- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Inputting Section 199A information from Partnership K-1 into Partner's Individual Return

Inputting Section 199A information from Partnership K-1 into Partner's Individual Return

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

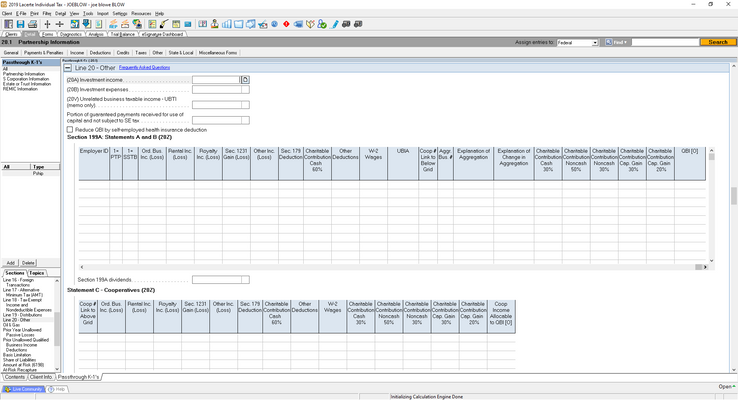

There is a previous thread that vaguely answered this question saying to go to the line 20 section and input into the information into the grid, however most of the items I have on this client's K-1 are nowhere to be found there.

This is where the previous response directed you:

So now does anyone have a clue as to where to input the following on this **bleep** grid lol. Obviously this is not as easy as the prior thread made it out to be:

20AH1 Bonus Depreciation Adjustment for Most Non-Conforming States

20AH2 Gross Receipts for Unrelated Business Taxable Income Purposes

20AH3 Gross Deductions for Unrelated Business Taxable Income Purposes

99O46 Estimated Tax Basis

99O47 Cumulative Passive Losses

I am assuming everyone is working on their deadline for Monday trying to get Partnerships and S-corps done and haven't had to input an Enterprise Products Partners K-1 into an Individuals return due to the pretty weak answer in prior thread.

Will the real Tax Sensei please stand up and bless us with the answer?

Happy Tax Season

-Turbo Tuck

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If taxes were a matter of plunking numbers in and getting forms out, any idiot could do them and then no one would pay us the big bucks.

So Box 20 is for informational items, where you have to know enough about taxes to choose your own adventure.

Bonus depreciation adjustment for non-conforming states is pretty self-explanatory, and the K-1 kind of explains it, too, in the ant-type pages in the back. If your client is a resident of a state that didn't conform to bonus depreciation, that's the state depreciation adjustment. The "state if different" column might work, but you might have to play around some. If your client's state conforms, you can disregard this. If you don't know whether a given state conforms or not, its forms instructions will sometimes say, or you can Google "bonus depreciation state conformity" and hope for the best.

H2 and H3 relate to UBTI (learn more by googling it), which only applies to things that file a 990-T: tax-exempt entities including retirement plans and IRAs. Your client is a person? Not relevant to you.

Basis (my recollection is that this is original cost basis, not current tax basis; if the capital account is positive, it usually but not always approximates tax basis for most PTPs) and accumulated passive losses are the entity's best guess as to those things. If the client comes to you with a PTP they've owned for prior years and none of the back K-1s and none of the old tax returns, it's better than nothing but not a lot better. Woe betide you if this client owned the PTP in prior years and doesn't have every K-1 and every tax return and every worksheet. So much woe. Heck, woe betide you if they do have them all and they're all prepared correctly. Woe is the nature of PTPs.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Neither PTPs nor Lacerte lend themselves to assuming that you can plunk numbers in the software and have the correct answer fall out. You cannot rely on Lacerte to handle QBI on a PTP K-1 correctly this year (or last year, which means the proforma wasn't right, either). You need to know the answer you expect and to maintain your own Excel calculation.

None of the items you're asking about are relevant to QBI, so they don't go in the QBI grid.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you Phoebe.

But I thought that I paid the big bucks for Lacerte so that I could plunk numbers in and have the correct answer pop out? : (

If none of these are relevant to QBI, could you possibly lead me into the direction of where they would be input then, or what effect if any they would have on the Partner's Individual return?

I've read the IRS' instructions and researched form 8995, but the more I have read, the more confused I have gotten.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If taxes were a matter of plunking numbers in and getting forms out, any idiot could do them and then no one would pay us the big bucks.

So Box 20 is for informational items, where you have to know enough about taxes to choose your own adventure.

Bonus depreciation adjustment for non-conforming states is pretty self-explanatory, and the K-1 kind of explains it, too, in the ant-type pages in the back. If your client is a resident of a state that didn't conform to bonus depreciation, that's the state depreciation adjustment. The "state if different" column might work, but you might have to play around some. If your client's state conforms, you can disregard this. If you don't know whether a given state conforms or not, its forms instructions will sometimes say, or you can Google "bonus depreciation state conformity" and hope for the best.

H2 and H3 relate to UBTI (learn more by googling it), which only applies to things that file a 990-T: tax-exempt entities including retirement plans and IRAs. Your client is a person? Not relevant to you.

Basis (my recollection is that this is original cost basis, not current tax basis; if the capital account is positive, it usually but not always approximates tax basis for most PTPs) and accumulated passive losses are the entity's best guess as to those things. If the client comes to you with a PTP they've owned for prior years and none of the back K-1s and none of the old tax returns, it's better than nothing but not a lot better. Woe betide you if this client owned the PTP in prior years and doesn't have every K-1 and every tax return and every worksheet. So much woe. Heck, woe betide you if they do have them all and they're all prepared correctly. Woe is the nature of PTPs.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you so much for your excellent explanation! It is much appreciated.