- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: WHERE DO I ENTER ELECTRIC VEHICLE CHARGING STATION INSTALLATION?

WHERE DO I ENTER ELECTRIC VEHICLE CHARGING STATION INSTALLATION?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Form 8936 ? https://www.irs.gov/forms-pubs/about-form-8936

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

ACCORDING TO GOOGLE THE FIRST THING TO DO IS QUIT YELLING.

Then google "Electric Vehicle Recharging Station federal tax credit how to claim"

About the 3rd or 4th link I got was to the IRS with reference to a form number.

I have never had this credit so I don't know how the form works, but that should get you on the right track.

side note - I think dkh may have the link for the credit on the vehicle not the charging station.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

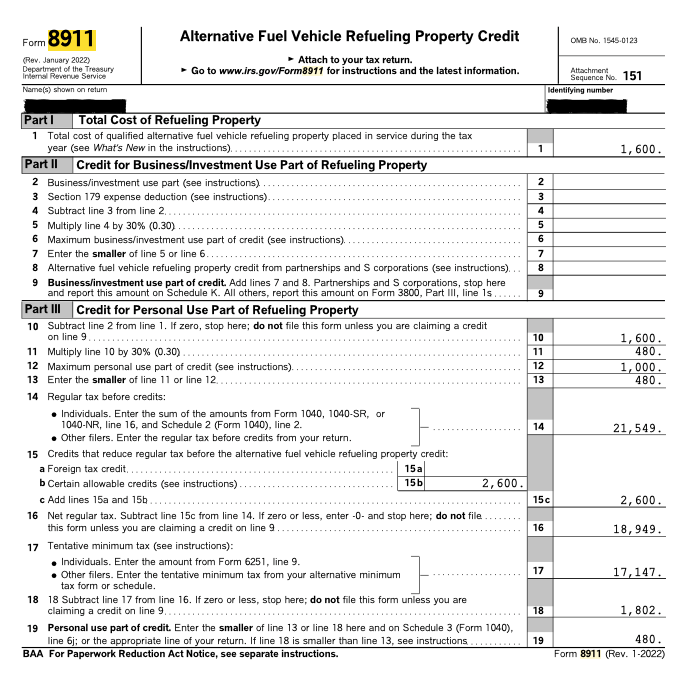

https://www.irs.gov/pub/irs-pdf/i8911.pdf

curiosity got the best of me... I had to Google for it form 8911

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

With the advent of COVID, I can't believe how common caps lock syndrome has become. Everybody remember to get your keyboard vaccinated so it doesn't happen to you.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Any idea of when Intuit is going to update the program so we can enter this form?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Any idea of when Intuit is going to update the program so we can enter this form?"

You can watch the Forms Releases dates from in the program or from the web:

https://proconnect.intuit.com/proseries/forms-finder/

| Form 8911, Alternative Fuel Vehicle Refueling Property Credit | Final on 03/17/2022, EF on 03/17/2022 |

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found the steps, you want form 8911 for the charging station.

1. CREDITS

2. General Business and Vehicle Cr

3. Go to Top and click on Energy9 Fuel Production

4. School down to : Alternative Fuel Vehicle Refueling Property Credit (8911)

5. Enter the amount you spent in this box: Total cost of qualified property

This will generate from 8911