Getting started with ProConnect Tax

by Intuit• Updated 2 months ago

Welcome to ProConnect Tax! Whether you're transitioning from a different tax program or joining ProConnect as a first time user of professional tax software, we're here to help you.

Check out our new Getting started for ProConnect Tax page.

If you receive an error message along the lines of You currently don't have permissions to [action]. Contact your firm's Admin for authorization either when trying to create new returns or when e-file roles have changed for tax year 2025, see here for how your firm Admin can resolve it.

Or jump directly to a topic on this page:

Creating your login and registering your EFIN

- If you're brand new to ProConnect tax, click here to access the sign in screen. If you have any other Intuit Products or services you can Sign In with your existing login information, or select I forgot my user ID or password to get reset your login information. If this is your first Intuit product, select the Create an account link to get started.

- Once you have successfully logged into ProConnect Tax you can begin creating tax returns, however, you'll need to register your EFIN with Intuit to e-file returns. See Register your EFIN with ProConnect Tax for the steps on how to upload your documentation to begin e-filing.

Creating tax returns

- If you're transitioning to ProConnect from a different program, Intuit offers a free Data Conversion process that can convert your tax returns to work with ProConnect. To see if your prior software is available for Data Conversion, click here.

- When you're ready to begin the Data Conversion process, click here for steps.

- Adding a new client: To manually add a new client: select the Clients tab on the left side of the screen then Add client from the upper right. Enter the client's information and select Save.

- To create a new tax return for a client: From the Clients screen select the Actions menu, then Create a new tax return. Here, you can select the return type and its respective tax tear, and then select Save to begin the tax return.

Printing & Filing tax returns

- E-file is now available for tax year 2023

- Print and e-file approvals are still pending for many state tax returns for Tax Year 2023. To check the print and e-file approval status for a specific state see our new Tax form finder. Once you select the return type and agency you'll see if the forms are finalized.

- Once e-filing is available for the tax year see How to e-file a return and print the confirmation letter in ProConnect Tax will help you setup a return for e-file and send the return to the IRS and/or state taxing agency.

- When you're ready to begin printing tax returns How do I print a return in ProConnect Tax.

Explore our support resources

Stay in the loop by bookmarking the following pages:

- The Community, a user-run forum where Tax Professionals just like you can ask questions, discuss topics, and provide expert help to your fellow community members.

- Hot Topics, where Intuit professionals will keep you updated on tax law changes, upcoming deadlines, and any current hot topics that may be important to know.

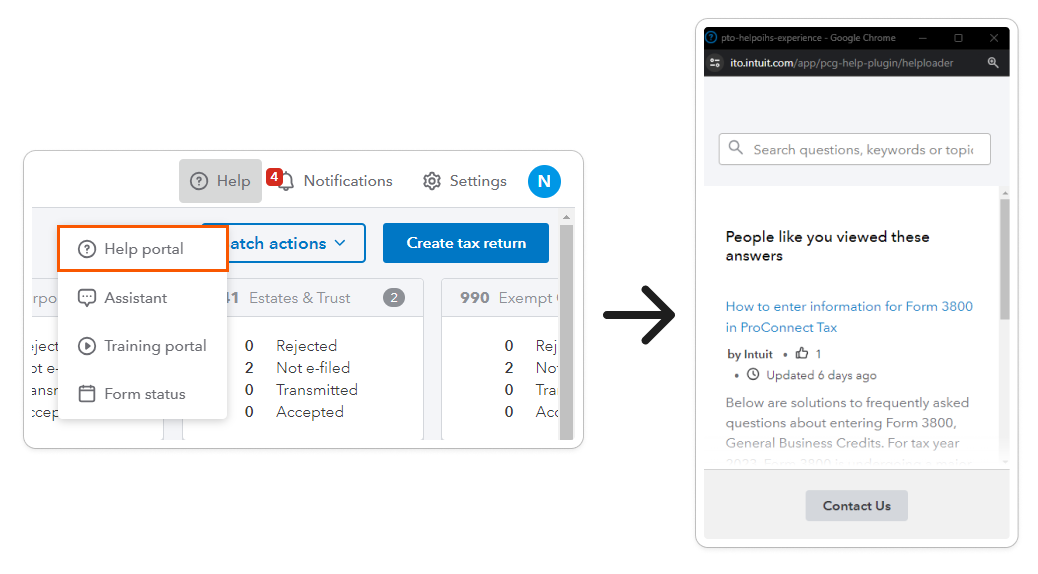

Using ProConnect Help in-product

With our in-product help, you can instantly search for any of our thousands of help articles without ever leaving ProConnect Tax.

To access it, select Help and then Help portal on the top right of the screen:

For additional help options, check out our digital assistant.