- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: If no refund is due, how can I transmit the direct deposit data to the feds with an e-file re...

If no refund is due, how can I transmit the direct deposit data to the feds with an e-file return in order to receive the virus economic stimulus payment?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How about a first quarter estimate of $10 direct debit?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You cant. We just have to wait for IRS to come up with a way to get that information to them, or be thankful when a check arrives.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Treasury Secretary Steven Mnuchin said Sunday that the administration is working to create an online system that will allow people to submit their direct-deposit information to the government so that they can receive their coronavirus relief checks more quickly.

"We will create a web-based system for people where [if] we don't have their direct deposit [information], they can upload it, so that they can get the money immediately, as opposed to checks in the mail," Mnuchin said on CBS News's "Face the Nation."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, thank you both Lisa and Bob; I am aware of what other agencies are doing to help solve this problem, and I expect to utilize them. I was hoping, in a wistful way, that the Lacerte coders could simply allow that data to be included in the fields that are already present on a 1040, rather than mask it blank if there is actually no refund showing on a return. I am in Japan, and most folks claiming the FEIE have no liability or refund, so the direct deposit data does not appear on the return even if entered into the software. For paper returns, I simply add it, but that is not possible for e-files. I add a "statement" to include the banking data, in the hope that a human might see it. The Lacerte coders could fix this in a jiffy by simply allowing entered direct deposit data to populate the appropriate fields.

Perhaps I was too subtle in asking how to do it. Instead, how about: "why not fix this?" might help my clients more. Anyone know how to get Intuit's attention? This is an easy fix that will help many clients.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Its the IRS computers that would need to be reprogrammed to pick the info up on the tax return.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Perhaps. Is that an assumption, or, do you code for the Service? I think the best response is for preparers and Intuit to send that data now, so that when and if the Service figures out how to access it, the data are already in the client's account file, and then the direct deposits can be made without further delay (not unlike Social Security recipients). It's bad around the world, as we all know. Let's do something to help people as soon as possible rather than adding more steps, and more delays.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IntuitAustin @willie3 has a very good idea. What is the likelihood that Lacerte or PS or PTO or all might incorporate this into the program?

My guess is the MEF is not set up for it and it will never happen. I hope Austin proves me wrong.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It never hurts to ask! From the Help menu, select Lacerte Feedback. Enter your "Lacerte Enhancement Idea Form".

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How about a first quarter estimate of $10 direct debit?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Now here is someone who is thinking. Thank you, George. Possibly an elegant solution. 1040 page 2 still does not populate the direct banking details, but there are some fields in the estimate page that indicate the needed data. Let's hope. Also, $1 seems to be sufficient, rather than $10: "Smaller, but aah, cleaner...and well worth a dollar."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But, will IRS do a direct deposit to a direct debit account? Only the shadow knows and unfortunately he probably doesn't talk with Mnuchin. Now if they could only put my idea on their shiny new poster https://www.irs.gov/pub/irs-utl/e-poster_payments.pdf

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Valid point, but the data are the same whether a debit or credit. Whether the data populates a refund field is in the realm of the Shadow, to be sure.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I will let you know if it works for me. I used direct debit on my 2018 and have not yet filed for 2019. I should know in a week, RIGHT?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

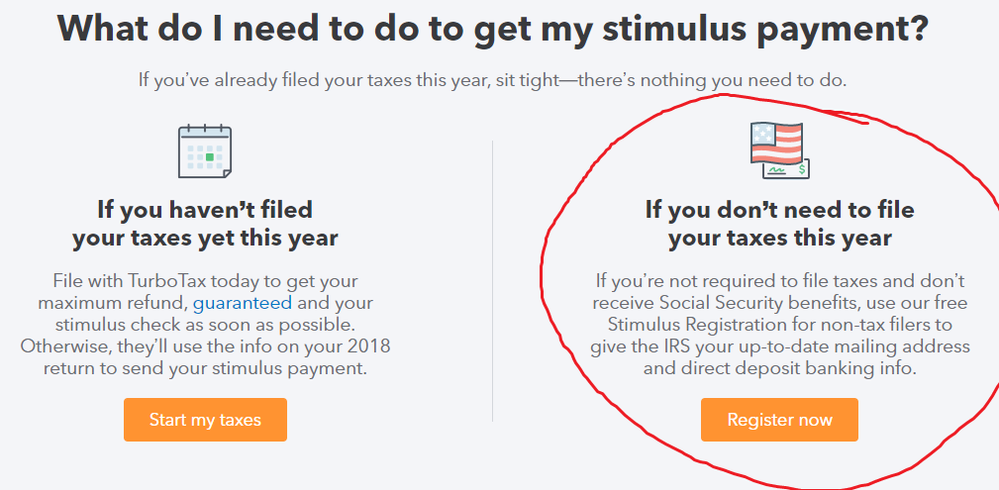

Intuit has partnered with the IRS to create a Stimulus Registration for non-tax filers. For more information see here: https://turbotax.intuit.com/stimulus-check/

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Look for this from the link above!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Great call out, thanks Lisa!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I saw a screen shot (in a tax preparer FB group) from someones Wells Fargo account showing the $1200 COVID-19 Stimulus payment landing in their bank account already...so it appears to be rolling out sooner than anticipated.....

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Wow, they aren't wasting time!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But remember,

The IRS reminds taxpayers that scammers may:

- Emphasize the words "Stimulus Check" or "Stimulus Payment." The official term is economic impact payment.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

$1 did not do it, and it was ignored. Later reading of daily IRS notices indicates that bank data for a payment are not used for direct deposit of refunds. Failed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"indicates that bank data for a payment are not used for direct deposit of refunds. Failed."

Payment of taxes is money Out of banking. Deposits are money Into banking. That's why it isn't being used for stimulus payments.

Are you following the IRS FAQ topic? They keep updating it:

https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

Don't yell at us; we're volunteers