- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Race Discrimination Lawsuit Attorney Fees -where are these recorded on Adjustments to Income Sched 1?

Race Discrimination Lawsuit Attorney Fees -where are these recorded on Adjustments to Income Sched 1?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Client received a $250K race discrimination lawsuit award: $40K backpay; $2K interest, and the rest compensatory/punitive damages. The $40K is W-2 income, with the $210K remainder included on a 1099-Misc box 3, which I recorded on line #8 on Schedule 1. I didn't separate out the interest income.

Her out-of-pocket legal fees of $80K s/b an Adjustment to Income, but I can't figure out how to put it on Sched 1, because there's no 'other adjustment' line. Do I show it on line #8 as a negative (under the $210K lawsuit other income) with the 'UDC attorney fees' description? Or is there another way to get it on 'Adjustments to Income'?

Also, some of those attorney costs were paid as a retainer in 2018, but I didn't deduct them on the 2018 return because we had no income yet and we didn't know what the outcome of the lawsuit would be. Can I deduct all the legal costs in 2019, even if some of the legal fees were paid in 2018?

Thanks for your assistance!

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

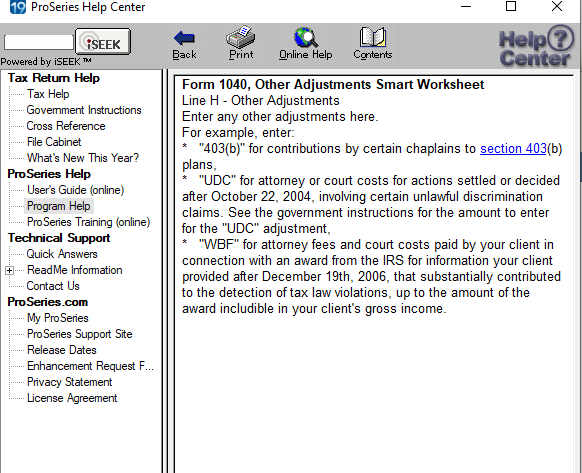

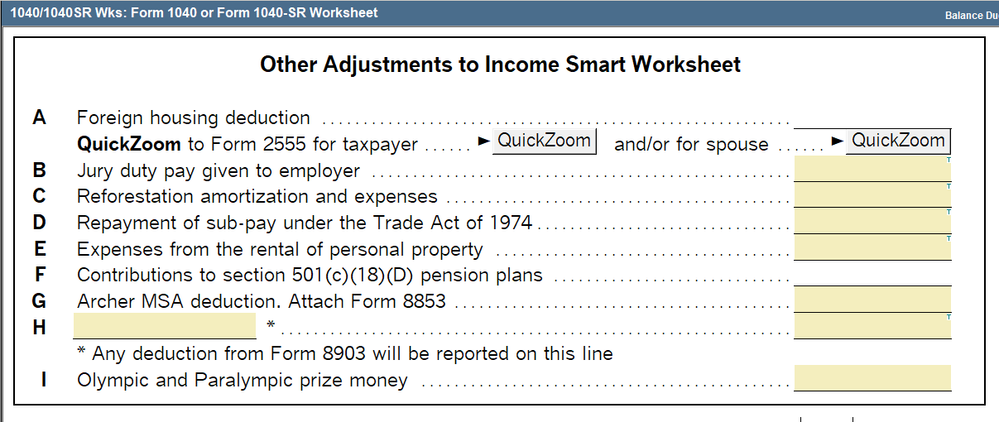

I found this in the Help file for that adjustments to income smart worksheet box... looks like you type it on line Line H

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

from pub 925:

Unlawful Discrimination Claims

You may be able to deduct, as an adjustment to income

on your Schedule 1 (Form 1040 or 1040-SR), or Form

1040-NR, attorney fees and court costs for actions settled

or decided after October 22, 2004, involving a claim of unlawful discrimination, a claim against the U.S. Government, or a claim made under section 1862(b)(3)(A) of the

Social Security Act. However, the amount you can deduct

on your Schedule 1 (Form 1040 or 1040-SR), or Form

1040-NR, is limited to the amount of the judgment or settlement you are including in income for the tax year. See

Pub. 525 for more information.

Also a link to a guide from IRS: https://www.irs.gov/pub/irs-utl/lawsuitesawardssettlements.pdf

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Terry,

Thanks for answering. Yes, I had already read 925 and had determined I could deduct the fees. What I'm asking is how to technically deduct this as an adjustment to income since there is no 'attorney fees' or blank line in the 'Adjustments to Income' tax form. I think I'll just have to show it as a negative in 'Other Income' . . .?

My 2nd question is can I deduct the 2018 retainer fees in 2019 since they are the UDC costs.

Thx!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found this in the Help file for that adjustments to income smart worksheet box... looks like you type it on line Line H

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you! You are amazing! I swear I didn't see a blank line on H before.

What do you think about the 2018 retainer fees being deducted in 2019 when the lawsuit was settled?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"What do you think about the 2018 retainer fees being deducted in 2019 when the lawsuit was settled?"

You would not deduct this in addition, because the prepaid retainer would have been used against the fees incurred in 2019. These would be like a downpayment and held until applied to the total owed by the client.

Or you described it incorrectly here: "some of those attorney costs were paid as a retainer in 2018"

You either pay Fees, or you prepay as a Retainer, to prove to the attorney there will be funds to apply to fees later. If the retainer was applied to anything in 2018, those were 2018 costs.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That's a good question, about the 2018 expenses. First, many "retainers" are deposited to an attorney trust account and not considered paid for fees until billed. All or part might be refundable. Second, the deduction is limited to recovery, and would Congress have intended to allow a deduction only for payments after the case is won? I would see it as more like a start-up expense, or purchase of a depreciable asset not placed in service until a subsequent year. You could try calling IRS three times and pick the best of three different answers.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"or purchase of a depreciable asset"

I think you meant Nondepreciable.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where are you claiming deductions for nondepreciable assets in the year placed in service?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks! That's what I was assuming. The 2018 retainer is a down payment for the 2019 fees, so I can take the total fees in 2019 since none of the 2018 retainer was applied in 2018. I appreciate your help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

I have also benefited from this answer. I was able to record the above line UDC deduction on line H. However, this UDC deduction did not transfer to the NJ-1040, therefore the NJ income is overstated.

Can anyone provide some advice on how to carry this federal deduction to the NJ State return or a work around to solve the overstated income issue?

I look forward to your response!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I didn't see a response regarding how to get the UDC attorney fee deduction included in the NJ State tax forms. Was anyone successful with this? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have you confirmed NJ allows this as deduction?

Don't yell at us; we're volunteers