- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Problem E-Filing Form 1040 with $0 Taxable Income

Problem E-Filing Form 1040 with $0 Taxable Income

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It looks like that I cannot e-file a Form 1040, because the taxable income is $0. However, on this Form 1040, there's earned income from Schedule C and unemployment benefits that are reported. In addition, the return shows a refund due that resulted from EITC, CTC and taxes paid on form 1099-G (unemployment). Can someone shed some light why this return cannot be e-filed just because the AGI has been absorbed by the standard deduction? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, I am aware that e-file season opens on January 29th. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Take a look at Section 4 of Rev. Proc. 2022-12 for what you need to enter for zero AGI filers.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What youve explained shouldnt be an EF issue...run through REVIEW and see what the diagnostics are telling you

Ohhhh, if the withholding exceeds the income on the return, you wont be able to EF the return.....but that doesnt sound like your issue, if Sch C has some earnings and youve got unemployment income as well.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As it stands, the Standard deduction exceeds the AGI by more than $1,500, therefore the taxable income is $0. Using $1 anywhere else on the 1040, as a work around, won't cut it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I believe the software systematically wouldn't accept to e-fille the 1040 (and state return) if the taxable income is $0. This is very odd because there's so many other moving parts, such as EITC, CTC, withholding taxes, refund on the return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Returns with zero taxable income get Efiled all the time, its VERY common for elderly clients taxable income to be reduced to zero with their standard deduction. Its zero AGI returns that have issues. or withholding that exceeds AGI that cannot be EFiled.

Please run through the diagnostics in REVIEW and see what it tells you.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you all for your help. It looks like that the EF error was due to Schedule 8812 and Form 4562, which are part of the return. These two forms are not ready for e-filing until 1/29. My bad - I thought the EF error was due to the $0 taxable income. I will advise next week if the EF error cleared. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good to know, but I made a small error in my reply. I put in the $1 in interest. Since there is not EIN to report I put in XYZ Bank and it goes through. OF course I run it by the client before I send it. The $1 fixes the bug without changing the figures in the return. I have spoken to Proseries in the past re the problem but somehow it hasn't been resolved. Maybe it's on the IRS end.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I still cannot e-file a return which contains a basic Schedule C. I tried to zero-in on the problem. It appears to be Schedule C. I have no clue which forms or schedules cannot be e-filed. This is a basic and simple return. Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

does it have self employed health insurance? I know there's a new form for that this year (7206) that isnt ready yet.

and other returns EF just fine or can you not EF any returns? if you cant EF any returns, be sure youve checked that PTIN verification box in Options > Preparer Info it will create a phantom error that you cant track down.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Form 7206 is not required on the return that I am working on. Somehow, Schedule C (the simplest schedule C) is triggering the e-file problem. The bigger problem is that the software is not telling me which forms or schedules are the cause of the e-file problem.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Again, youve went to Options > Preparer Info and made sure that PTIN Verification box is checked? If not, it creates a phantom error that doesnt point to the problem.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No problem with PTIN and the software is up to date.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There’s likely an issue with Schedule C. Many Turbo Tax users have reported this problem on the internet. Intuit has yet to address the Schedule C issues and fix them.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client who isn't claiming any self-employment health insurance expense / deduction, and I still get the form 7206 error when going through the error checking. If form 7206 isn't necessary for the tax return, I don't know whey the error checking has to hold the tax return hostage.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

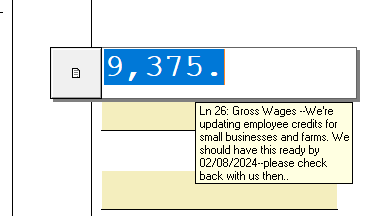

So I just entered wages on a Sch C and saw a note popup about a delay on this form, so if you have wages on Sch C, theres nothing you can do but wait.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