- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: PPP Loan Forgiveness

PPP Loan Forgiveness

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How has everyone been handling the statement required in Rev Proc 2021-48?

Where are you entering it in pro series or are you attaching a pdf statement? Would like to be able to complete some of the corporate returns.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can you tell me where on schedule C it is

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Found it

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I can not find it for the 1120'S if anyone knows where it is or can direct me please respond.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

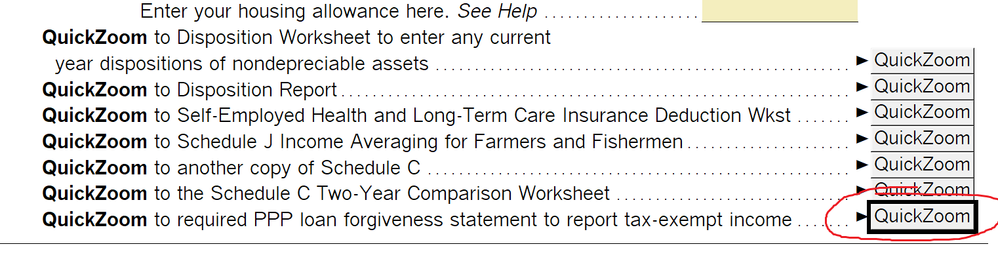

Sch C is here

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks I was able to find it on the C still can't find it on 1120S. Any help would be appreciated

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found it on the C not the Sub S. Sorry

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ive asked a Moderator if she can track down its location.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have only read that it applies to schedule C of form 1040. I have not read anywhere where it applies to any other type of entity. We will have to wait and see. Just my opinion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It was in the Draft 1120S Instructions.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

someone pointed it out in FB forum group.

Pg 34 L16B 1120S instructions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just received Kiplinger tax letter. In regards to this, it says to see instructions for form 1040, 1065, 1120, or 1120s. Based on that, it appears it applies then to these entities. Just my opinion.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@garman22 a little puzzling that they ask for that information, considering that the federal government was the one that issued and forgave the PPP loans. Could they not get that information from themselves? Also since it is not taxable, one must ask why are they asking for information on it? I can only surmise that they may use that for examination purposes, but I am not sure . Also if someone does not have an accountant, and forgets to attach it to the return, what would the penalty be since it does not have an effect on the returns taxes? Just wondering and just asking and as you know just my opinion....Have to take the dog out now in this frigid DARN weather, hopefully that doesn't get bleeped out like the word I said yesterday, which I didn't even think was a swear word: A dam is a concrete structure used to hold water back.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@PATAX wrote:

Also since it is not taxable, one must ask why are they asking for information on it?

The options determine (1) when the Basis is added for shareholders and partners, and (2) for purposes of §448(c) for the $25+ million threshold.

So actually, it can be much more important for S-corporations and Partnerships because that determines when they get Basis from the tax-exempt income.

I would think it would be rather unusual for Schedule C to worry about the the §448(c) threshold of $25+ million, and Schedule Cs don't need to worry about Basis, so that seem rather pointless for a Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@TaxGuyBill 👍thanks for that excellent information.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I miss my dogs......enjoy the cold a$$ weather with them while you can!!

@TaxGuyBill brings up a good point. I dont have to worry about 25+ million for anyone. Im sure some do tho. I read somewhere last year that if you can reasonably expect forgiveness, include in the year received.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@garman22 👍 you're right, I do not think there are too many of us that use Pro Series and have 25 million dollar plus client... I think the big CPA firms use a different software or have in-house software... If you want to get yourself a dog, then do yourself a favor and get a German Shepherd. Believe me when I tell you, this is the best dog that God ever created. Their intelligence is unbelievable. They are fiercely loyal. They are kind when they have to be, and mean when they have to be. They are also obedient, disciplined, and regimental . People cannot believe it when I tell them that Heidi has never bit, scratched, or destroyed anything in the house, never....I hope she does not catch this coronavirus that I have, so I have been doubling up on her vitamins too.....🐕☝

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@PATAX wrote:

@garman22 👍 you're right, I do not think there are too many of us that use Pro Series and have 25 million dollar plus client... I think the big CPA firms use a different software or have in-house software... If you want to get yourself a dog, then do yourself a favor and get a German Shepherd. Believe me when I tell you, this is the best dog that God ever created. Their intelligence is unbelievable. They are fiercely loyal. They are kind when they have to be, and mean when they have to be. They are also obedient, disciplined, and regimental . People cannot believe it when I tell them that Heidi has never bit, scratched, or destroyed anything in the house, never....I hope she does not catch this coronavirus that I have, so I have been doubling up on her vitamins too.....🐕☝

I do like Shepherds a lot. My neighbor had one that was SUPER intelligent and obedient. His dog was intimidating and I usually show no fear around any dog. My wifes family has dobermans and her cousin has one. I was a little hesitant to meet him (I grew up in the early 80's and dobies/rotties were the "IT" dog), her cousins dog is AWESOME!! I fell in love with him almost immediately.

My breed has been Boxers. My first was fierce and never showed any fear in any situation. My 2nd was a clown and was more of a beta/omega dog but was maybe my favorite as he liked to talk ALL the time! My third was female and a lover. I lost her in 2020. All three had unique personalities.

I married 5 years ago to a woman who is fiercely allergic. She is currently seeing an allergist in hope she can get her allergies under control. IF she can, I want a Cane Corso and she would love a doberman. I know there are hypos but for the most part they are little dogs.

"A house is not a house without a dog in it" - unknown.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I've got clients with PPP2 loans that have not applied for forgiveness yet. So yes this can be an item for 2022 tax returns, too. (Assuming they don't decide treat as forgiven in 2021.)

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

PPP loans forgiven should be added to AGI for purposes of arriving at MAGI. So maybe that is why the government is asking for something that is readily available here:

https://projects.propublica.org/coronavirus/bailouts/search?q=%22%22

At least this is something we can look up for clients.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@taxiowa thanks a million for that link.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@taxiowa wrote:

PPP loans forgiven should be added to AGI for purposes of arriving at MAGI.

MAGI for what purpose? It will not be added to MAGI for most (maybe all?) purposes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am confused, which doesn't take much these days. This is what the statement is printing for a Schedule C:

Applying section 3.01(3) of Rev. Proc. 2021-49 for taxable year 2021.

Shouldn't that read "Rev. Proc. 2021-48" or am I missing something?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The statement also applies to Sch F flyers. Same area as on the Sch C to fill in the attactment Also on the last Kiplinger Tax Letter it says see instructions for Form 1040 (self-employed individuals) which includes Sch F farmers.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Happy day...you probably already found this:

1065 -Pg 4, Line 18a, is a Quickzoom button for the PPP loan forgiveness statement

1120-S - Sch K, just below line 16B, is a Quickzoom button for the PPP loan forgiveness statement

1120 - Bottom of Pg 2 is a Quickzoom

1040 Sch C - look for the questions at the top of the form...the last is a Quickzoom to the PPP