- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: 1065 Sch K-1 Wks - Disregarded Entity

1065 Sch K-1 Wks - Disregarded Entity

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Happy day,

A silly question, which will undoubtedly have a reasonable answer unfathomable to me.

Working on a 1065, and a partner is a SMLLC, which is disregarded and did not obtain an EIN. I enter the DE's name as it appears in the operating agreement, the human's SSN, and choose DE for partner entity type. A little further down there is a prompt to enter the DE's name and TIN...which is what I entered in the name and ID field in the first place. So I've been screwing around with different variants to clear the error, but at the end of the day, I'd like to be able to do what is right.

Because I have procrastinated this return for long enough, I thought I would ask the wizened members of this elite discussion board for their perspective on the matter.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Lord Happy wrote:

I enter the DE's name as it appears in the operating agreement, the human's SSN, and choose DE for partner entity type.

A little further down there is a prompt to enter the DE's name and TIN...which is what I entered in the name and ID field in the first place.

I think your first sentence above is for Box E and F of the K-1, should show the human's name and ID number, so you don't enter the name of the LLC there.

I think your second sentence above is for Box H2 of the K-1, and the TIN should show "None". If that software gives you an error with "None", that is a software error that needs to be corrected.

https://www.irs.gov/instructions/i1065#idm140377965267840

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Happy day Lisa...no, the whole partnership consists of disregarded entities as partners and this is not the first one I have entered in this return. The pop-up error box says if one doesn't have an EIN, to trick the error away by entering "APPLD FOR" in the EIN field down in that section, which isn't true. None will ever be applied for. I can also trick it away by making the SSN look like an EIN, since it requires that structure, which also isn't true. I try so hard to avoid blatantly lying on tax returns...apparently governments have views on this sort of thing 🙂

This also has an effect on the page identifying the partnership representative.

I called in to the much-maligned support folks and got right through. There was no answer forthcoming. And so I am reduced to just lying on the tax return, and will do 8 imputed interest spreadsheets in Dogecoin as penance for my sin. So sayeth The Service.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What if you just lose the DE and put them as an individual? Its going on the recipients personal return under their SSN anyhow, does it matter that its a DE?

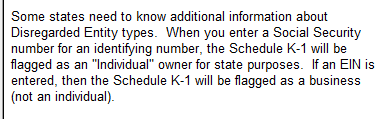

The HELP screen for that DE category isnt very helpful with this but it does have this

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Happy day Lisa...I considered that for the sake of expediency, but I wasn't sure what the legal implications might be when some squabble breaks out or a liability issue arises. We're seeing more of this SMLLC thing as partners among our clients. I should probably beef up my knowledge in this area where an operating agreement states SMLLCs formed in Delaware are the partners, and what issues may arise from something as simple as a naming convention on the K1.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Lord Happy wrote:

I enter the DE's name as it appears in the operating agreement, the human's SSN, and choose DE for partner entity type.

A little further down there is a prompt to enter the DE's name and TIN...which is what I entered in the name and ID field in the first place.

I think your first sentence above is for Box E and F of the K-1, should show the human's name and ID number, so you don't enter the name of the LLC there.

I think your second sentence above is for Box H2 of the K-1, and the TIN should show "None". If that software gives you an error with "None", that is a software error that needs to be corrected.

https://www.irs.gov/instructions/i1065#idm140377965267840

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So the answer is: It's a software problem that will not be corrected?