- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Where are you entering California COVID-19 Relief Grant for Sole Proprietorship Schedule C filer?

Where are you entering California COVID-19 Relief Grant for Sole Proprietorship Schedule C filer?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

California COVID-19 Relief Grant FEDERAL Tax Return:

Are you entering the grant amount on Schedule C as Business Income subject to SE tax?

Or,

Are you entering the grant amount on Other Income Statement Line 24b Other Taxable Income?

I have seen it both ways but got confused with the worksheet on the CALIFORNIA Tax Return that does the adjustment as Other Taxable Income only.

Thank you.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

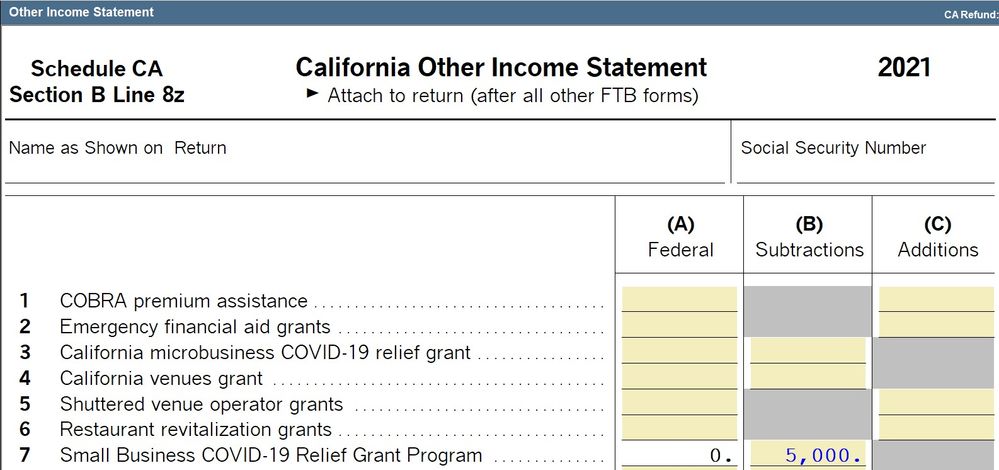

Sch C, then adjusting it on CA as shown in the picture shown. CA taxes self employment income as ordinary income,so the adjustment doesnt need to be connected to the CA Sch C.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sch C, then adjusting it on CA as shown in the picture shown. CA taxes self employment income as ordinary income,so the adjustment doesnt need to be connected to the CA Sch C.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Are you entering the grant amount on Schedule C as Business Income subject to SE tax?"

Yes, for Fed.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks I was expecting to see the adjustment on Schedule CA Section B Line 3 as a business income subtraction.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It counts as income to the Feds, and is reduced for CA.

"These grants are taxable for Federal. Any expenses paid with this grant are deductible. These grants are not taxable for California."

https://gpwcpas.com/grant-credit-loan-and-other-relief-comparison-chart/

That article has a table that has been updated for the recent SB, even though they didn't change their date at the top.

Don't yell at us; we're volunteers