- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: IRIS for TCC - HELP?!

IRIS for TCC - HELP?!

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have an e-services e-filing account online with the IRS (even tho I use ProSeries for all my tax e-service filings) and see there is a new portal for free e-filing 1099s for clients, but am totally mystified at how to sign up for it. I click on the "Access IRIS Application for TCC" on the IRS site, it takes me to my IRS efile business services account but gives no clues where to find the application to fill out so I can add that service to my account. I only have "e-file" in my services and you need TSS to access that portal. I opened the video the supposedly gives instructions but that was no help.

Been on hold interminably calling the IRS tax professionals number for guidance. Sigh. I know, understaffed, but adding new services we really need without tech support to help us do it?? 1099s are due in a matter of weeks and knowing I COULD do it electronically for free through my e-services account rather than making clients pay or me doing it on paper is more than a bit frustrating!

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm waiting until next year to see how this year goes. You might try starting here:

https://www.irs.gov/filing/e-file-forms-1099-with-iris

and going through the application instructions. I read somewhere last month that it may take the IRS up to 45 days to process the applications (which may make it pretty useless this year), not sure how much truth is in that but time will tell.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm waiting until next year to see how this year goes. You might try starting here:

https://www.irs.gov/filing/e-file-forms-1099-with-iris

and going through the application instructions. I read somewhere last month that it may take the IRS up to 45 days to process the applications (which may make it pretty useless this year), not sure how much truth is in that but time will tell.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Oh lovely. Since they are due January 31 and everything takes forever with the IRS, I guess I may bag it and make my clients pay the online fee for an outside service again and work on adding this to my IRS services file for next year. But I will check out the link you gave, in case it gives me better help than the official IRS link from within my e-services account did.

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yeah, after I click the button from that link that takes me here,

https://www.irs.gov/tax-professionals/iris-application-for-tcc

the application button just takes me to my IRS e-services account, which is a dead end. I think I may try to call them one more time before tax season really hits but otherwise, like you - wait and see until next year!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No harm in giving registration a try but don't promise anyone anything. 🙂

Even if it's the greatest thing since sliced bread, the employer still has to get recipient copies out. IMO that's the best perk of the online shops. Enter your data, enter your credit card, done. They submit to IRS and mail out recipient copies.

I have a handful of small business clients who literally only issue one 1099-NEC per year, and that's to me. For them this would be great, no mailing, I just shred them anyway. 🙂

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Oh true. Having to still manually send out client 1099s does make the online shops much easier. Yeah, I think I will give up on the IRS this year and just stick with the online shops. I'm all about EASY.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good idea to wait so if any bugs can get flushed out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm not an accountant but need to file a 1099 for a consultant we used, and came across IRIS.

I applied for a TCC yesterday for our EIN, and the application was completed and I can see the code online today.

It looks like the system doesn't go live until tomorrow though.

How ordinary small businesses went through the business of generating 1099's seemed mysterious to me, but it seems like people can DIY now online which seems like a pretty big deal. Is it?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

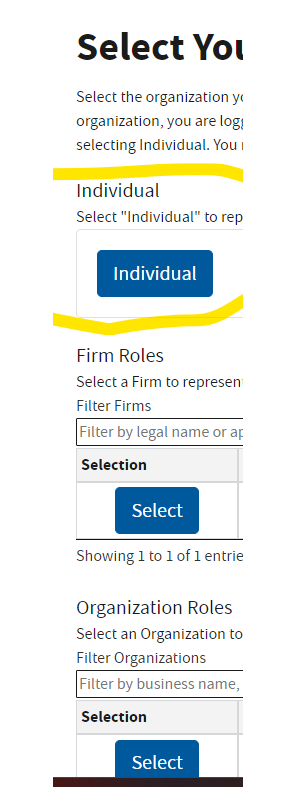

I was in this same oodaloop!! However, I did figure it out. Once you have signed into eservices using your ID.me, you will see "Select your Organization" and potentially several different options. I had 3. Do not pick either of the ones that actually have your name or business associated. While it makes sense to select these, this will only take you to your completed applications. Select the first one, Individual, and it will take you to the miraculous, New application drop down option. YAY!! I just finished mine. I did use an incognito window simply because sometimes Cookies are bad lol

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ohhh!!! Now that makes perfect sense as to why I was in a loop going nowhere! That option never occurred to me, because wanted to set it up under my business.

Thank you SO MUCH for this update. I think I will sign up so it will be ready to go next year but probably won't use it this season as I've been making non-QB clients pay for the 3rd party e-file services.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I submitted my application on 12/30/22 and received my TCC's on 01/05/23.

You can check the status of to see when it's completed by going back to your eservices account under the application you submitted. Once it reads completed, you can drill down into the IRIS application to see the TCC's issued.

The IRS IRIS contact number is very helpful - they answer right away and agents are very knowledgeable.

I was told the 45 day issuance has to do with how long it might take to receive your TCC's in the mail.

Now just waiting for them to open the portal!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am so discouraged with this IRIS....applied and received code but it has been a nightmare trying to login. Once I login it keeps saying the IRIS system is down and won't be ready until January 10th....I tried again today which according to my calendar is January 10th and it still says it is down for maintenance.

