- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Business Activity Code 611610

Business Activity Code 611610

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

UPDATE - Code 611610 and 791100 work on 1065 and Sch C. Does NOT work on 1120 and 1120S. If it was a code error, it wouldn't work for some and not for others.

Dance Studio clients who have used 611610 as the Business Activity code receiving error that the code is invalid for 2022. This code has been used for 10+ years and IRS codes have not changed. Pro Series is saying I need to pick from their "list" of business activity codes, yet none apply appropriately. The 711 series available is not even close to their activity description.

Anyone else have this problem and what is your fix?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

NAICS has this for dance studios

https://www.naics.com/sic-industry-description/?code=7911

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@jennisbsvb wrote:

611610 as the Business Activity code

IRS codes have not changed.

As far as I can tell, that code has NEVER been part of the IRS codes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for the reply, the 7911- series gives an error also.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for the reply, the 7911- series gives an error also.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have you looked at the list in the Instructions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

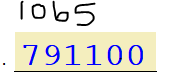

I just opened a dummy return, and put the 791100 bus code into the box on Sch C, no error.

Is thisa Sch C? or a different entity type?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

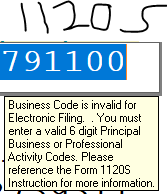

It is an Scorp. I pulled over another client Scorp dance studio and received the same error.

Both 791100 and 611610 work just fine on a Sch C and Partnership.

Does not work on 1120S or 1120.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

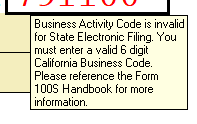

It is a state error?

I dont get an error on the federal 1120S for that 791100 number, but California sure doesn't like it! The error says to reference the 100S handbook

WTH is a 100S handbook?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK, the handbook is the instructions booklet, the closest Im seeing in the instructions booklet is Performing Arts Companies 711100

These are really only used for statistical purposes, I dont know why they have to make it so hard.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

True, but they don't even come close to a Dance Company and true it's for statistics but I am hesitant to use a code that is wrong. And since it works on other types of returns, I know it's not the code that is wrong.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@jennisbsvb wrote:

but I am hesitant to use a code that is wrong. And since it works on other types of returns, I know it's not the code that is wrong.

Why are you refusing to look at the Instructions? They have a list of the IRS codes. The codes you have mentioned are NOT on the list, so they are invalid codes.

So really, the problem may be the Schedule C and 1065s are incorrectly not giving you an error code, because you are entering a number that is not on the list in the Instructions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Having a similar problem, no good fix. Type 990 would not allow the prior used business code 900002 on screen 18. Deleting removed the critical diagnostic for efliling..

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Lexi Conn wrote:

Having a similar problem, no good fix. Type 990 would not allow the prior used business code 900002 on screen 18. Deleting removed the critical diagnostic for efliling..

Where do you see that code in the list of codes in the IRS instructions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi, the botom right corner- last on the list.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Lexi Conn wrote:

Hi, the botom right corner- last on the list.

https://www.irs.gov/pub/irs-soi/18pf_business_codes.pdf

Sorry, I missed that this was a 990. That link is for the 2018 Instructions, but that code is still on the 2022 Instructions as well, so I'm not sure why it isn't accepting that.

Most of the complaints I've seen this year about code problems (including the original poster in this thread) is because the code they were using is no longer valid in the current Instructions, but that doesn't seem to apply to you.