- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Foreign wages

Foreign wages

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

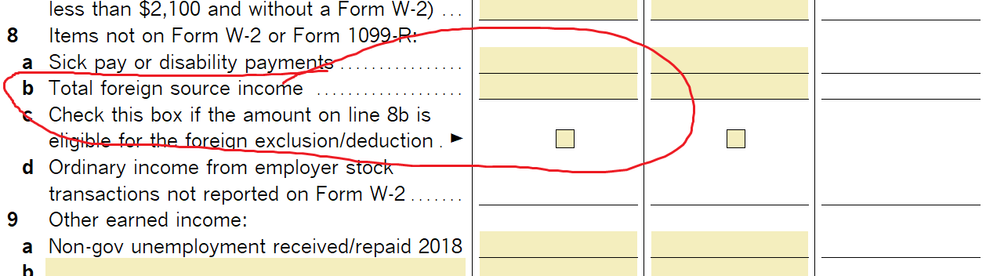

Hello all... I have a client with foreign wages and foreign tax paid. Earned 100% out of the country by a US Citizen and he is eligible for 2555 exclusion and 1116, but that won't matter.

1. Do I enter the W-2, without an EIN. An error is generated.

2. Or do I just do it all on 2555

3. OR is there another way to enter the wages.

FYI the 1040NR does not allow for 2555. Thank you

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This worksheet has a line for foreign income, no W2 input needed.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

US citizen files 1040, not 1040NR.

The more I know the more I don’t know.