- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Claiming College tuition

Claiming College tuition

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client that has paid his daughter college tuition but he does not claim the child on his tax return. Can he receive the credit for the college tuition he paid?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, you cannot claim an education credit for a non-dependent.

In order for you to claim an education credit, the student must be a dependent on your tax return.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No child will have claim it in their return. Child would need to be a dependent and full time student and under 24 years of age

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

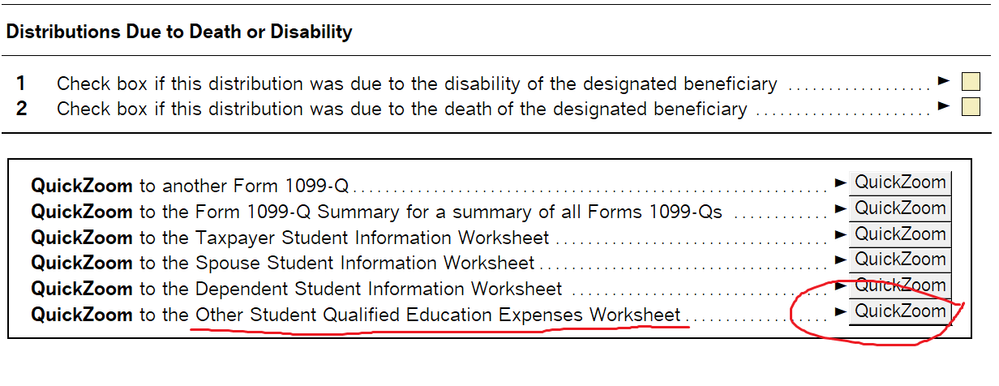

If you look at the worksheet where there is the Q indicate that you could claim the credit for the tuition

and the child not being a qualified dependent but when you go into the program, it will not give you the credit because as you said it has to be a dependent. Thank you for your time. Bettie

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Q, you mean the 1099Q? At the bottom of the 1099Q is a place for Other person

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

or do you mean on the dependent worksheet Code Q?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If there is another parent who is claiming the student, then that parent can claim the education credit even though the other parent actually paid those expenses.