- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Underpayment of estimated tax penalty

Underpayment of estimated tax penalty

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have had a number of clients getting IRS letters for the tax program charging too much for their underpayment of estimated tax penalty. I look into it and I can't see where we can change the interest rates that Proseries has set up. I think it is changed periodically when we install the updates. Has anyone else ran into this problem

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

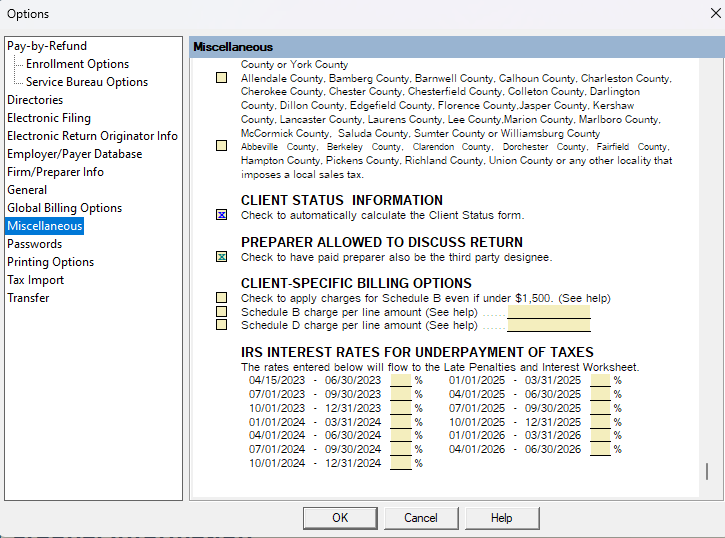

Estimated Tax Penalty isn't interest, so this wont help with that issue....but if you want to update the interest rates for late filing/payment purposes, you can do that here...you have to be IN a client file to get this Miscellaneous Option screen

I have seen other reports of the estimated tax penalty being computed wrong but that was was earlier in the season and I thought it was fixed, but you could be seeing returns that were filed prior to the fix....I guess its better for them to get a refund, than to get a bill.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do those clients live in an area that had a disaster that may have had the due dates extended?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The program isn't charging anything, you are still in charge of the program. First, you do know that IRS won't assess any penalty if it's under $100 and you check the box to let IRS compute it? Second, the program likely is computing the penalty as though payment will be made April 18, and your clients are likely filing and paying sooner.

Post an example.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This was an issue back in the beginning of March...not sure if the estimated tax penalty was affected as well.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