- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Advanced Child Tax Credit amount.

Advanced Child Tax Credit amount.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good morning online community,

I would like to know if for a MFJ couple AGI 156000 with 2 children, one is 2 and the other is 12. They were supposed to received an advance payment of 550 which they did totaling 3300 for 6 months. It is my understanding that in the letter the irs is sending they will divide the amount allocating 1650 to each taxpayer. It when you combine the amounts it is going to be 3300. Why I am getting different refund if I put 3300 on the first taxpayer than when I divided between the two taxpayer inputting 1650 each. Isn't the amount the same? I will appreciate your answers.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When preparing the 8812, how and where is the adjustment made for the amount of advanced credit which was received? Very confusing this year.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Common sense would say the refund should be the same, but common sense doesn't necessarily apply when you are dealing with the IRS or Intuit. What is the difference?

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The guidance on where to enter this information sits within the IRS Letter 6419.

Box 1. Aggregate amount of AdvCTC payments you received for 2021.

Enter this amount on Schedule 8812, line 14f or line 15e, whichever applies.

If you file a joint return for tax year 2021, you must add the amounts in Box 1 from both

Letters 6419 and enter the total amount on Schedule 8812.

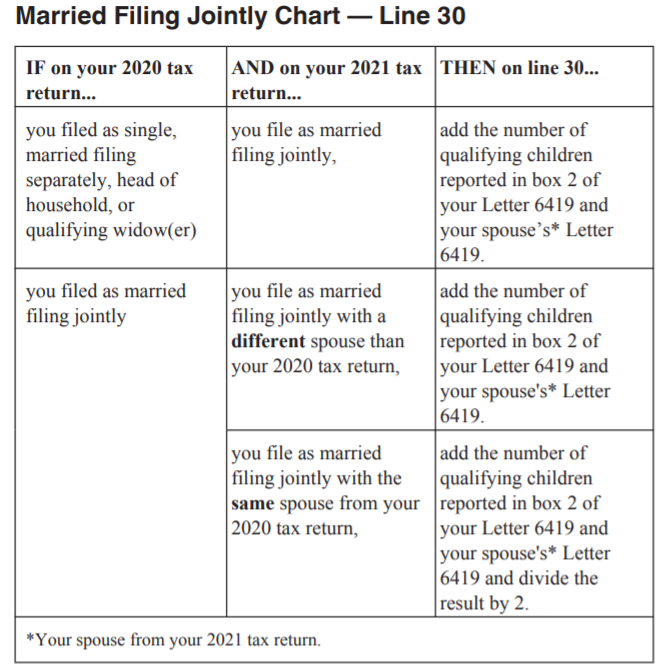

Box 2. Number of qualifying children taken into account in determining the Advanced CTC.

See Schedule 8812 instructions if you complete Part III, Additional Tax.

Buckle in...it's going to be a bumpy ride!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I can't see why the amount would be different. I was thinking maybe it had to do with the safe harbor repayment limitation but it looks like you're over the AGI limit. That can be an odd calculation in Part III in certain circumstances. Sometimes 2+2=4 and sometimes 2+2=2. There's a handy chart in the instructions. <smh>