- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- COVID Connections

- :

- COVID Connections

- :

- Re: stimulus checks

stimulus checks

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are deceased taxpayers eligible for stimulus check?

ie. I had a spouse die in 2019 and we filed a joint return for 2019.

The wife received a stimulus payment for $2400

Best Answer Click here

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ive seen similar reports in other tax preparer groups....looks like that's how its happening....I saw one that the spouse had died in 2018 (no 2019 return filed yet) and surviving spouse got the full 2400.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Welcome to the Tax Pro Community!

If you're looking for assistance with your personal taxes, please go to TurboTax's community and post a question.

Otherwise, if you're a tax preparer, please post your question on the applicable product board.

Cheers!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ive seen similar reports in other tax preparer groups....looks like that's how its happening....I saw one that the spouse had died in 2018 (no 2019 return filed yet) and surviving spouse got the full 2400.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Washington evidently is a lot smarter than me. I just quite don't know how a dead person is going to stimulate the economy, but someone in Washington evidently does. Of course, when the dead person walks in to the bank to cash their check, some of the bank tellers might feel stimulated --------------- and leave work for the day.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- I have same situation for a client. Based on what I've read the surviving spouse will NOT have to pay this back on 2020 tax return. Is that how you understand it working?

Also, tell me how to do the " @Just-Lisa-Now- wrote" function.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN wrote:Washington evidently is a lot smarter than me. I just quite don't know how a dead person is going to stimulate the economy, but someone in Washington evidently does.

Duh. They are, of course, going to spend it on 2018 energy improvements.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@dkh wrote:@Just-Lisa-Now- I have same situation for a client. Based on what I've read the surviving spouse will NOT have to pay this back on 2020 tax return. Is that how you understand it working?

Also, tell me how to do the " @Just-Lisa-Now- wrote" function.

We don't know for sure yet, but that's my understanding as well.

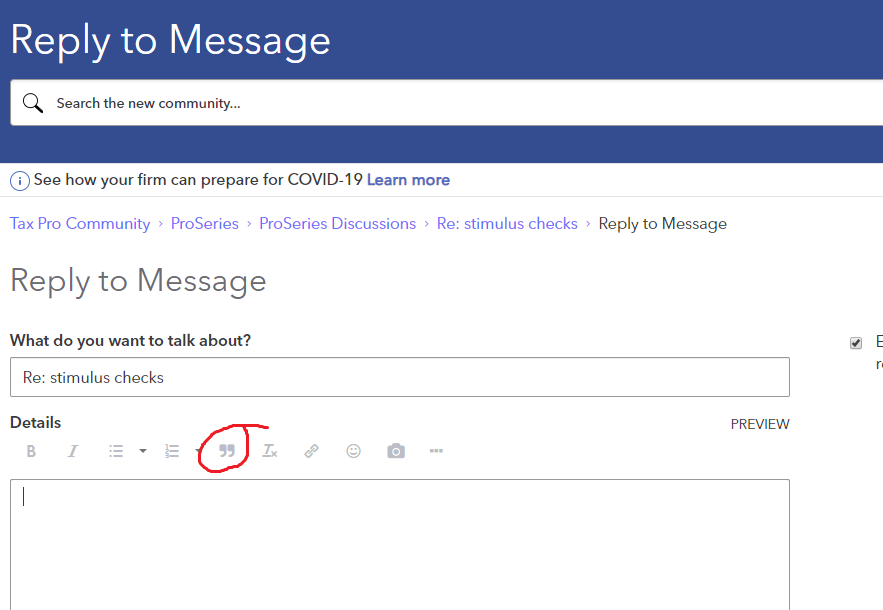

When replying, click on the "three dots" and you'll get an extra tool bar, then click on the giant " to quote.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From everything Ive read, no repayment of stimulus on the 2020 return, even if you got too much!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This little "thingy" will make what was written appear in your reply

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So, are dead spouses a Loan or a Grant? Because I would like a couple of them, please.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My wife and I are in a similar boat. Her mother passed away last month but got 1,200 into her bank account yesterday. We’re really not sure what to do with it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a similar issue. My mom passed last year. I filed her final tax return last month indicating that she is deceased and yesterday I received a direct deposit in the joint account we shared that was POD.

No one is available to answer calls on IRS customer service line and no information is available on line.

