- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- Earned Income for minors

Earned Income for minors

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a new client who has two children ages 7 and 12 who both earned 1099 income as performers for commercials. The 12 year old earned 5729.00 and the 7 year old earned 1043.00. I'm not sure how to report. I told my client that while both will be claimed as his dependents, both would have to file a separate tax returns due to the income generating 1099's. Is this correct?

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, each child will need to file their own return to claim this self employment income and any expenses they incurred.

Be sure to mark the box that they can be claimed as a dependent of someone else.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for the reply. I have never had this situation in 27 years of tax prep. So I had the right idea from the start. Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Don'f forget to tell the parents that since the kids have earned income they can open Roth IRA and fund them up to the amount of earned income. Great way to get an early jump while the market is down.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In this situation, will the children be able to claim the standard mileage deduction on their tax return? The parents drive the children to different photo shoots. Even out of state in some cases.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@dvieyra7 wrote:In this situation, will the children be able to claim the standard mileage deduction on their tax return? The parents drive the children to different photo shoots. Even out of state in some cases.

I would say no since the kids do not own (or lease) the vehicles. Going forward I could maybe see a scenario where the children reimburse the parents for mileage under an accountable plan.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for reply. I just need to know how to waive kid's Self-employment tax through proconnect if he is under 18 and works for his parents?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think you will find that exemption only applies if the child is employed (W-2) by his parent.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So the TV commercial was for the parents' business? And it's not filing an entity return, like an 1120? And trying to deduct what they paid their own kids?

If the kids did get a W-2, they might qualify for the "Qualified Performing Artist Deduction," although they probably don't need it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So the parent must only file W-2 instead of 1099 for kids, right?

How about the FICA, FUTA tax on W-2?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is the child Self Employed, or is the child an Employee? You said self employment tax, which seems to indicate the child is an Independent Contractor (which is unusual). It is a matter of facts, not what the ideal tax outcome is.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the child under 18 works for the parent, he/she is not available for self-employment tax or FICA, FUTA tax. see the website of https://www.irs.gov/newsroom/tax-treatment-for-family-members-working-in-the-family-busines. I just need to know, how to input it to make the kid exempt from SE or payroll tax on their earned income. If I check "not available for self-employment tax" in "Business information" tab in "Business Income (Schedule C)" menu in "Income" Column, all the kid's income in Schedule C is unearned income, with lower standard deduction and more tax. How to make

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did anyone say that the kids did the work for the parent's business? I didn't see that.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

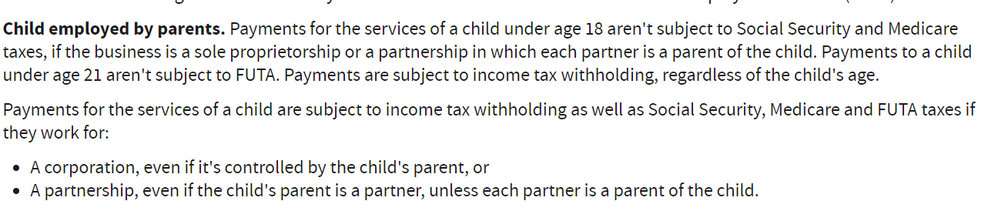

@zhangyanjenny wrote:

If the child under 18 works for the parent, he/she is not available for self-employment tax or FICA, FUTA tax.

That is wrong. If the child under 18 is an EMPLOYEE for the parent, he/she is not subject to Social Security, Medicare or FUTA. If the child is an Independent Contractor, self employment tax DOES apply.