- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Generating 8582 for Rental with loss

Generating 8582 for Rental with loss

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

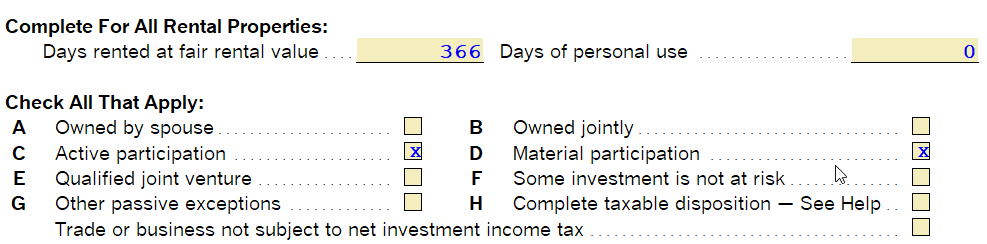

I have a client with a rental that they had a loss of 54,698. I am trying to generate an 8582 to limit the amount of Passive Activity Loss to 25,000 so that it will flow over to 8995, and create a carryforward QBI deduction. I previously used Lacerte, now using Pro Series, I think there is a box I am missing but I cannot figure it out. I calculated it the old fashioned way with pencil and paper and know this is how it needs to be filed. There must be a box in the software I am missing. (I used Lacerte previously and am new to Pro Series)

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If a rental, it's the Active Participation Box on Sech E worksheet

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@cera smile wrote:I am trying to generate an 8582 to limit the amount of Passive Activity Loss to 25,000

Are you saying it is currently allowing the ENTIRE loss, rather than just $25,000?

As a side note, a $54,000 loss for one year is extremely large, so you may want to verify that is correct and that something like depreciable improvements are not being deducted.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, it is trying to report the ENTIRE amount. The loss is because it is a complex of cabins, many of which had to be completely remodeled (first year owning this property).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Were these units that were undergoing "major" remodeling actually available for rent?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

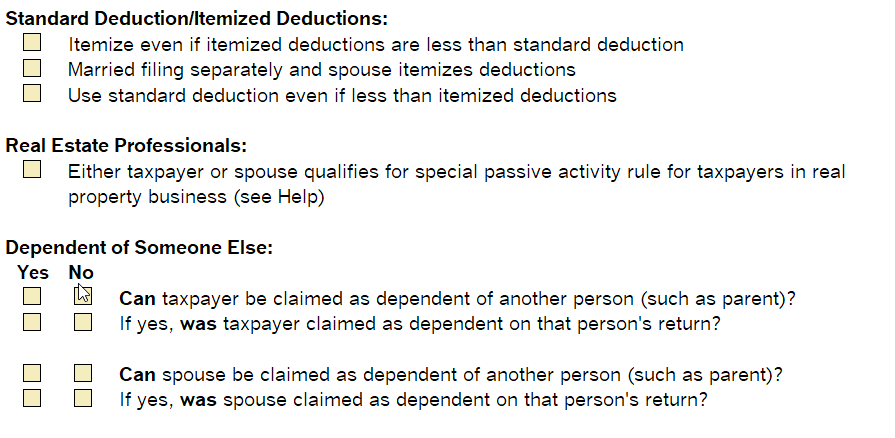

- Are you reporting this on the Schedule E worksheet?

- Is there other passive income on the tax return?

- Are there any personal days?

- Is Box G or H checked?

- On the "Info Wks" (the first sheet where you enter the taxpayer's name, SSN, etc.), scroll about 80% down, and check that the Real Estate Professional box is NOT checked.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The only other "income" is another rental which had a loss of about 2000. Yes they were available for rent part of the year, once the repairs were done.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

they were available for rent part of the year, once the repairs were done.

OK... but were they "available for rent" while they were being renovated? It can be an important distinction that you need to consider.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, exactly except joint ownership

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes. They were once repairs were made.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK, one more time then I give up:

WERE they AVAILABLE *while* the renovations were being done? NOT - were they available after the renovations were done.

If the units were NOT available while the extensive renovations were being done, then it is very possible the costs incurred during that time are NOT immediately deductible.

You need to do research on whether this applies in your client's situation, depending on the specific facts & circumstances.

As Bill pointed out, $45000 in 'repairs' is a large amount in most cases (even here in pricy CA).

And can we assume you are familiar the the TPR's (Tangible Propery Regs) that came out few years ago?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does this qualify for the $25k exception? Residential rental or transient lodging?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hmmmm. I'm puzzled why it is allowing the entire loss.

Just to triple-check ... Line 22 of Schedule E is showing the entire $54,000-ish loss, right?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, that is the problem. Like I said, I even printed and did it all paper and pencil and I KNOW it should be limited to 25,000 for that property.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, familiar. I will research that more in depth. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm having the same problem, ProSeries is incorrectly carrying forward the entire loss rather than the $25,000 limitation. Did you ever figure out how to correct this?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The $ 25000 limitation is the amount 'possibly' deductible in a given year.

The carryover is not limited to $ 25000. The carryover is the entire amount of cumulative losses.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sorry, I shouldn't have used the term carryover or carry forward, that was misleading - let me explain it another way:

Client has a $35,000 rental loss. Client is not a real estate pro, so he can only deduct $25,000 of the loss. ProSeries correctly shows a $25,000 loss on Part III of 8582, but incorrectly shows a $35,000 loss on page 1. This is a 1041 return, first year, so no carryover issues, and no other passive income.