- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- Re: CSED and 10-year period

CSED and 10-year period

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

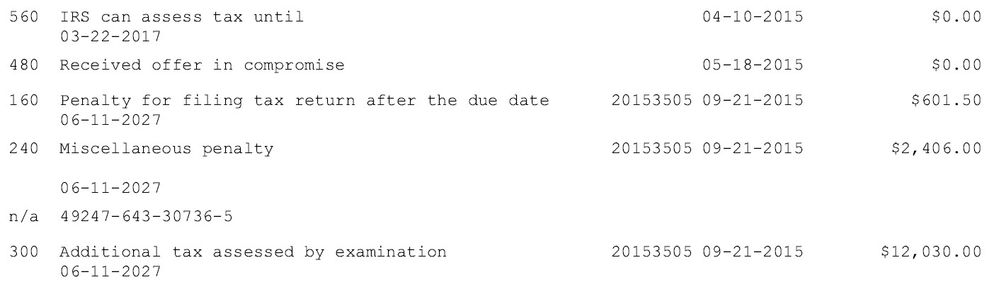

I've been learning a bit about CSED and the 10-year rule. Generally, the IRS has 10-years from the date of assessment to collect. And there are suspension periods which make it complicated.

What does the date 06-11-2027 taken from a transcript indicate? Are they the date that the 10-year limitations period end?

Best Answer Click here

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found a reference for the codes:

https://www.irs.gov/pub/irs-pia/6209sec8amasterfilecodes.pdf

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found an article that breaks it down for you:

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found a reference for the codes:

https://www.irs.gov/pub/irs-pia/6209sec8amasterfilecodes.pdf

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As always, don’t trust anything IRS tells you.

https://procedurallytaxing.com/tigtas-annual-review-of-cdp-processing/

“ TIGTA found that in 20% of the reviewed cases the IRS got the CSED wrong.”

https://procedurallytaxing.com/more-clarity-on-csed-problem/

“In our quest to resolve the CSED problem, we involved the Local Taxpayer Advocate office. It confirmed that the CSED had run, despite the fact that the taxpayer’s account was still open, and told us there was a glitch in the system; however, we were not told what the glitch was. A strong suspect for the glitch has now been identified.”

“as noted in the National Taxpayer Advocate’s 2014 Annual Report, the IRS often engages in forced collection action after the Collection Statute Expiration Date (CSED) has passed.”

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

working on a Saturday?!

Thank you.

An answer is not immediately apparent, but I'll keep looking. As to the CSED, there are separate codes for CSED activity.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"An answer is not immediately apparent,"

You have to work for it.

The first link I provided explained how it works and how it is assessed, and that each type of penalty and/or tax has its own expiration date. That's why you see (in your attachment) March and June, and June is on three issues. Then, it also explains what and how you might see delays, suspension, or extensions. If you can't figure out why something is listed, then along with the table of codes, you might be able to discern how and why, such as in your attachment, you see that line with 0 value. Just as with any transcript, you look at each line to determine its impact to the overall process. You have three different things that show June dates right now, but that doesn't mean they will transpire together through the processes.

"Assessments with their own CSED include but are not limited to:

- Original tax assessments from voluntarily filed returns;

- Tax assessments arising from amended return filings;

- Substitute for Return (SFR) tax assessments filed by the IRS when an individual fails to file a return;

- Audit assessments; and

- Certain penalty assessments."

..."However, overlapping situations run simultaneously; the time for multiple events is not added more than once where one event may overlap another."

And you show an Offer In Compromise: "If you submit an Offer in Compromise (OIC), the running of the collection period is suspended from the date the offer is pending to the date the offer is accepted, returned, withdrawn, or rejected. If your Offer is rejected, the collection period is suspended for an additional 30 days and, if you file an appeal of the rejection, the collection period is suspended while the appeal is pending.

Tax Topic No. 204 can help you better understand the details of OIC agreements."

I assume you are working on something with notifications and some actions were taken at some time against some tax year filing.

Don't yell at us; we're volunteers