- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: 1099 R with Code G rollover, also with Taxable amount?

1099 R with Code G rollover, also with Taxable amount?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

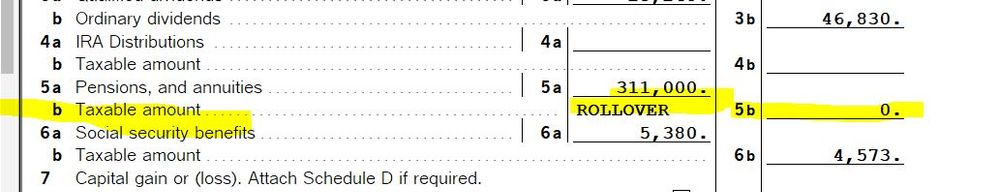

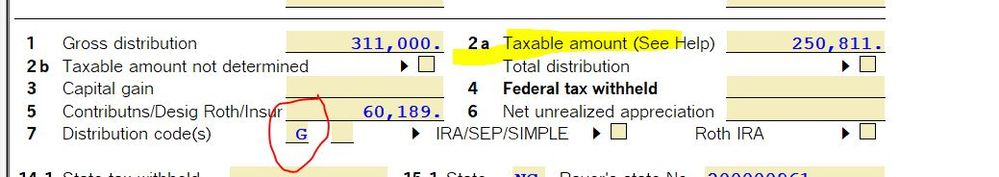

I have never seen a form like this before where a 1099 R has a code G for rollover, yet an amount taxable is also indicated.

Even so, the software does not seem to recognize the taxable amount in form 1040.

Should the broker have issued a separate 1099 R for taxable and non taxable? still, it's a roll over so why taxable?

Thanks for shedding any light on this.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Not sure if you noticed the taxable amount is the gross less the taxpayer contributions.

I think the Code G negate's the amount the administrator put on the taxable line, and that proseries is correct.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That make sense, it threw me off that this CX was advised by financial advisor to remit almost 70k in estimated tax for this.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Could this be this an IRA of that was rolled (converted) into a roth? could this be taxable transaction? I think I might ask to see the statements for each account to make sure I understand whats actually happened.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That's a good point to look into.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It seems to be an Annuity; not a qualified retirement account. I don't see that any of the Boxes are checked.

Annuities tend to have Qualified and Non-qualified portions.

I always find articles help: https://proconnect.intuit.com/community/proconnect-tax-idea-exchange/idb-p/605

"An investor can only move the qualified employer-sponsored annuity into an IRA--the non-qualified annuity serves as a supplemental retirement account."

https://finance.zacks.com/can-annuities-changed-ira-tax-penalty-9419.html

"Non-qualified annuities are the kind most people own, and it can be expensive to get your money out. The amount you've invested isn't taxed a second time because you paid your premiums in after-tax dollars. Your gains, on the other hand, are fully taxable as ordinary income."

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I've seen this for in-plan Roth conversions of after-tax 401(k) contributions. These are popular in big tech companies and sometimes called a "Mega-Backdoor Roth Conversion".

I believe to get this to work right in ProSeries I had to split the amounts out and pretend I had two 1099-R forms (one for basis, one for earnings).

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You can ask the taxpayer to ask their broker if they now have two accounts. The taxable amount is treated the same as distributed if it is non-qualified. You also should find out if this was Annuity contract, Variable Annuity, Life Insurance contract, or what it was. It doesn't seem to involve any "typical" retirement plan account that you are familiar with. If you knew for certain what it is, you can do some online research.

No, I wouldn't have expected 2 1099 nor do you need them. The details are already provided.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From the client. she told me it was rolled over from IRA 401k to ROTH account.

I think "G" would not be the right code. Currently with G, no tax is triggered. Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I guess if I were to do this, I would have to attached the form to the return so IRS knows what is happening?

It was IRA 401k to ROTH , so it should not be a rollover but a conversion.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I wouldn't bother attaching anything. There's no withholding for the IRS to match on the 1099-R so they're not going to care. The income you're reporting matches what they see on the 1099-R and if you split in two the gross distribution number will match as well.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Would I then create a substitute form?

I cannot use the "G" code for the taxable amount.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just use one of the other codes that makes it taxable but not subject to penalty.

The 1099-R Wks was invented as a substitute for mailing in 1099-R forms that have withholding. Since there's no withholding you're just using the Wks as a tool to get the software to correctly compute the income on Form 1040.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"From the client. she told me it was rolled over from IRA 401k to ROTH account."

It would be Taxable, but it might be pro-rata. Again, if that is an annuity or insurance contract, there might be post-tax payments, which would not be taxable pro-rata to their contribution of the total balance.

There is no Roll Over, unless it was Split. And that also could have happened. The post-tax part that was held at the employer is moved to a non-qualified (regular investment or savings) account. The pre-tax amounts (from an employer, or earnings) are qualified to be transferred/rolled over into a similar sheltered tax-deferred account.

This is why we cannot help you. There is a huge matrix for this type of event. The taxpayer should give you paperwork, answer, find answers, put you in touch with the employer or broker, etc.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

By the way, the rest of the 1099 R shows the employee contribution.

The form gives me what is taxable amount, and what was employee contribution.

IRA 401k to Roth .

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employee contribution to 401(k) is nearly always pre-tax, so there is taxable conversion. Employer match is always pre-tax, so there is tax on conversion. Earnings were sheltered, so there is tax on conversion.

But an employer plan can provide for Roth 401(k), and only the employee can contribute to that, and it is post-tax. That makes it already taxed. Converted that to Roth is more like a Rollover, since it is from Roth to Roth. It would not be taxable.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Code G is correct. I had an IRA to a Roth IRA conversion with a code G and couldn't get the dollar amount to be taxable. The solution is on the bottom of the 1099-R - Mark boxes B5 and B7 and the dollar amount will become taxable.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The taxable amount is on line 4b. 5A shows the entire amount of the pensions and annuities

and the rollover is correctly aligned with 0. I don't see where anything is incorrect in this form.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"I don't see where anything is incorrect in this form."

Are you working on 2023 taxes?

Because you just posted in a topic from 2022, which means they were working on 2021 taxes. And the rules changed in the meantime, and often the forms change, anyway.

For instance, an employer is now (since the SECURE Act passed at the end of 2022) allowed to put an employee's match into Roth 401(k).

Don't yell at us; we're volunteers