- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- Re: Roth contribution computation

Roth contribution computation

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

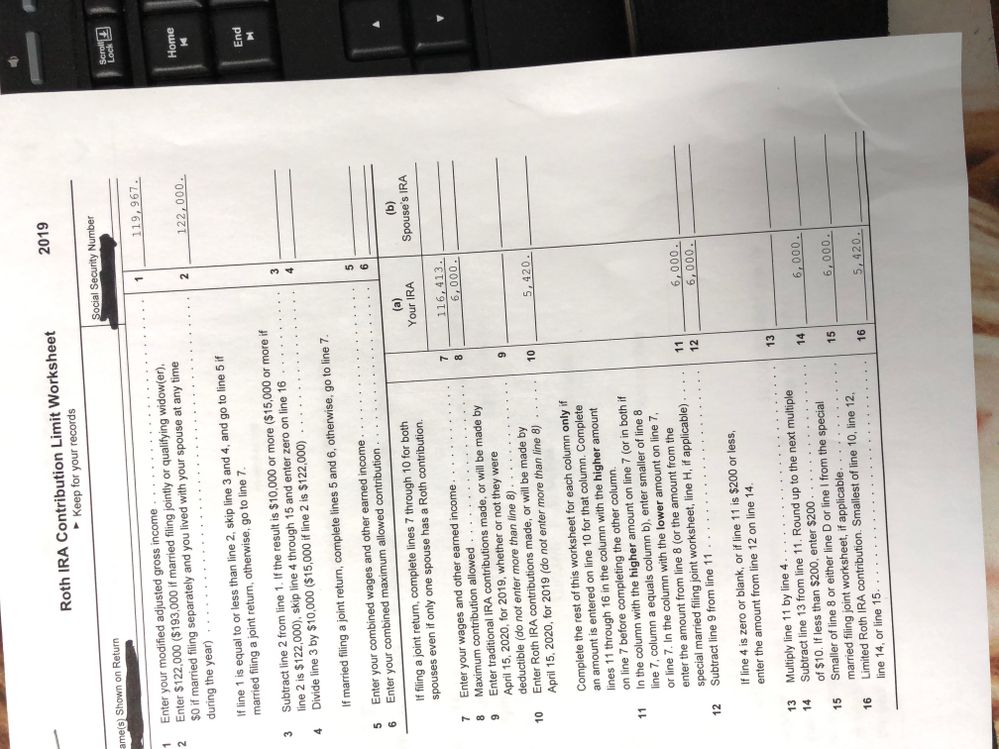

I have a single client under 50 y/o who had AGI of $119,967 and wanted to do the max Roth of $6000. Proseries limited her to $5420 . She is a member of a retirement plan thru her employer.

As I read it, if your AGI is under $122,000 you can do the max? So why is their a limit of $5420?

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you saying her AGI is under $122,000 or her MAGI. You have to use MAGI not AGI

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am using MAGI from the Proseries Roth IRA Contribution limit worksheet!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is working for me.

Have you looked through the entire Roth IRA Contribution Limit worksheet to see where it limits it? That should answer it. If you don't understand where it is limiting it, give us all of the numbers on that worksheet and we may be able to help you figure it out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks..how do I attached the Proseries Roth w/s?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hmmm. They don't make it easy, do they? The only way I can see is to attach a "photo" (when replying, look above the text box where it has the options for Bold, Italics, Underline, etc ... the "Photo" is about the 8th one).

If you do attach it be SURE to NOT show the client's Social Security Number.

If it is too problematic, you may just want to list the amounts in the response box (you can choose the "Numbered List", next to the "Photo" to correspond with the line numbers on the worksheet).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Line 10 shows that the taxpayer only contributed $5420 to his Roth.

Maybe check the contribution sheet to see what you entered for the amount of contributions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That is so stranger as I originally entered $6000 and it came back and showed the max to be $5420 and now its letting me do the $6000.

Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You are welcome. 🙂