I don't want to be penalized by the IRS as I am the sole heir and executor of the estate.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My grandmother passed away Nov 2019 and I show a $1200 stimulus payment. I can't find anywhere to contact the IRS for returning this. Anybody have suggestions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's part of her estate now.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am in the exact same boat I don’t know if it is mine to keep the irs isn’t taking calls. Please keep me updated if you hear anything.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am in the exact situation. Please keep me updated if you hear anything on what to do.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I’m in the same situation. The money went into my account because that was put on her last tax return when I filed for her after she passed. I can’t get anyone at the Irs.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I’m in same situation but it was my mother.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am in the same situation with my father. If anyone does have additional information please post.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm in the same situation - stimulus for my dad went into the estate checking account. Estate is already closed but I haven't closed the account yet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My mother passed away in 2019 my father in 2017. Is she eligable for the $1200 stimulus. The IRS does not have her bank info because she always paid.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa do I have to return the money to the irs? I can’t get anyone on phone and my tax preparer is not answering me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My Dad passed away in September 2019. We have a joint savings account and it had 1200 dollars in it this morning mine went to Checking, I haven't filed his Final return yet because of the shut down . You can not talk to anyone at the IRS and I cant find any answers?? How do I pay it back or is it mine to keep?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Commenting to follow. My dad passed last year and my mom received 2400. She's not touching it but would also like to know what she should be doing with it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm leaving it there until we find out how and if I'm supposed to have it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We are in the same boat. My deceased sons 1200. Hit my account this morning. That is where he had his 2018 tax return deposited because he did not have an account. I have called IRS, HR Block. No one seems to have an answer on what to do with this money. I appreciate all these comments as some are helpful. I will be looking on here for an update on what we are suppose to do.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm also replying to stay in the loop. My mom passed away in January of 2020. My stepdad received $2,400 in his account this morning. I'm his power of attorney, so I'm just hoping to learn if I should set this extra money aside to be paid back, or if he will be able to keep it.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am facing the same dilemma- my mom just passed away a month ago and I just filed her 2019 taxes 2 weeks ago along with a refund form. Her stimulus check was just deposited into a bank account that also has my name on it. The government had initially deposited her last due SS payment and then retracted it, leaving me to file a refund form for beneficiaries. Will see what happens with the stimulus?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So far it sounds like this stimulus thing is running smooth as can be. I'm glad they have put so much thought and research into the program to make it work so well. I just hope the COVID 19 testing program isn't put directly into the hands of the federal government, or we will all be dead. But then again, that isn't so bad because we will evidently still get a check for $1200.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm in the same boat. My father passed when COVID was just becoming a big issue, so he lived into the 2020 pandemic. I'll keep an eye on this board and leave the money alone until we get further guidance.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

" and my tax preparer is not answering me. "

All of these New people making these comments seem to be Lost on the Internet. This is a forum for users of Professional Tax Preparation programs sold by Intuit.

This is not a Turbo Tax forum and not a Tax Guidance forum. You all seem to be in the wrong place.

The topic you are asking about is not going to be a Hot Topic here for "what do I do now?" Going forward, I recommend keeping an eye on the news and using a better website, such as the TurboTax forum, if that is how you prepared your own taxes. Or, stay in touch with your own Tax Professional, the person you Paid to do your work, as they will want to continue to support you.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's an interesting dichotomy. Lots of posts here about deceased taxpayers getting direct deposits. Lots of posts on the Drake forums about folks with bank products NOT getting their money.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My deceased husband had our tax returns going into his personal checking account, which at this time is still open. So, that is where my stimulus check is. The bank knows he is deceased; so, I am afraid if I try to access the money, they will know he is dead and would I be illegally withdrawing this money, even though $1,700 of it is mine? I don't feel I can legally access his account. Anyone have any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This sounds more like a legal question, than a tax question...are you in a community property state?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Curlydvm I am facing the same dilemma- my mom just passed away a month ago and I just filed her 2019 taxes 2 weeks ago along with a refund form. Her stimulus check was just deposited into a bank account that also has my name on it. The government had initially deposited her last due SS payment and then retracted it, leaving me to file a refund form for beneficiaries. Will see what happens with the stimulus?

You should be ok. The Stimulus Check is a 2020 Stimulus check. Since your mom passed away in 2020, there should be no issue. What some people are failing to recognize is that it is a 2020 event. There will be like 3 new lines on the 2020 return.... 1) amount of stimulus payment you were due 2) amount you got, and 3) amount to be credited to your 2020 return (1 minus 2). if you got the correct amount, no issue...if you got more...best I can tell..also no issue..but if you didn't get what you should have...it is added to your 'tax payments made".... and you get credit for it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So the bank doesn't know he's dead?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I also received a payment for my deceased father. Filed his last taxes for 2018 and his refund was deposited to my account. Following just in case there's a resolution.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@sjrcpa So the bank doesn't know he's dead?

Better yet... does the bank know if he bought or sold any crypto-currency.....

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Contact the estate attorney for advice.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@dd4vols Thank you so very much for your reply, time, and consideration. I am going to hold off as long as I can on using the much needed funds (to take care of her last affairs) just incase.

I do so appreciate you and @Just-Lisa-Now- for taking the time, however, to answer some of us as I have searched and called like many others on here to no avail, and this was the ONLY place that any such info/thread was addressing the matter. I realize it is very early in the process, but there are many of us facing desperate times or immense loss and truly need to consider use of these funds for one reason or another.

From one Vol to another- Much, much THANKS!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"and this was the ONLY place that any such info/thread was addressing the matter."

No, it's not. Go here:

https://ttlc.intuit.com/community/other-financial-discussions/discussion/02/216

This is the link for Personal tax issues following Covid-19 changes.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I suppose web searches are how people keep landing here, instead of finding TurboTax. Can you lock this topic, perhaps? Thanks.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, I will get legal assistance. Was just throwing this out there. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Welcome to the Tax Pro Community!

If you're looking for assistance with your personal taxes, please go to TurboTax's community and post a question.

Otherwise, if you're a tax preparer, please post your question on the applicable product board.

Cheers!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"