- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: No IRS Continuing Education Credits for Intuit's 2 Day "Tax Season Readiness" Conference

No IRS Continuing Education Credits for Intuit's 2 Day "Tax Season Readiness" Conference

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

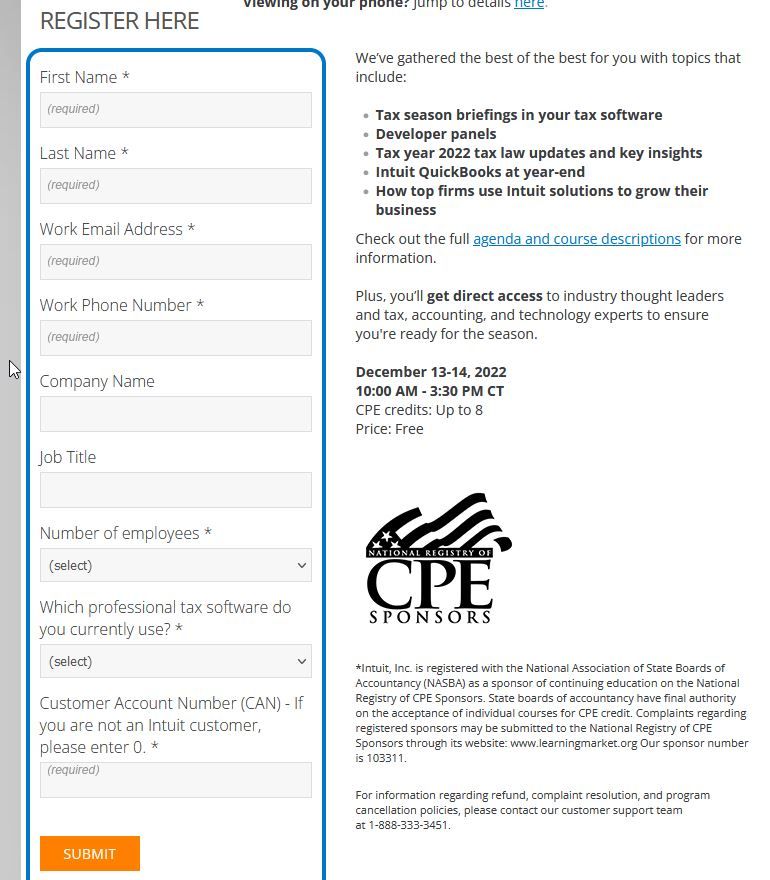

I was curious, and I looked at the post for the 2-day "Tax Season Readiness" classes.

If you go the registration screen it does NOT ask for a PTIN. That seemingly indicates that even though Intuit is advertising that you get up to 8 free CPE, that CPE does NOT qualify for the IRS.

I wonder how many annoyed tax preparers there will be that THOUGHT they were going to get CPE for towards the IRS, then later realize they get nothing.

After looking at the titles of the classes, I guess it makes sense. It seems like most of the "classes" are mostly advertising Intuit products, which would not qualify for CPE for the IRS.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Intuit is advertising that you get up to 8 free CPE, that CPE does NOT qualify for the IRS"

That's why it's free. If it was worth something, they would charge you for it 😁

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For CE and CPE credits, you can use the labels on the event page as filters.

All events can be seen here on the training site: https://proconnect.intuit.com/training/

The virtual conference has speakers from all departments of Intuit, we're excited to kick off the new year! Here's some time slots that might interest you:

Day 1

10:00-10:20 Day 1 Opening Keynote from Jasen Stine, Intuit’s Training and Education Leader for the Tax and Accounting Profession

10:30-11:30 Tax Season Briefing with Lacerte

10:30-11:30 Tax Season Briefing with ProConnect Tax

10:30-11:30 Tax Season Briefing with ProSeries

1:10-2:10 Your Top Questions in Lacerte

1:10-2:10 Your Top Questions in ProConnect Tax

1:10-2:10 Your Top Questions in ProSeries

2:15-3:15 Lacerte and ProConnect Tax Developer Panel

2:15-3:15 ProSeries Developer Panel

Day 2

10:00-10:20 Road Trip with Renee Daggett, CEO of AdminBooks

10:30-11:30 Tax Year 2022- Tax Law Update & Key Insights

2:15-3:15 Today's Threats and How to Protect Your Firm

3:20-3:40 Shift Your Mindset For The Upcoming Busy Season

Check out the full agenda and course descriptions for more information.

