- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: reporting the sale of inherited home on in 2020 software

reporting the sale of inherited home on in 2020 software

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have called support twice on this and no one can answer the question. It was great last year. I cannot find where to enter the info for the sale of an inherited home. Last year we could enter date of death, address , basis , closing costs etc. I cannot figure out how to do it this year. anyone find it???

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

CSR is useless......

Go to 1099-B worksheet to enter Inherited home.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

last year they had a real nice worksheet to put in date of death, address or home , basis, but that worksheet is gone. And I agree, it would be nice if they hired people that knew something about taxes and the tax program. I have yet talked to one that had any clue about either. 🙄

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

They're not supposed to know about taxes, and we're supposed to know enough about Schedule D that any sale can be shown. There is nothing special about an inherited house that makes it different from a Mustang kept in the garage for 30 years, or a coin collection.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sounds like a worksheet that belonged in Turddotaxx. As tax professionals, we shouldn't need to be spoon fed something as basic as the sale of inherited property.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

were able to put lots more information on the worksheet. of course we can just throw figures on the D but I appreciated being able to put more info on the worksheet.

they arent supposed to know about taxes ??? really ???how can they know the software if they have no basic knowledge of taxes. good grief, thats just common sense.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think frustration is warranted when the way the information is input changes from one way to another; I think most here if not all are experts in tax prep.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

DID YOU FIGURE IT OUT I CANT

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Follow these topics:

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, they took the worksheet away. You just have to enter it like a stock. I'm very disappointed in the program this year

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

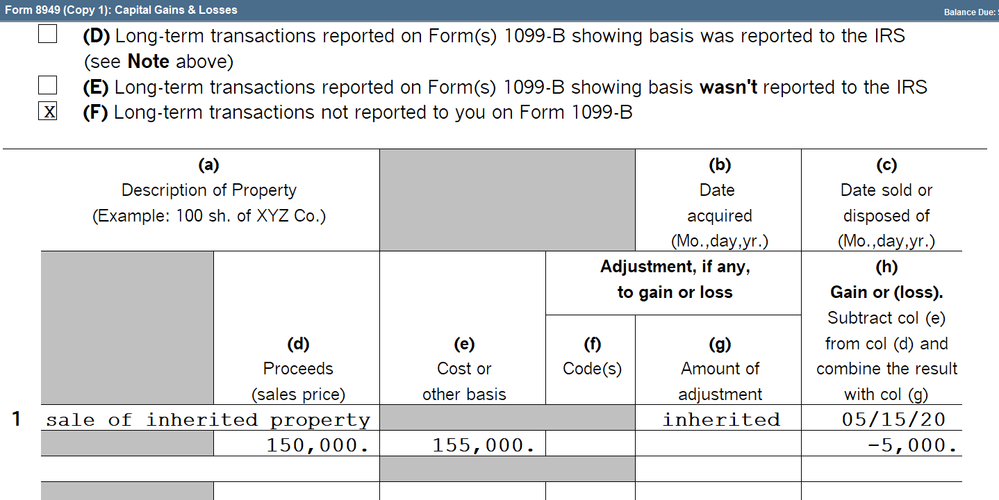

Personally I don't see the big deal. Enter description, date acquired, date sold, cost or other basis & exps of sale and sale price.

None of the other stuff is needed.

But that's just me (Just my opinion 😀). Seems to be tripping up a lot of people this year.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

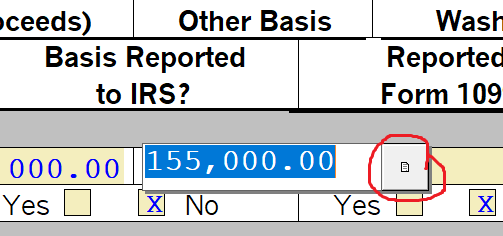

You just enter it like any other capital sale. Included your cost of sale in with the basis so that the selling price matches any 1099-S (you can open the supporting statement in the Basis box to list it all individually if youd like).

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Seems pretty simple to me. But what do I know?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Glad you do, and that you have been helping all these people. Obviously it's a ProSeries and Lacerte difference.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It ain't that tough. I don't get why why the multitudes were so perplexed by it this year. Wait until they find out that in order to log into their program next year, you have to solve an online Rubik's cube. Or maybe that isn't true and that was just a rumor started by some pot stirrer 🤣

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

pot stirrer

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for posting that ----------- I didn't want folks to mistakenly think that I was the pot stirrer here.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Enter the date acquired as Inherited.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"No, they took the worksheet away."

You mean this worksheet?

"click on the Schedule D worksheet, then do the quick zoon to 1099-b worksheet,"

Don't yell at us; we're volunteers