- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Where do I enter prior year California depreciation amounts, life, method, etc?

Where do I enter prior year California depreciation amounts, life, method, etc?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

California depreciation does not conform. Where do I enter prior year depreciation amounts, life, method?

If I'm in the California Asset Entry Worksheet and Quick Zoom to the Asset Life History - everything on it are Federal numbers which are wrong.

This question is about an individual return but I have the same issue on a California partnership return.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

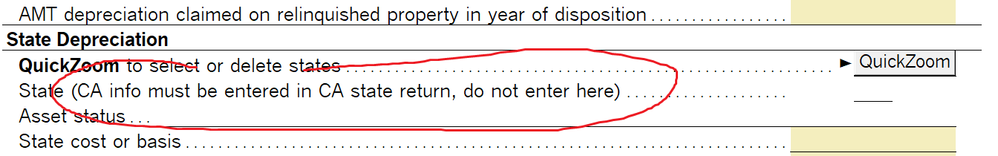

Federal depreciation asset worksheets. Page down to find state asset, sec. 179 and prior years' depreciation.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

CA gets entered on the CA asset worksheet, not the fed.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I can override them. I can also override the info on the Asset Life History page. I'd rather not, as I don't know what will happen the following year? If the overrides remain - including the method and life - I guess it's okay.