{editing to add that I'll look into how credits for this conference works, thanks!}

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Gabi, both of the posts that you posted say "earn CPE credits". The registration page says "CPE credits: Up to 8".

So it seemingly may give CPE to CPA, but NOT to those who need CPE for the IRS (Enrolled Agents and whatever the other certificate registration thingy is called).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The rest of us need CE

There are 7 courses here https://proconnect.intuit.com/training/professional-webinars/

4 offer CE.

I use CPAacadamy Pick your time zone, profession (or ethics) and ZOILA! there are several CE courses

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@George4Tacks wrote:

The rest of us need CE

Ah, you are right.

I think most education providers just call it CPE (see links below) because most classes cover both, but you are right, the IRS just calls it CE.

https://www.natptax.com/EventsAndEducation/eEducation/packages/Pages/default.aspx

https://checkpointlearning.thomsonreuters.com/CPE-Packages/Compare-CPE-Subscriptions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Would reccomend Natp.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have some more details, hope this helps:

CE credits are available for

Day 1

CPE: 1

CE: 1 --

10:30-11:30 Tax Season Briefing with Lacerte

10:30-11:30 Tax Season Briefing with ProConnect Tax

10:30-11:30 Tax Season Briefing with ProSeries

Day 2

CPE: 1

CE: 1 --

10:30-11:30 Tax Year 2022- Tax Law Update & Key Insights

Here's the full breakdown for credits for the virtual conference Dec 13-14 2022:

Day 1

CPE: 1

CE: 1 --

10:30-11:30 Tax Season Briefing with Lacerte

10:30-11:30 Tax Season Briefing with ProConnect Tax

10:30-11:30 Tax Season Briefing with ProSeries

CPE: 1 --

11:50-12:50 QuickBooks Desktop at Year End

11:50-12:50 QuickBooks Online at Year End

CPE: 1 --

1:10-2:10 Your Top Questions in Lacerte

1:10-2:10 Your Top Questions in ProConnect Tax

1:10-2:10 Your Top Questions in ProSeries

CPE: 1 --

2:15-3:15 Lacerte and ProConnect Tax Developer Panel

2:15-3:15 ProSeries Developer Panel

Day 2

CPE: 1

CE: 1 --

10:30-11:30 Tax Year 2022- Tax Law Update & Key Insights

CPE: 1 --

11:50-12:50 Implementing and Communicating Tax Savings Strategies During Tax Season

CPE: 1 --

1:10-2:10 Intuit Solutions Showcase

CPE: 1 --

2:15-3:15 Today's Threats and How to Protect Your Firm

The virtual conference portal stays open for 90 days after the event where you can download certificates.

If it's passed the 90 days, you can email PCGTraining@intuit.com to retrieve certificates.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How can Intuit offer CE if it doesn't ask for a PTIN?

The registration for the other programs (which give CE) ask for your PTIN to receive credit. But this doesn't.

Personally, I'm not interested because most of Intuit's presentations are just advertisements. But things don't seem right for those who want credit.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

PTIN is required:

In the presentation, there is a toggle to Update your PTIN

At the end of the presentation, there is a survey and the Certificate is e-mailed from pcgtraining@training.intuit.com

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, that registration page is precisely my point. Although the other "classes" have the entry for PTIN, the "Tax Season Readiness" one that I am talking about does NOT have that.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The conference offers CPE credits, NOT CE credits.

PTIN would be required for CE Credits.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, you had corrected me on the CE versus CPE earlier in post, but then Gabi came back and stated that some CE is available (see her post earlier). But without asking for a PTIN, that won't happen.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you have hiccups receiving the credits you earned, please private message me or reach out to PCGTraining@intuit.com and we'll figure out next steps.