- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Amended return from MFS to MFJ for spouses in VA and MD

Amended return from MFS to MFJ for spouses in VA and MD

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

John and Mary filed their separate returns in VA and MD respectively, and each of their returns has errors, they want to correct the errors and file jointly.

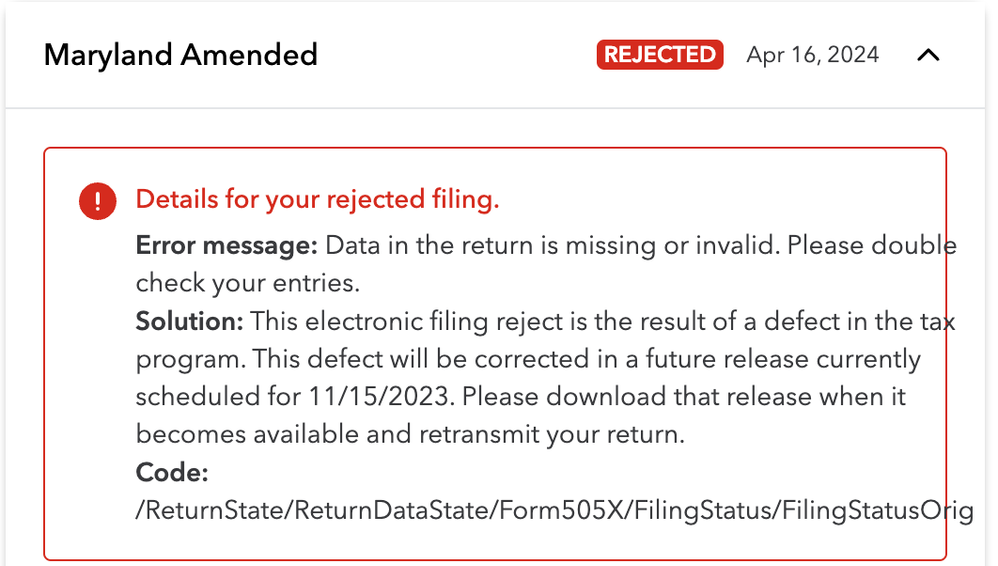

There is no problem in VA as they can file combined returns. For MD, they need to file nonresident return per MD instruction when one of spouses is a nonresident. The return was rejected with the following message.

What is the defect that it refers to? The proconnect software, or the MD state's software? I think the reason is John has never filed the original return, so for him it is not an amendment, but he cannot file an original return because Mary has filed her return. Do should I do in this case? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This appears to be a software bug, follow the steps below to resolve the problem.

- Go to the Amended return input screen.

- Scroll down to the Federal Income Tax Return section.

- The fourth line down is “Spouse SSN on original return when applicable”. Ente the spouse’s SSN in this field.

- Once that is done, click on the Return Actions in the upper right.

- Then click on Customer Support Tools. This will open up a matrix with all the inputs from this screen.

- Scroll to the bottom and hit Edit. Then Continue.

- Then find the line with the code 471. You should see the SSN that you just entered at the end of that line.

- Under the fourth column from the left, STATEID, enter MD.

- Then hit Save in the lower right.