- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: LLC Amendment

LLC Amendment

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

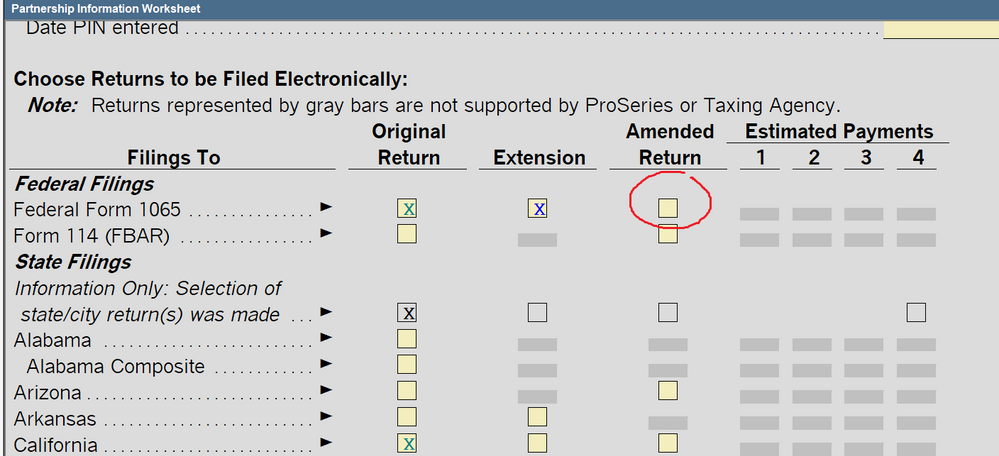

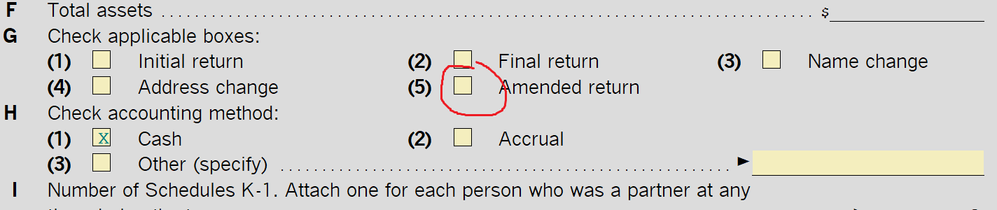

Sorry to ask again. But a coleague cpa told me that partnership returns cannot be amended. I know how to file amendments. I was surprised that I could not amend partnership returns for years 2019 and forward.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

First bit of advice - stop listening to that CPA.

Go ahead and amend - you are allowed to do that.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

partnership returns can be amended...not sure where they got that idea.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think that coleague cpa's are trained in barbershop roundtables, unlike colleague cpa's.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This applies to federal as well?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Partnership returns cannot be amended if the partnership is subject to the Consolidated Audit Procedures. Instead, these returns need to go thru the Administrative Adjustment process - which is not fun.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Depends on your client base. Most of mine are not eligible to elect out.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Sorry to ask again."

Yes, you already had this running and were getting help. I marked that one to be deleted, so that people don't start answering on both topics for the same issue, not knowing you are also already being helped.

Just keep updating this one for that same issue; no need to start again and again. Thanks.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Since your other post indicates this is for a 2020 return, is there an extension?

If yes you can file a superseding return.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for the suggestions on the LLC amendment.

There was no extension because it was a short year return and we had not filed the extension in May 2020.

I actually efiled it as an amendment and it was accepted. Fortunately, there is no $ value change, only a member change.

Hoping there won't be letters from IRS.

Learned a lot during this process.

Thank you to the community.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That was not the issue.

"IRS no longer accepts LLC amendments unless the LLC had "elected out of the centralized partnership audit regime under section 6221(b)".

States are ok for amendments.

There is another choice using an administrative adjustment filing.

Anyway, I was able to efile the amendment; hopefully as there was no $ change; it'll be accepted. If not we have the back up for the reasons.

Thank you!