- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Linking 1099-Misc to Sch C

Linking 1099-Misc to Sch C

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In other software, I have entered form 1099-Misc and the linked it to Sch C.

This feature does not appear to be available in ProConnect.

Is there a way to enter 1099-Misc in ProConnect?

Otherwise, I do not see a point in entering 1099 information unless there is withholding. Otherwise, I would just enter 1099 amounts on Sch. C.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is not other software.

This feature is not available

NO

You are correct in your assumption.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Otherwise, I do not see a point in entering 1099 information unless there is withholding."

Yes.

"Otherwise, I would just enter 1099 amounts on Sch. C."

No. You enter their entire business activities. The 1099-Misc is one entity having a reporting requirement because of whatever activity that was, which is one of the boxes has an entry and that box has a reporting threshold.

But the whole business is likely more activity than one value in one box.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So you still enter each 1099 individually? How do you link it to the Sch C?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, you don't need to enter those business 1099-NEC or -Misc at all. You need to get the taxpayer to give you all of their reportable details. If your taxpayer had $4 million business gross in the year, and none of the business they did falls under a 1099- reporting requirement, would you skip reporting the income entirely? Of course not.

1099-Misc and -NEC are informational.

That means someone your client's business did business with, had an activity that falls into the reportable threshold, which is basically, "To be able to include it on my business taxes as deductible, I needed to report you to the IRS as having this income from my business, and now the IRS knows you also are in business and to be expecting a tax return from you with your business income."

Example: A Royalty expense from a publisher to a writer is income to the writer and gets reported for taxes and may not be the only type of business income for that writer. The Royalty would be reported on a 1099-Misc. Speaking engagements might be reported on 1099-NEC. But your client, the writer, might also have other sources of income, such as editing a neighbor's first novel (and the neighbor would not issue a 1099-NEC).

You use that 1099-Misc and -NEC as part of your due diligence. The same is true of the 1099-K. These are telling you about the person's activities, but you need to learn what it means, what types of activities and how it is treated for tax preparation.

Hope that helps.

That's informational.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I want to make it clear - all income is being reported on Sch C regardless.

It is just a matter of either:

1. Hard-coding the income on Sch C.

2. Linking the income to Sch. C from a 1099 that is entered somewhere else in the software.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This ==> "1. Hard-coding the income on Sch C."

1099-Misc has various boxes, so that clues you into their activities: business, landlord, royalty, etc. It is not the amount to enter, by itself. Let's imagine a landlord rents 25 storage units. Only 3 are rented to businesses, so only 3 tenants will send your taxpayer client a 1099-Misc for rent they paid from their business to your taxpayer client, the landlord. But your taxpayer client has rental income from all of their rental activities. That's what they provide to you so that you can prepare their tax filings.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Appreciate your help. In this case, let's assume all 1099-Misc / 1099-NEC are for business compensation.

As long as the activity is entered on Sch. C, the income is captured properly in the software.

There is no need to enter the 1099 anywhere in the software.

I had used ProSeries, and you link to it to the Sch. C, which prompted this question.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Linking in this case doesn't transfer anything to anywhere. It's just informational. You never told us which box(es) have a value, but you stated Sched C.

It's not the same as having 1095-A for health care coverage linked to Sched C for the related credit and penalty parts of the tax code, for example. The IRS is doing cross-checking for all of that.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do you use the help articles? Here's a good listing with help links:

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

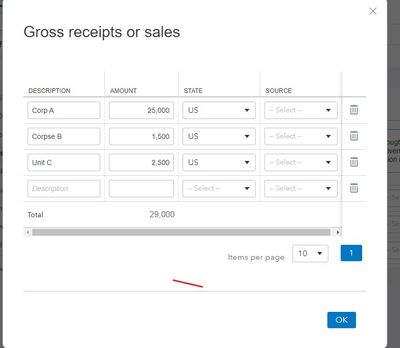

Got it - so you simply need to enter business revenue in the section "Gross Receipts Reported on A 1099"

Appreciate your help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just to confirm, any 1099-Misc (Box 3) or 1099-NEC does not need to get entered separately - it can simply be hard-coded on the Sch C. Gross Receipts

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

YOU GOT IT!!!!!

If you like you can click the + by the Gross Receipts and list each 1099, then it will total

Answers are easy. Questions are hard!