-between. I updated this morning, still the same, that is why I asked.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ironman, The worksheet is there and it prints fine, there are figures in line 1 and line 18 but no figures anywhere in-between those two. Just blank lines. I updated this morning and checked and it is the same. 😞

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just plugged some numbers into a return and it worked fine for me. Out of curiosity, can you try plopping some numbers in another client's return to see if there is a "flaw" with the client or if the issue is your copy of the software.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

established client that was transferred back in late December (along with all my clients) but this is the first one with SS so far.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Pull another one up and add some SS to it...same thing?

Create a new client and give it some income and SS...does it fill out the worksheet?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hmmmm...I put a SS number in another client that was also transferred in December and the form filled out. I think there is a glitch with this one client. It isn't too complicated and they informed me they have more info to get to me. Think I might delete, re-transfer and start over while I'm not super busy yet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's good to hear that the problem is limited instead of haunting your whole client base.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just transfer clients one at a time until mid-March or so (sometimes later). Even if the software has no bugs prior to that--sorry, "unexpected behaviors"--Congress and the state legislatures really love making retroactive changes to the tax laws.

If we ever get to travel again, Utah is up next on my bucket list (hopefully in 2022). I've been to SLC before but then we turned north since my uncle was living in Spokane, WA. So I didn't make it to all of the wonderful National Parks (Arches, Bryce, Canyonlands, Zion, etc.). I have seen the Grand Canyon from the AZ side. I hear Great Basin (across the border in NV) has great stargazing on the new moon so I'd like to try to work that in too.

But first I have to survive this tax season and a move that keeps getting postponed.

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

IronMan suggested the same thing. See my reply to him. I did it and it was all there. Gonna delete the client and start over. I don't have too much info in yet and it is not a complicated return. I'll let you all know. It may not happen till Monday!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Rick,

This December transfer is the earliest I have ever transferred my clients. Sheesh!

I lived in Utah (St George, Ogden, and Salt Lake Valley) for about 40 years. It is a beautiful state and so diverse as is Arizona, where I live now. We are expecting snow tomorrow where I live. I am about an hour north of Phoenix, live on a dirt road, up on a hill in a canyon with amazing views. Other than the satellite (SLOW) internet, which is all I have a choice of, I love it!

Janis

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

LOL. I was on a dirt road like that when I toured AZ! This was circa 1987 so I don't remember the actual route but I think we were driving from the Painted Desert down to Phoenix and there was this great "shortcut" on the map (how bad can it be right, they put it on the map!) This ended up being a long and winding dirt road on the side of a mountain (I'm back East so what you call a hill, we call a mountain). No guardrails. If you were unlucky enough to meet someone coming the other direction, chances are one of you had to back up until the road was wide enough to pass each other!

In December of 2019 I helped a friend of mine move his mother's stuff from SC to CA. We didn't get much sight-seeing time in but I did make it a point to take a lunch break and stand on the corner in Winslow, AZ on the way.

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We have a Jeep. We are on those "back roads" all the time. It is good stress therapy for me and my camera. Happy tax season all. May it all be over this year on April 15! And Rick, Winslow is cool. Route 66!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I deleted the client, re-transferred them and now the SS worksheet is working. I will be watching all the others before I add all the info...just in case. Thanks for all your help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for reporting back! Sometimes data gets corrupted in the early transfers and there's no easy fix, you just have to start over. Hopefully you don't have too much data entry to duplicate this year!

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Well, I never updated this. When the SS worksheet filled out again I thought deleting and re entering info for my client was going to work. Low and behold, the info went away again. Finally I noticed a statement near the bottom that said if it was calculated on the SS form for those that contribute to a traditional IRA. I don't know if this is new or I have never had a client on SS and still working that contribute to an IRA. I thought I would mention this in case someone else has this trouble! It threw me!