- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Purchasing Returns

Purchasing Returns

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi All,

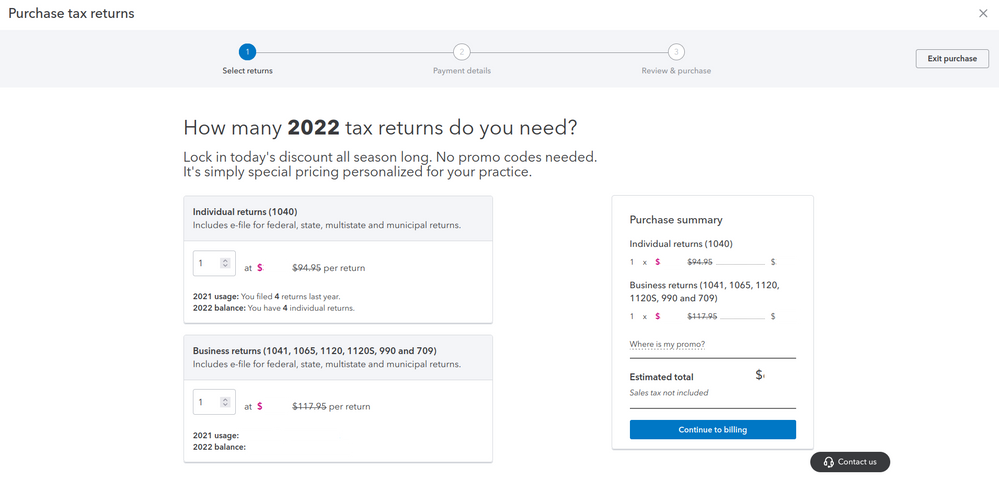

I have been using ProConnect 3+ years. All of a sudden this year it is not allowing me to purchase returns online and is asking me to call them EVERY time I need a return. I print a lot of my returns to PDF prior to filing for the clients review but, I can't do that without purchasing a return....anyone? I don't want to call them and Pre-Purchase 50 returns just to e-file or print 1 to PDF.

Help!

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You are asking this question to other users. You need to decide how many you will need and do discount, or pay per return. https://proconnect.intuit.com/tax-online/pricing/?s_cid=SEM_PTO_G_BR_SL_General_3Q-Google-Brand-PTO-...

Pay attention to that asterisk which is way down at the bottom and reads as:

- #1 professional tax software on the cloud :

Based on Intuit internal data of the number of paid users of ProConnect for tax year 2020 compared to publicly available statements from competitors for the same time period.

- For Tax Year 2022:

All Intuit ProConnect Tax Online returns pre-ordered and purchased are for use during the calendar year 2023 and can be used for any tax return supported by Intuit ProConnect Tax. 1040 and business returns and can only be used for the designed return type. Returns purchased but not used by December 31, 2023 will not roll over into the next tax year. Any pre-orders not canceled prior to December 22, 2022 will be charged to the credit card on file. Intuit has no obligation to refund all or part of the purchase price for prior purchases of ProConnect Tax or unused returns. ProConnect Tax tax returns are credited to the Customer Account Number that purchased them and cannot be transferred to other Intuit accounts. Terms, conditions, features, availability, pricing, fees, service and support options are subject to change without notice.

- Save 35% off:

Purchase of all tax year 2022 tax returns purchased between 8:00 AM CT on October 1, 2022, and March 15, 2023, at 11:59 PM CT. Savings calculation based on tax year 2022 list price. 35% discount is a limited-time offer for new customers that may only be claimed once.

- Save 60% off 100 or more total returns::

Purchase of all tax year 2022 tax returns purchased between 8:00 AM CT on January 6, 2023, and January 31, 2023, at 11:59 PM CT. Savings calculation based on tax year 2022 list price. 60% discount is a limited-time offer for new customers that may only be claimed once. Purchase discounted returns directly from Intuit ProConnect Tax at ito.intuit.com or call 833-206-5239. Customer will be required to provide payment information at the time of the pre order.

- Cancellation: Upon cancellation or the termination of your account, you may not have access to the ProConnect Tax Services, data and other Content you uploaded to the Tax Online Services. Please follow in-product instructions to cancel your account. We suggest that you retain your own copies of any data or Content that you may need, as Intuit is not responsible for providing you access to the Services or your data or Content after any cancellation or termination of this Agreement.

- Refund policy:

If you purchase returns between the date of first availability of the next Tax Year, but before December 22, 2022, you may cancel your order. In the event you do not cancel your purchase before December 22, 2022, or purchase returns after December 22, 2022, Intuit shall issue a refund on unused returns within thirty (30) calendar days from your purchase date upon request. No other refund requests shall be honored.

- Add-on information: Additional terms, conditions and fees may apply with these optional add-on services.

- Terms, conditions, features, availability, pricing, fees, service and support options are subject to change without notice.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi George,

Maybe I wasn't clear. I have already purchased some for this year via phone call.

The issue is when I try to purchase (and when I tried to pre-purchase in December) through the online software I get a notice that they cannot process my purchase and I need to call.

During my call with proconnect they said there was an issue on their side that they were trying to fix.

My question is if other users are having this issue.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am having the same issue. I try to purchase online (As I have done so for the past 4 years) and it says it cannot load my billing info and I need to call to order. This is frustrating as I don't want to call EVERY time I need to purchase a return!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am currently having the same issues.

I tried purchasing through the phone and I do see the charges, but the returns are not adding towards the credits. I have S-Corp and C-Corp clients waiting for their returns to be filed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I pre-ordered 15 business returns for 2022. When I try to file a return I'm required to pay. Looked at my account usage and it shows 0 returns purchased. Unfortunately, I can't find my receipt.

I did purchase through my ProAdvisor account.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You should be able to purchase additional returns by increments of one. If you are not able to do so for some reason, you should speak with Intuit to have them fix it because that's really an anomaly.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am having the same problem. The Review my order button is grayed out so I can't purchase one Individual return (1040) online. No one is available to help at (844) 830-8560 or at (844) 877-9422 because the office is currently closed. I have been using ProConnect Tax since 2013 and this has never happened in the past.

If it is not broken don't try to fix it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So after about 3-5 business days, the pending charges were returned (thankfully) and I gave it another try.

It worked. So I guess it's one of those "system bugs" where it'll work when it WANTS to work. Just make sure to track your purchases so you aren't being charged for uncredited returns. Calling can only go so far because all phone support said was, "I assure you that your purchases has been successfully processed and the tax returns should be credited." That was false. But give it time and it'll fix itself.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Not only does Intuit have a problem resolving known issues with the software this year, they didn't call back after leaving a voicemail at two different phone numbers last night (844) 830-8560 or at (844) 877-9422 because the office is currently closed. I had to call them at (844) 877-9422 to purchase one additional TY22 PTO Individual return (1040) at 9:00 AM this morning.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Problem resolved! While on the phone for technical support for other issues thanks to screen sharing, I learned that all I needed to do to Review my order and purchase additional tax returns in ProConnect Tax was input the three digit CVV in Payment information.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

yes having the same issue