Am I doing something wrong? January 31 is approaching quickly and I have a pile of 1099s to prepare for my clients.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi @bheizer

I would wait patiently...they will open it up but it might not be Jan 10th. 2023 was the first year this rolled out and it opened up a week or so later that published. It beats paying for the forms, or a 3rd party site to do these. Stay hopeful!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I was finally able to get on the to taxpayer portal.....But a couple issues and wondering if anyone else having the same problems???

1. When I enter the info for my client's 1099s and get to final page to proof, it automatically puts my business name on the second payer's line and for some reason its is putting my son's name and his phone number....I'm having to go back and edit and delete that info on each 1099.

2. I can't figure out how to print 1099 to send to recipient. It downloads to a zip file and my computer says it can open the file.

Any suggestions/help would be greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@bheizer wrote:

I was finally able to get on the to taxpayer portal.....But a couple issues and wondering if anyone else having the same problems???

1. When I enter the info for my client's 1099s and get to final page to proof, it automatically puts my business name on the second payer's line and for some reason its is putting my son's name and his phone number....I'm having to go back and edit and delete that info on each 1099.

2. I can't figure out how to print 1099 to send to recipient. It downloads to a zip file and my computer says it can open the file.

Any suggestions/help would be greatly appreciated.

Are you setting up the client (issuer) in "Issuer Management" first? If not, you'll likely want to do that. Then when you "Start New Form" you'll select that Issuer from the drop down on the Payer Information screen. If that's already your process there could be something buggy. I've only done one test run with myself as issuer so I don't know if I'll have the same problem when I go to set up another client.

.zip files are fairly generic at this point. Windows help might get you where you need to be. File explorer can natively do some things but I've found it way too limiting to be very useful. You might look into downloading WinZip or BreeZip or the original PKZip. There are probably dozens with various bells and whistles (which you likely don't need if your only requirement is to uncompress a zip file).

I'll try entering a client one and see what I can figure out.

UPDATE: When I click on "Add Issuer" I just get a page that says "Loading..." I've tried both Chrome and Firefox with no success. Guess maybe their system is not quite ready yet . . .

UPDATE2: For good measure, I also tried Edge with no success.

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, I did not realize you could set up client issurer....so glad you told me....will check it out. I was finally able to get the other problem straightened out with it automatically filling in the blanks with wrong info. Not sure how but it finally quit..

Still not able to open the zip file. I downloaded to documents but it still won't allow me to open. Still working on that.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@bheizer wrote:

No, I did not realize you could set up client issurer....so glad you told me....will check it out. I was finally able to get the other problem straightened out with it automatically filling in the blanks with wrong info. Not sure how but it finally quit..

Still not able to open the zip file. I downloaded to documents but it still won't allow me to open. Still working on that.

Maybe try generating the zip file again from the IRIS site? Someone on another list posted suggesting their zip file was corrupted (no data in it) so maybe the zip creator on the IRIS site was glitching earlier in the day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you have a FIRE TCC# it can be as quick as a week to process to get a new IRIS #. It never hurts to apply.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Found the IRIS Issuer and I entered infor for one client but when I clicked the add another one it won't let me....anyone else having this issue?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apparently I am still missing something because even when I click the individual button, I do not get an option for new application? Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I was just able to add a second name to issue management....didn't try for anymore at this time but maybe its up and running...

I have prepared over 120 1099s so far for my clients but have not submitted any.....I try and wait until the last minute in case any corrections come in. Just wondering if when I submit all of them at once will the system be able to handle them?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where are you seeing the TCC numbers online in your completed TCC application? Mine went to complete back on 1/9 but I still don't have it and I have scoured the irs site for it to no avail.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On the Application Summary screen, under TCC information, it should be listed under the column TCC.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Here is a link to the IRS instructions - includes applying for the TCC and processing 1099's.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where did you find your TCC in your application? I can't find mine anywhere and I can't get anybody to answer the phone at the IRS!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On the Application Summary screen, under TCC information, it should be listed under the column TCC.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

https://www.irs.gov/tax-professionals/iris-application-for-tcc

"Access IRIS Application for TCC"

Select the organization you applied the TCC under - It should say "IRIS TCC" under the Application Type".

It will then list the organization's application - click on the "eye" under View/Edit.

Go down to the bottom of the page under "TCC Information" and it will show the TCC code - mine is 5 alpha-numeric digits.

If your application status at the upper right of the page does not say "Completed" - it is still in the process of being issued.

This is the IRIS help line: 866-937-4130

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good luck in getting through to the help line. I have tried several times and you either get disconnected after two hours on hold or they tell you that you will have to call back another day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

nancypnow this worked perfectly and the advice about using the incognito window was critical. Until I did that, the "New Application" button wouldn't even appear. So thank you and for anyone else trying to do the TCC application, I highly recommend using an incognito window and following these instructions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Private browsing window in Firefox allowed me to see more options. Thanks nancypnow!!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The real question is "Why doesn't Proseries have a 1099 option?" . If they are our clients, we do their business returns, therefore the software has all of the payer information. Wouldn't it be nice to just have an "Add 1099 recipients" worksheet, then be able to efile the 1099s?