- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: FORM 5695

FORM 5695

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

One of my client spend 15000 for hot water boiler. Where do i enter the amount? I entered in 22b and only $150 credit generated by proseries in line 32 and no change in the refund. Did i anything wrong?

GK

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@gk this thread is pretty long, what kind of energy improvement did your client install so I can find my way to the right section?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just tried to look for you and while attempting to access the HELP window for the lines on the 5695 to verify what belonged on which line, the program crashed and closed down, so thats a great start to Monday morning.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Restarted the program, seems to be working now. Reading the 5695 instructions, page 3, $150 appears to be the the correct amount, but is it a non-refundable credit?.

Have you looked at the actual tax return (not just the refund meter) and followed the money to see how the credit gets applied?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A hot water boiler is a fancy name for furnace. A few folks in the Chicago area wished they had a new $15,000 system to keep their Tesla's warm a week or so ago.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We ran into the single digits for highs and negative double digits for lows for roughly the same period as you had your chilly spell. First time it got that cold this winter, but that was pretty mellow for us for this time of year.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think a good part of the country got banged around with this cold. We had it pretty good for December but Mother Nature was just saving her sh-t up before smacking us around.

Im done with Winter now, please.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As someone who lives and works in the village right next to where the Tesla fiasco occurred, I can only say thank goodness for my gasoline powered car.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I believe I heard on the radio that a major Rent-a-Car company has plans on doing away with its Fleet of electric vehicles. And I also thought that I heard on the radio that car dealerships have excess electric car inventory piling up. That's not going to make the politically correct crowd too happy.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have the same issue - the $150 credit is there - it's on Schedule 3 - it even subtracts properly on page 2 of the return - but then it goes off

The total tax is $7,094 - total credits (including the $150) is $1,795 - leaving the tax liability at $5,299 - but according to Pro Series - if you subtract $5,299 from the withholding of $8,818 you get $3,369, not $3,519

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Interesting.......I can honestly say I have not looked at the program too much, which is to say hardly at all. Is the 5695 even ready to go?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

gas power for the win!!

I heard that the Teslas were piling up all over the place as the stations could not keep up with the demand. I for one will NOT join the Electric Car lines...................nvr really crossed my mind honesty.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Agree with you

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have the same issue. i saw the amount in sch 3 and there is no change in the refund? it goes away. how to resolve this.

Gracemon

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

i saw the amount in sch 3 and there is no change in the refund? it goes away. how to resolve this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

ANY SOLUTIONS YET?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

ANY SOLUTION REG FORM 5695 CALCULATION. ANY UPDATE.

GK

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@gk wrote:

ANY SOLUTION REG FORM 5695 CALCULATION. ANY UPDATE.

Yes. The solution is to wait until ProSeries has the form ready. Currently, it is scheduled for February 7th. However, because the IRS Instructions are not final yet, it seems likely that date will be delayed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's 2/7/24 Where's the update to From 5695 in Proseries?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is nothing. I checked today morning too.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

the day is not over ppl. Tomorrow we can cry to the high heavens.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

I see the updated form today however it is NOT generating any credit. Is this only my issue or you guys also experiencing the same issue. Pls reply

GK

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is working fine for me. Assuming you did the update, would need more info before trying to figure out why it isn't working for you. Do you have the correct boxes checked? Is there a tax liability?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

client has refund. kindly advise the lines to be checked off

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am having a similar issue with 5695. Client is entitled to 2,000 credit for a biomass stove and the 2,000 amount appears on line 30 but does not carry down to line 32 despite client having a tax liability. I feel like the credit computation worksheet is not working correctly.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

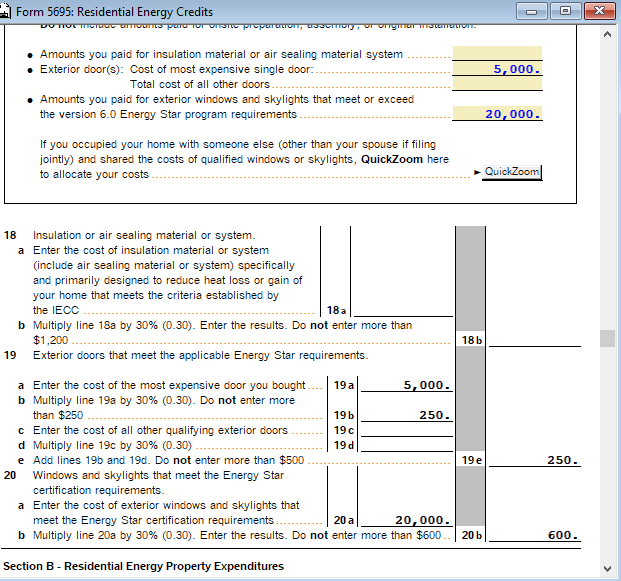

I have a problem with Qualified Energy Efficiency Improvement worksheet. I entered the amount there but Amount is not flowing to 18a-20b. How do we fix that.

GK

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Jeff13 seems to work ok for me here, the first time I did it, something weird happened and the page jumped and the credit wouldn't flow, I deleted everything and started over, I marked those 2 boxes 21a and 21b, then scrolled down and put the $$ in the smart worksheet for the biomass stove, then everything seemed to flow, and the $2000 landed on Sch 3.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

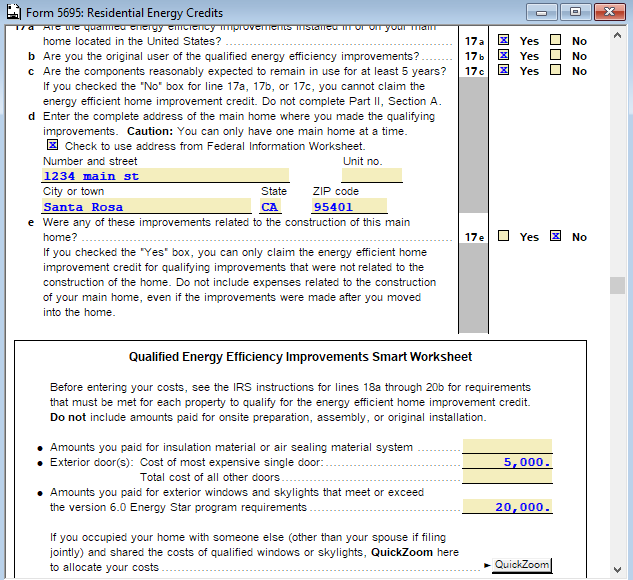

@gk did you mark the boxes up at Line 17 and enter the property address?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes i did from 17 a- e.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Theres a lot of extra checkboxes this year, and they dont light up as being required to be filled in...annoying!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Lisa,

I still have issue, there is NO amount flowing to 18a-20b. I checked 17a-e and 21a-b. Could you kindly advise?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@gk this thread is pretty long, what kind of energy improvement did your client install so I can find my way to the right section?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Client put new doors and windows for $24514.00. Please help

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Seems to flow fine for me, you might want to delete the form and start over from scratch. I just marked the boxes at Line 17, then plugged the dollar amounts in the smart worksheet above Line 18 and the figures flowed fine

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